THE

ORANGE

HUB

How Salaried Employees Can Get a Personal Loan in India

A personal loan is a boon when you are going through a financial emergency. It is easily accessible as it is an ideal option to meet your short-term funding requirements such as marriage expenses, travel, online courses, medical exigencies, etc. Getting a bit of extra credit through a personal loan requirement can become as much of a necessity for a salaried employee as well. So, if you are a salaried employee looking for a personal loan in India, here are a few things you need to know.

Personal loan eligibility criteria for salaried employees:

The eligibility criteria for personal loans vary from one bank to another. For salaried employees, it is easy to avail a loan of up to Rs 25 lakh starting at the rate of 10.75% p.a. from ICICI Bank, as meeting personal loan eligibility isn’t much of a complication. However, there are some general rules that are usually followed, and they are:

Nationality- The foremost criteria for applying for a personal loan is you need to be a resident of India

Age limit - Usually, the minimum age limit is 23 years, and the maximum age is 58 years for salaried individuals

Employment status - To apply for a personal loan, you need to be employed for a minimum of two years

Minimum salary - Since you do not need any collateral for a personal loan, banks will take into account your disposable income. They decide on the minimum salary requirement based on factors like the borrower’s credit score, nature of employment, previous relationship with the bank and so on

Credit score - Your credit score is a major factor in determining your eligibility for a loan. But there is no need to lose hope if your credit score is not good enough. The fact that you are a salaried employee with a stable job can also work in your favour in this regard.

Documents required for Salaried Employees to apply for a personal loan

Proof of Identity: PAN Card, Voter’s ID, Passport, or Driving Licence

Proof of Residence: Utility bill, Passport or Leave and Licence agreement

Latest 3 months’ Salary Slips

Latest 3 months Bank Statement (where salary/income is credited)

2 Passport size photographs.

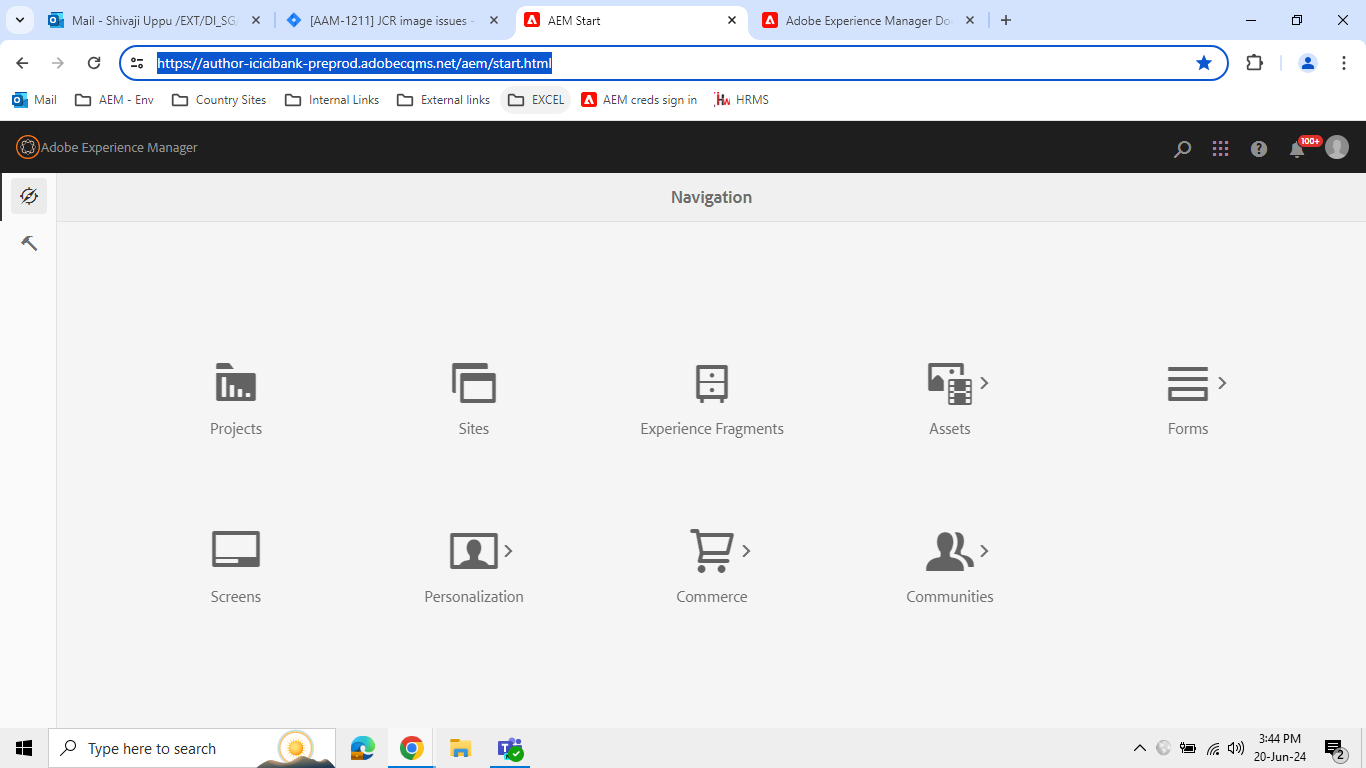

Salaried employees can also be eligible for pre-approved personal loan offers if they are an existing ICICI Bank customers. You can check for the personal loan offer using the iMobile Pay app or ICICI Bank Internet Banking account.

To know more about the criteria and guidelines, get in touch with ICICI Bank right now. They will help you get a personal loan at a highly affordable interest rate. Don’t let financial worries trouble you anymore!

Scroll to top