- Remittances

- Special Customer

- Expression Bank Guarantee

- Capital Account transactions

- Chemical Industry

- Inland Bill Discounting

- Inland Letter of Credit

- Export Bill for Collection

- Solutions for Exporters

- Export Finance

- Forex and Currency Risk Management

- Import Bill for Collection

- Solutions for Importers

- Import Finance

- Information Technology Industry

- Application Forms

- Apply for LC

- Letter of Credit

- Trade Online

- OPGSP

- Application Forms

- Request Letter Formats

- Bills for Collection

- Travel and Tourism Industry

- Sample Trade Documents

- Application Forms

- Research Reports

- Forex

- Customized Industry Specific Solution

- Special Relationship Customer

- Application Forms

- Useful Trade Links

- Application Forms

- Forex Channels

- Application Forms

- Buying from Domestic Market

- Solutions for Domestic Business

- Guarantee Apply For

- Trade Solution for Exporters

- Trade Solution for Importers

- Supplier in Domestic Market

- Trade Solution for Service Providers

- Import Plus

- FAQ's

- Export Finance

- Apply for Remittance

- More

Want us to help you with anything?

Request a Call back

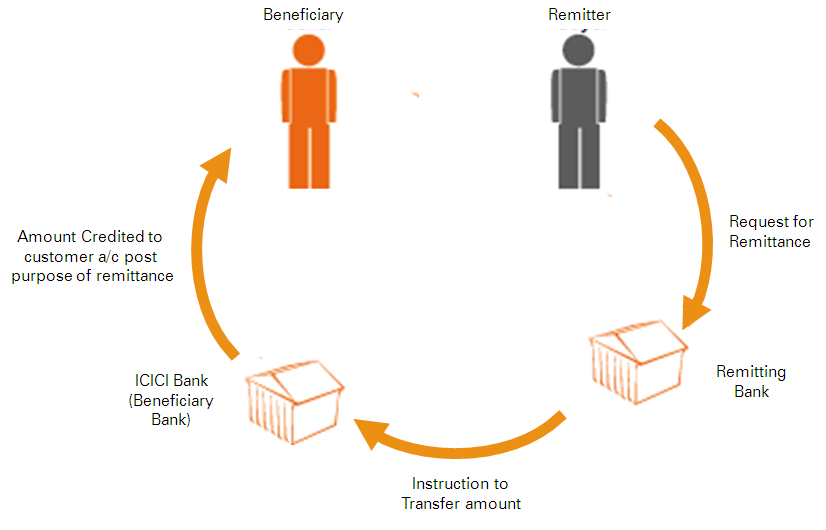

Trade Services - Inward Remittances

ICICI Bank offers a convenient and well equipped international wire transfer service. Through this service, you can simply instruct your local bank to send money to ICICI Bank's local account held with the correspondent bank. Post instructions, it takes 1-2 working days for a Wire transfer request to get processed and money to reach our local account in your country. The money will then be transferred to your beneficiary account in 2 hours time, provided you furnish the required documents to your Branch.

How Inward Remittance works

- Step 1 – Remitter request for remittance with its Remitting Bank

- Step 2 – Remitting Bank gives instructions to its correspondent NOSTRO bank to transfer the amount

- Step 3 – Remitting Bank’s NOSTRO correspondent further request ICICI Bank’s NOSTRO correspondent to transfer the remittance amount

- Step 4 – ICICI Bank’s NOSTRO correspondent further credits the amounts to beneficiary bank i.e. ICICI Bank

- Step 5 – Beneficiary bank (i.e. ICICI Bank) credits amount to customer’s account post stating purpose of remittance