Explore Credit Card Features & Benefits

CHOOSE THE BEST CREDIT CARD THAT SUITS YOUR NEEDS

Platinum Credit Card

- Zero Joining and Annual Fees

- 2 Rewards Points per Rs. 100 spent, except Fuel

- 1% Fuel Surcharge waiver at HPCL petrol pumps

- Exclusive Dinning Offers through Culinary Treats Programme

Coral Credit Card

- 25% discount on movie tickets, on BookMyShow and Inox, twice per month

- Exclusive Dinning Offers through Culinary Treats Programme

- One Complimentary Railway and Domestic Airport Lounge Access, per quarter

- 1% Fuel Surcharge waiver at HPCL Petrol Pumps

Rubyx Credit Card

- Welcome vouchers worth Rs. 5000+

- 25% discount on movie tickets, on BookMyShow and Inox, twice per month

- Air Accident insurance of Rs 1 cr and lost card liability Rs 50k

- Two Complimentary rounds of golf, per month

Sapphiro Credit Card

- Welcome vouchers worth Rs. 9000+

- Buy one movie ticket, get Rs 500 off on second tikcet, on BookMyShow, twice per month

- Two Complimentary International Airport Lounge Access, per year

- Four Complimentary Domestic Airport Lounge Access, per quarter

Manchester United Platinum Credit Card

- Complimentary Manchester United Football

- Up to 3 reward points per Rs. 100 spent

- 25% off up to Rs. 100 on selected cinema ticket retailers

- 1 Complimentary Airport Lounge Access per quarter

Manchester United Signature Credit Card

- Complimentary Manchester United Football & Holdall

- Up to 5 reward points per Rs. 100 spent

- 25% off up to Rs. 150 on selected cinema ticket retailers

- Two Complimentary Airport Lounge Access/quarter

show more cards

RECENTLY LAUNCHED CREDIT CARDS

Save even when you spend and enjoy special privileges with the Amazon Pay ICICI Bank Credit Card. This is a card that pays you back, everywhere and every time. It is a card made exclusively for you, so there is no limit to your celebrations

Set out for your favorite destinations in luxury with the Emirates Skywards ICICI Bank Credit Card. Earn Skywards Miles and enjoy unlimited* airport lounge access.

Give momentum to your spends to live your passion. With the Accelero ICICI Bank Credit Card, you can expect adventures, thrills and exclusive privileges, throughout the year.

Everything You Need to Know About Credit Cards

Use your Credit Card from reliable and trusted merchants.

Set up alerts for transactions to detect any fraudulent activity.

Always check your Credit Card statement for any discrepancies.

Never save your card information on any websites.

Use strong, unique passwords and never share your Credit Card information with anyone.

Never use your Credit Card on public WiFis or unsecured transactions.

In case of fraud or theft, report the same at the earliest to avail the Card Protection Plan.

Are you familiar with the charges applicable on your Credit Card transactions? Let’s find out more about the six common types of Credit Card charges:

| Joining/Annual Fee | The Joining Fee is an initial cost to own the Card. It varies from bank to bank and on the type of card you apply for. It is usually followed by an Annual Charge. |

| Interest Charge | Interest Charges are levied on all new transactions and on outstanding dues, due to non-payment by the due date. The maximum charge is 3.75%, per month. |

| Late Payment Fee | If you are unable to pay the outstanding amount, the Bank will notify you to pay the minimum amount. In case you fail to pay the minimum amount, a late payment fee is charged. |

| Foreign Transaction Fee | Although some Credit Cards are accepted globally, you will still have to incur an extra transaction fee if you are swiping in a foreign country. It is usually around 3.50% and is charged as a percentage of the transaction amount. |

| Over-the-Limit Fee | You are assigned a credit limit based on the type of Credit Card. If you spend beyond the threshold limit, your Bank will charge an Over-the-Limit Fee which can be around 2.50% on the over-limit amount. |

| GST | The Goods and Service Tax or GST is applicable on all Credit Card transactions. Presently, the GST rate for banking and financial services is at 18%. |

|

Credit Card |

Monthly |

Annual |

Overdue Interest rate |

ICICI Bank Instant Platinum Credit Card/ ICICI Bank Instant Gold Credit Card/ Fixed Deposit Instant Credit Card |

