THE

ORANGE

HUB

How to Get a Personal Loan without a Salary Slip?

Getting a Personal Loan without a salary slip might seem challenging, but it's not impossible. Several lending institutions, including ICICI Bank, offer avenues for individuals to secure a Personal Loan even without traditional proof of income. Most Personal Loans require proof of a regular income source, usually validated through salary slips or bank statements. However, several alternative routes can help individuals secure a Personal Loan without salary slips. Let’s explore what these options are.

Considerations before applying for a Personal Loan without a salary slip

Before applying for a Personal Loan without a salary slip, it's important to think about a few things. These things can help improve your chances of getting your Personal Loan approved:

Credit Score importance

A great credit score serves as the main component for loan approvals. Lenders gauge your creditworthiness based on this score, which summarises your borrowing history, repayment patterns and overall financial behaviour. Maintaining a good credit score significantly increases the likelihood of a successful loan application. Maintaining a high score means paying bills on time, not having too many outstanding debts and having a clean record without missing payments. A good credit score increases the chances of getting your loan approved.

Collateral or Guarantor support

In situations where traditional income proof is unavailable, certain lenders might extend a helping hand by considering collateral or a guarantor. A reliable guarantor willing to vouch for your repayment capabilities can boost your application, reassuring the lender about loan repayment in the absence of salary slips.

Self-Employment Alternatives

For those who run their businesses and don't get a regular salary slip, it's crucial to demonstrate that your business makes enough money. Instead of showing traditional salary slips, you can use official financial statements of your business. These papers indicate how well your business is doing financially - its profits, turnover and overall health. This reassures lenders that even without the usual proof of salary, you have a stable income to pay back what you borrow.

Documents to gather for a Non-salaried Individual

KYC Documents:

These are essential papers that help verify your identity, where you currently live and your birthdate. To prove who you are, you might need an ID card, like a driver's licence or passport. For your address, documents such as a recent utility bill (like an electricity bill or water bill) and a document with your birthdate, such as a birth certificate or a passport, are typically required.

Proof of Residence or Workplace:

This is about showing where you live or work. You can do this by providing documents like utility bills (electricity bill, water bill, etc.) that have your name and address on them. If you rent a place, a rental agreement could work or if you own the place, documents confirming property ownership.

Income Proof:

Sometimes, it might be tricky to provide traditional salary slips. In such cases, you can use alternative documents to show how much money you earn. For instance, bank statements can demonstrate your regular transactions, showing the money coming in and going out. If you're self-employed or have your own business, audited financial statements can serve as proof of your income.

