Importance of a Letter of Credit

The nature of international trade includes factors such as distance, different laws in each country and the lack of personal contact during international trade. Letters of Credit make a reliable payment mechanism. The ‘International Chamber of Commerce Uniform Customs and Practice for Documentary Credits’ oversees Letters of Credit used in international transactions.

Why apply LC through ICICI Bank?

Easy to apply

Letter of Credit FAQs

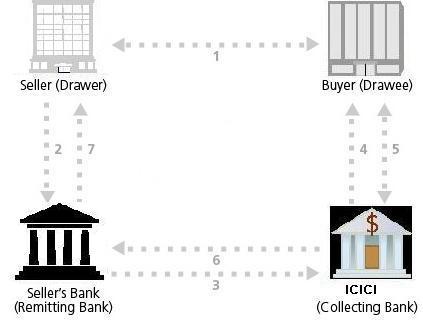

How does a Letter of Credit work?

- Step 1 - You (the buyer) and the supplier sign a contract stating that the payment will be made based on the Letter of Credit

- Step 2 - You approach ICICI Bank to issue a Letter of Credit in the supplier’s favour

- Step 3 - ICICI Bank issues the Letter of Credit, advised by its own branch or correspondent bank in the supplier’s country

- Step 4 - Advising Bank advises a Letter of Credit to the supplier

- Step 5 - The supplier receives the Letter of Credit, sends the shipment of goods and delivers documents to its own bank

- Step 6 – The supplier’s bank sends the documents to ICICI Bank for payment

- Step 7 - You now pay the amount due to ICICI Bank and get the documents in turn.

Types of Letters of Credit

- Sight Letter of Credit - The issuing bank makes the payment once the documentation is received in order

- Usance Letter of Credit - The issuing bank accepts the draft once all documentation received is in order and agrees to pay on the maturity date

- Standby Letter of Credit - This is typically used to ensure that the applicant will meet the payment or contractual obligations. A Bank Guarantee can also serve the same purpose.

The ICICI Bank edge

- Convenient - Sanctioned and issued quickly

- Wide Acceptance - Globally accepted by all beneficiaries

- Multi-choice – An ICICI Bank Letter of Credit can also be availed against 100% cash margin in the form of Fixed Deposits

- Competitive pricing.