2.49% |

29.88% |

InterMiles ICICI Bank Credit Cards |

3.50% |

42.00% |

|

ICICI Bank Coral Credit Card |

3.40% |

40.80% |

|

ICICI Bank Rubyx Credit Card |

3.40% |

40.80% |

|

ICICI Bank Sapphiro Credit Card |

3.40% |

40.80% |

|

ICICI Bank Make My Trip Platinum Credit Card |

3.50% |

42.00% |

|

ICICI Bank Make My Trip Signature Credit Card |

3.50% |

42.00% |

|

ICICI Bank Manchester United Platinum Credit Card |

3.67% |

44.00% |

|

ICICI Bank Manchester United Signature Credit Card |

3.67% |

44.00% |

|

ICICI Bank HPCL Coral Credit Card |

3.40% |

40.80% |

|

ICICI Bank HPCL Super Saver Credit Card |

3.50% |

42.00% |

|

ICICI Bank Accelero Credit Card |

3.40% |

40.80% |

|

ICICI Bank Mine Credit Card |

3.40% |

40.80% |

|

ICICI Bank Expressions Credit Card |

3.40% |

40.80% |

| Minimum Age of 21 | ||

| Minimum annual income | ICICI Bank Salaried customer | ₹ 2,40,000 |

| Non-ICICI bank Salaried customer | ₹ 3,60,000 | |

| Self employed and holding Savings account with ICICI Bank | ₹ 3,60,000 (ITR) | |

| Self employed and not holding Savings account with ICICI Bank | ₹ 4,80,000 (ITR) | |

Credit Cards make it convenient to make purchases but there are always some dos and don’ts you need to look out for.

Do’s

Always pay your bills on time and in full to have a robust credit history and no interest charges.

Always check your Credit Card statements regularly for errors to avoid any fraudulent activities.

Always use your Credit Card wisely to avoid a debt trap.

Don’ts

Don't share your Credit Card information with anyone.

Don't exceed your credit limit.

Don't make late payments.

Some of the common types of Credit Cards in India are:

Reward Credit Cards - Maximise your spending and earn rewards with a great credit card that fits your lifestyle and financial needs.

Fuel Credit Cards - Save money on gas and earn rewards with a fuel credit card that's designed for drivers like you.

Travel Credit Cards - Travel more, spend less with a travel credit card that earns you rewards, miles, and perks on every adventure.

Cashback Credit Cards - Earn cash while you shop with a cashback credit card that puts money back in your pocket for every purchase you make.

Business Credit Cards - Boost your business with a credit card that offers amazing perks tailored to your company's unique needs and expenses.

Things to know before applying for a Credit Card

Choose the right card

Different Credit Cards cater to different needs, so choosing the right card is essential. Consider factors such as the interest rate, annual fees, reward points, and cashback offers when selecting a card.

Understand the billing cycle

The billing cycle is the period between two statement dates. It's essential to understand the billing cycle to avoid late payment charges and interest charges.

Pay your bills on time

Late payments can negatively impact your credit score and result in late payment charges and interest charges.

Avoid maxing out your credit limit

It's advisable not to use your entire credit limit. Using more than 30% of your credit limit can negatively impact your credit score.

Keep track of your expenses

It's important to keep track of your expenses to avoid overspending and to pay your bills on time.

What are the documents required when applying for a Credit Card?

For existing customers:

If you are an existing ICICI Bank customer, we may not require your address documents for a Credit Card application if your latest mailing address is updated in our records. However, we will need your income documents, such as salary slips or income tax returns for the last three years.

For new customers:

If you are a new customer, we would require your identity, income, and address proof.

Popular Credit Card FAQs

A Credit Card is a payment card that works on the concept of purchasing now and paying later. A Credit Card is accepted universally and allows the Cardholder to purchase goods without cash. Bank issues the Credit Card with a certain credit limit amount to spend basis the customer's income eligibility and profile. There is a set time period for paying the Credit Card bill however, in case of any delay the customer has to pay the utilised amount along with an interest and other charges.

The benefits of an ICICI Bank Credit Card:

- Universal payment acceptance

- Earn Reward Points or cashback for every retail spend made on ICICI Bank Credit Card

- Enjoy credit free payment days of maximum up to 48 days including the due-date

- Fuel Surcharge waiver

- Exciting discount offers on dine-out and movie tickets

- VISA lounge access benefits

- Build a credit history etc.

Eligible applicant must:

- Be a citizen of India

- Be between the age limit of 21 years till 58 years, if salaried

- Up to 65 years of age, if self-employed

- Must fulfil the minimum income requirement at the time of application.

