Zero Balance Account

- Get a Zero Balance Salary Account for your employees

- Don’t worry about maintaining a minimum balance in the account.

Employee Reimbursement Account

- You can open a Reimbursement Account when you open the Salary Account

- The company can opt to disburse expenses for travel, food, etc. through Reimbursement Accounts

Special offers

- Get attractive offers on loans and Credit Cards

- Bank anywhere for free

- Get the privilege of 8-8 banking

- Investment advisory

Reduce paperwork

- Negate the requirement of cumbersome paperwork pertaining to salaries or maintenance of records.

Simple procedure

- You can credit salaries through an online platform, bulk NEFT or you can send ICICI Bank an advice (in form of a cheque/debit instruction, ECS, etc.) for the total salary amount, along with the salary details of the designated employees in a soft and hard copy format

- Once this is done, we will credit the respective employees' accounts, as per your statement of advice.

National Pension Scheme

- ICICI Bank is also registered with PFRDA to offer National Pension System (NPS) services to corporate customers

- The corporate can claim tax benefits for the amount contributed towards the pension of employees under 80CCD (2)

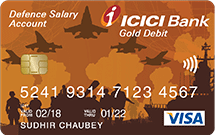

Special offers for Defence

- We salute the brave men and women who defend our nation and we are proud to introduce our Defence Banking Services for Armed Forces

Large Branch and ATM Network

- Avail our large network of over 5,200 branches and 15,600 ATMs.

Zero Balance Account

- Get a Zero Balance Salary Account and don’t worry about having to maintain a minimum balance in the account.

Welcome Kit

- Fill in a simple form and get your chequebook and Debit Card, immediately

- International Debit Card

- No annual fee on your Debit Card

- Get a higher cash withdrawal and spend limit, per day. Reduce or increase your spend limit, based on your needs

- You can use your Debit Card for international online purchases.

Money Multiplier

- Earn more money when you link your Fixed Deposit Account with your Savings Account Internet Banking

- Log in with your User ID and password and experience convenient banking with our free best-in-class Internet Banking service.

Online Fund Transfer

- Easily transfer funds, online to and from anywhere in the world, without needing to make cash withdrawals or cheque deposits.

Mobile Banking

- Use the iMobile Pay app to transfer funds, pay bills, buy movie tickets and more, on the move.

Public Provident Fund (PPF)

- Get a PPF account, which is a safe investment that gives you attractive returns, with the added advantage of tax benefits under Section 80C.

National Pension System

- You can claim tax benefits for the amount contributed towards your pension under Section 80CCD(1) with an overall limit of Rs lakh Pension Account

- Get a Zero Balance Pension Account for receiving a pension, post retirement

- Ensure that you update your Aadhaar number in your ICICI Bank Pension Account Family Plus Account

- Get a Zero Balance Savings Account (Family Plus Account) for your parents, spouse and children.

Phone Banking

- Manage your transactions, easily by calling our Customer Care, from the comfort of your home.

Loans

Avail a number of benefits on some of the most popular loans:

- Personal Loans*

- As a special offering, our Salary Account customers would be extended Personal Loans.

- Home Loans*

- Home Loans from ICICI Bank come to you with attractive interest rates and personalised services, which can be availed from the comfort of your home.

- Car Loans*

- Car Loans from ICICI Bank come to you with an instant approval, simple documentation and competitive interest rates.

- Two Wheeler Loans*

- Two-Wheeler Loans from ICICI Bank come to you at attractive interest rates coupled with a flexible financing option.

- Loans Against Securities**

- ICICI Bank will advance loans to Salary Account holders against Securities and Mutual Funds owned by them.

Investment Services

Salary Account holders can:- Transact in shares instantly and safely, through Demat

- Invest in Government Bonds, Mutual Funds, Foreign Exchange and Insurance products

Insurance

- Get a complimentary Personal Accident Insurance Protection.

Click here to know more about Terms and Conditions.

The organisation needs to have a minimum of:

Silver Salary Account

Enhanced banking experience and much more with our Silver Salary Account

Gold Salary Account

Open up to the world of Gold Salary Account

Titanium Salary Account

Presenting Titanium Salary Account, A perfect combination of banking convenience and exclusive offers

Defence Salary Account

Defence Salary Account is designed exclusively for Defence Personnel like you

Select Plus Salary Account

Select Plus is aimed at benefitting high income or net worth individuals looking to gain premium features from their bank account