THE

ORANGE

HUB

All your business needs now on one single page – ICICI Bank’s Connected Banking

What is Connected Banking?

Start-up Entrepreneurs and Small and Medium Business Owners understand the pains and challenges of managing multiple business-finance-related aspects, like banking, payments, collections, HRMS and payroll, etc. These are time-consuming activities and any error can lead to big losses. To streamline these diverse activities and integrate them into one platform, ICICI Bank has introduced a revolutionary service called ‘Connected Banking’.

This industry-first service provides a common platform to avail multiple services and significantly reduces your time, energy and cost spent in managing these individual activities, across several different interfaces. Its automated nature safeguards data security, maintains data integrity and provides error-free reconciliation and reporting. ICICI Bank offers the benefit of this service by partnering with 60+ different ERP and other financial service providers, the detailed list of which can be found here.

Noteworthy features of Connected Banking

- Instant paperless registration

- Seamless bank reconciliation

- Direct vendor payments & collections with automated reconciliation

- Fetch Bank Balance and generate Bank Statements

- Tax, GST & Custom Duty Payments

- Other bill payments

- Multi-Mode Collection services

- Instant Overdraft services

- Direct Current Account opening facilities.

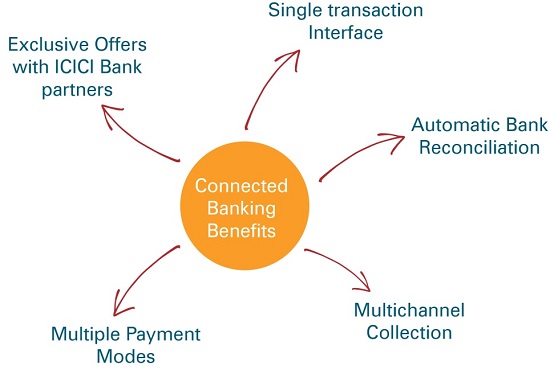

Benefits of Connected Banking

- Single Transaction Interface - You will no longer need to use multiple screens for each functionality of the service, instead Connected Banking acts as a single interface with all the banking and accounting-related software speaking to each other in the background

- Automatic Bank Reconciliation- Saves time and manpower costs and ensures error-free reconciliation

- Multiple Payment Modes - You now have the freedom to make payments to your vendors, employees, utility companies, etc. through a single interface through your ICICI Bank Current Account

- Multichannel Collections - you can also receive payments from your customers through a multitude of channels like cash/cheque/cards/net banking, etc.

- Exclusive Offers - ICICI Bank’s partners present several lucrative offers on accounting/payroll software to reduce your operational costs.

Strategic Partners for Connected Banking

ICICI Bank’s Connected Banking enables Small and Medium Business owners to avail the benefit of an end-to-end automated banking and accounting platform without the need for any additional cost related to IT equipment or personnel with skills to manage IT integration.

By registering for the Connected Banking service online, you can start availing benefits, such as making or receiving payments with automatic reconciliation directly from the software. This allows you to free up your time and energy to focus on more strategic business decisions rather than these transactional ones.

For inquiry, give a missed call on 9650703704.

Scroll to top