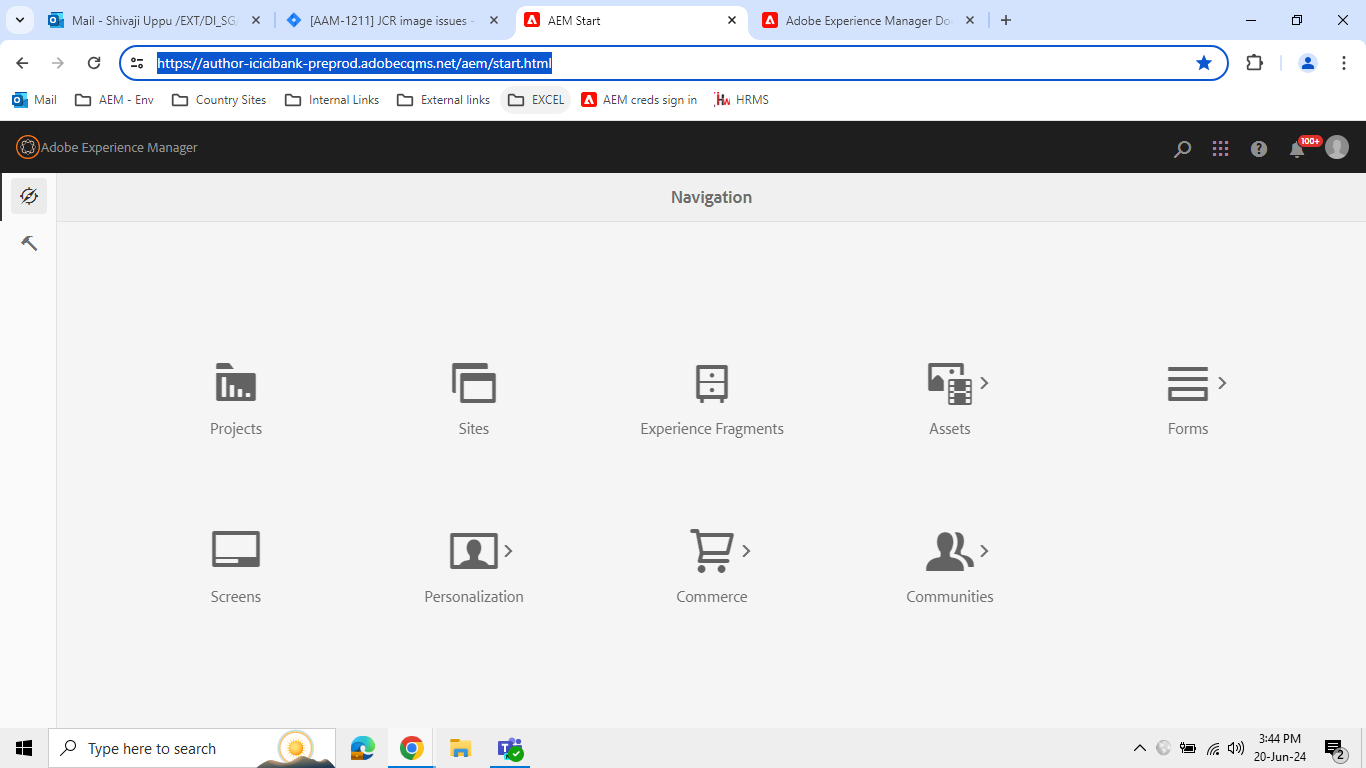

Steps to apply for a Personal Loan with ICICI Bank

To apply for a Personal Loan online with ICICI Bank, follow these steps:

Gather essential documents:

Before starting the application process, make sure you have the necessary documents like your PAN card, Aadhaar card, income proof, address proof and bank statements. Having these on hand will make the application process more efficient.

Access the Personal Loan application form:

Proceed to the Personal Loan Application section on the ICICI Bank website. Look for the application form, which will require you to provide your basic personal and financial information. Fill out the form accurately

Check eligibility and submit form:

After completing the form, submit it to check your eligibility. The Bank will assess your details to determine your eligibility for the loan. This process typically involves quickly reviewing your credit history, income and other factors.

Select loan amount and tenure:

Once your eligibility is confirmed, use ICICI Bank Personal Loan EMI calculator available on the website, to determine the loan amount and tenure that best suits your financial situation. This tool helps you calculate the monthly instalment you will need to pay based on the chosen amount and tenure.

Personal Loan Eligibility Criteria

ICICI Bank extends Personal Loans to self-employed individuals. To qualify for this loan, specific eligibility criteria must be met:

Age:

Applicants should be at least 28 years old (for self-employed individuals) or 25 years old (for doctors). The upper age limit is 65 years.

Minimum turnover:

The required minimum turnover is Rs 40 lakh for non-professionals and Rs 15 lakh for professionals. These figures should be as per audited financial statements.

Minimum profit after tax:

For proprietorship firms or self-employed individuals, the minimum profit after tax should be Rs 2 lakh. According to audited financial records, it stands at Rs 1 lakh for non-professionals.

Business stability:

Self-employed individuals must have a business history of at least 5 years, while doctors must demonstrate a minimum of 3 years in their current practice.

A minimum of 1 year of a liability relationship (such as a Current Account or Savings Account) or an asset relationship (any loan) with ICICI Bank within the last 36 months is necessary. Additionally, a satisfactory repayment track record is expected.

Conclusion

Obtaining a Personal Loan without a salary slip demands thorough preparation and presentation of alternative evidence showcasing financial stability. While it might involve additional effort, various avenues exist to secure a Personal Loan, even without conventional income proof.

However, each lender has its unique criteria, so make sure to connect with ICICI Bank expert advisors for personalised guidance and better chances of approval.

Scroll to top