'Our claim settlement ratio for FY 2022–23 is 98.7%^^. This is computed, basis individual claims settled over the total individual claims for the financial year. For details, refer to the Annual Report for FY2022-23 on the ICICI Prudential Life Insurance website.

#Doctor’s document confirming diagnosis, needs to be submitted.

*The premium has been calculated for a 31-year-old healthy male for a Rs 20 lakh cancer cover and a Rs 10 lakh heart cover for a policy term of 5 years and is exclusive of all taxes. The annual premium is Rs 2,174 (exclusive of all taxes).

~Up to Rs 25 lakh for heart cover + up to Rs 50 lakh for cancer cover. Cash pay-out depends on the severity of the condition. Please refer to the sales brochure carefully for the pay-outs at the different levels of the conditions.

**You will get daily hospital cash benefit of Rs 5,000 if you get hospitalised for a continuous period of 24 hours, due to any of the listed conditions under your chosen cover. The benefit amount is fixed and will be paid irrespective of actual hospitalisation expenses. This benefit will be payable, subject to a maximum limit of ten (10) days per policy year and thirty (30) days over the policy term. The yearly limit for the number of days of hospitalisation cannot be carried forward to the next year.

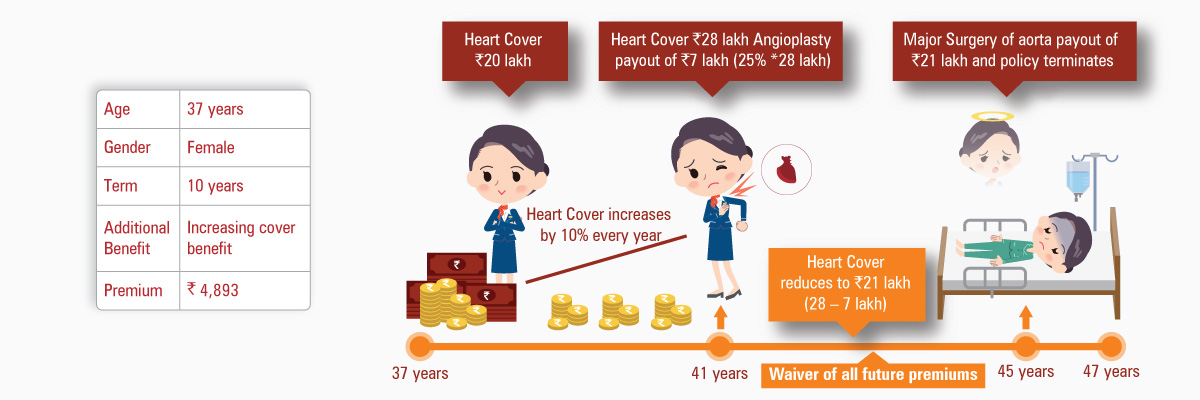

##The Sum Assured chosen at inception increases by 10% simple interest on each policy anniversary, for every claim-free year. The maximum Sum Assured under the cover will be capped at 200% of the Sum Assured chosen at inception. This increase in Sum Assured will stop on occurrence of the first claim under the cover. Where cancer cover and heart cover are chosen together, the Sums Assured for both the covers increase by 10% simple interest on each policy anniversary, for every claim-free year. The maximum Sum Assured will be capped at 200% of the Sum Assured chosen at the inception, for each type of cover. On occurrence of the first claim under any one type of cover, the increase in Sum Assured will stop for that cover type and Increasing Cover Benefit will continue for the other type of cover, for which no claim has occurred.

^^A discount of 5% on the first year’s premium will be offered on purchase of ICICI Pru Heart/ Cancer Protect when the Life Assured and his/ her spouse are covered under the same policy. The policy benefits of both the Lives Assured will be independent of each other. The Sums Assured of both the Lives Assured could be different. A claim made by one Life Assured under the policy does not affect benefits of the other Life Assured. This family benefit has to be chosen at the inception of the policy as spouse cannot be added once the policy is issued. This discount is not applicable on Single Pay Policy. With one policy, you can avail either Family Benefit or Loyalty Benefit.

***Tax benefits under the policy are subject to conditions under Section 80D of the Income Tax Act, 1961. Goods and Services Tax and Cesses will be charged extra over the premium amount as per the applicable rates. Tax laws are subject to amendments from time to time.

`This premium has been calculated for a 35-year-old healthy male for a heart cover of Rs 25 lakh and a cancer cover of Rs 25 lakh for a policy term of 20 years and for all benefits chosen (i.e., hospital, income & increasing cover) and is exclusive of taxes. The annual premium is Rs 18,263 (exclusive of all taxes).

~~Cancer cover provides protection against pre-cancerous (Carcinoma-in-situ) stage, early stage of cancer and severe stages of cancer. Zero stage cancer refers to Carcinoma-in-situ as per standard medical classification. Refer to http://www.cancer.gov/cancertopics/factsheet/Detection/staging . Heart cover provides protection against the most common, listed heart problems. However, pre-existing diseases are not covered. Please refer to the sales brochure carefully to know more about the illnesses covered.

``To know more about the inclusions and exclusions on the listed minor and major conditions, please read the sales brochure carefully.

ICICI Prudential Life Insurance Company Limited. IRDAI Reg. No. 105. CIN: L66010MH2000PLC127837

© 2016, ICICI Prudential Life Insurance Company Limited. Registered Address: ICICI PruLife Towers, 1089, Appasaheb Marathe Marg, Prabhadevi, Mumbai-400025. Insurance is a subject matter of solicitation. For more details on the risk factors and terms and conditions, please read the sales brochure carefully before concluding a sale. Call us on 1-860-266-7766 (10 a.m. – 7 p.m., Monday to Saturday, except national holidays and valid only for calls made from India) and on +91 8069385555 (Valid for calls made from outside India) (10 a.m. -7 p.m. (IST), Monday to Saturday, except national holidays). Tax benefits under the policy are subject to conditions under Section 80D of the Income Tax Act, 1961. Goods and Services Tax and Cesses will be charged extra over the premium amount as per the applicable rates. Tax laws are subject to amendments from time to time. ICICI Pru Heart/ Cancer Protect: UIN 105N154V03. Advt. No.: W/II/1615/2017-18

ICICI Bank Limited (‘ICICI Bank’) with registered office at ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, 390 007, Gujarat (CIN: L65190GJ1994PLC021012) is a corporate agent (Composite, IRDAI Reg. No.: CA0112 valid till 31/03/2025) of ICICI Prudential Life Insurance Company Limited (‘ICICI Prulife’). Insurance is underwritten by ICICI Prulife.

The products, services and benefits referred to here, are subject to terms and conditions governing them as specified by ICICI Prulife from time to time. ICICI Bank is acting merely as a corporate agent of ICICI Prulife. Purchase by ICICI Bank’s customer of any insurance product, is purely voluntary and is not linked to the availing of any other facility from ICICI Bank. ICICI Bank will not be liable or responsible for any loss resulting from the insurance company's products/ services.

Beware of spurious/ fraud phone calls!

IRDAI is not involved in activities like selling insurance policies, announcing bonuses or investment of premiums

Public receiving such phone calls are requested to lodge a police complaint.

.png)