The ICICI Bank Credit Card application process is very easy. Here are the steps to apply for a Credit Card:

Visit our official website

Select your Credit Card as per preference and check eligibility

Validate your address and employment information

Complete the authorisation process with either NetBanking or a Debit card

After an internal review, we will provide you with a new Credit Card.

A Credit Card balance is the available balance from the sanctioned credit amount, which a Cardholder can use to purchase goods through the following methods: Online, Point of Sale, Cash Withdrawal etc.

A Credit Card Statement is a summary of spends and payments made through the Credit Card during the specific period of credit cycle.

Reward Points are awarded against retail purchases on your ICICI Bank Credit Card, which may differ between cards. It can be redeemed on our reward platform.

You can activate your Credit Card for International transactions through iMobile Pay or Retail Internet Banking (RIB).

ICICI Bank offers a varied range of Gemstone and Co-branded Credit Cards which fulfils your day-to-day expenditure requirement along with exciting offers and discounts on selective range of products throughout the year.

RELATED CREDIT CARD OFFERS

Offer from OnCourse Global for ICICI Bank customers

Offer Flat 40% off on All Tax related service (ITR Filing, Tax planning, Notice Management, GST, etc)by

TaxBuddy : Exclusive Offer For ICICI Bank Customers!

Offer Flat 40% off on All Tax related service (ITR

Filing, Tax planning, Notice Management, GST, etc)by

ICICI Bank brings exclusive offer on Aanya Wellness!

ICICI Bank brings exclusive offer on Aanya Wellness!

Pay using ICICI Bank Internet Banking

Get 10% discount at Licious

Get 10% discount at Licious

Pay using ICICI Bank Internet Banking

ICICI Bank brings exclusive offer on Postcard Hotel!

ICICI Bank brings exclusive offer on Postcard Hotel!

25% up to Rs.5,000 per room discount on making a

OGet 30% off on all GimBooks subscriptions, with ICICI Bank Credit and Debit Cards.

Get 30% off on all GimBooks subscriptions.

Get 30% off on all GimBooks subscriptions.

Get 30% discount on assisted filing services at ClearTax

Get 30% discount at ClearTax

Pay using ICICI Bank Net banking or Cards

Get 15% discount on a minimum order of Rs 500 at Gourmet Garden

Get 15% discount on a minimum order of Rs 500

Pay using ICICI Bank’s Credit/Debit Card or Internet

India SME Accelerator Network Offer

India SME Accelerator Offer

Pay using ICICI Bank Credit or Debit Card

OAvail of 30% discount on yearly subscription plans of 1/3/5 year/years.

My Wealth Protector Offer - Avail 30% discount

Pay using ICICI Bank Cards or Internet Banking

Offer from OnCourse Global for ICICI Bank customers

OnCourse Global for ICICI Bank customers

Use your ICICI Bank Credit/Debit Cards and Net Banking.

Supplementary Credit Cards

You can also get an add-on or supplementary credit card With the add-on card, you can share almost all the benefits of your ICICI Bank Credit Card with the members of your family at no additional fee with an add-on card. Interested to know more about this feature? Click the button below to discover how you can extend the benefits of your credit card to your family.

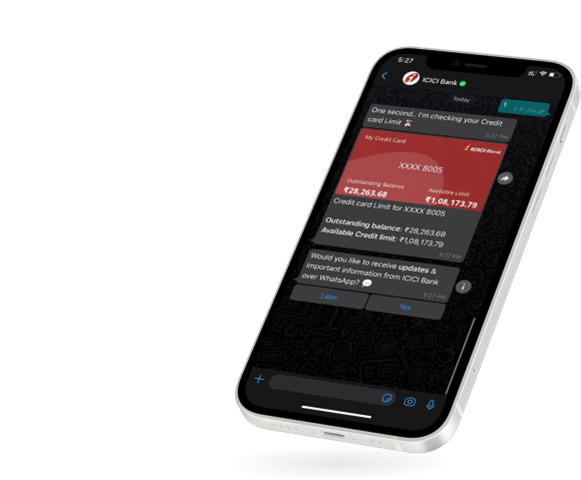

DIGITAL BANKING

Advance. Innovative. Instant

- Mobile Banking

- Net Banking

- WhatsApp Banking

DIGITAL BANKING

Advance. Innovative. Instant

Quick tips and helpful product demonstration videos - ICICI Bank Online Demos & Videos

Explore Now

Before you go…

… apply for an ICICI Bank Credit Card and get it instantly.