- Forex

- Special Customer

- Expression Bank Guarantee

- Capital Account transactions

- Chemical Industry

- Inland Bill Discounting

- Inland Letter of Credit

- Export Bill for Collection

- Solutions for Exporters

- Export Finance

- Forex and Currency Risk Management

- Import Bill for Collection

- Solutions for Importers

- Import Finance

- Information Technology Industry

- Application Forms

- Apply for LC

- Letter of Credit

- Trade Online

- OPGSP

- Application Forms

- Request Letter Formats

- Bills for Collection

- Travel and Tourism Industry

- Sample Trade Documents

- Application Forms

- Research Reports

- Remittances

- Customized Industry Specific Solution

- Special Relationship Customer

- Application Forms

- Useful Trade Links

- Application Forms

- Forex Channels

- Application Forms

- Buying from Domestic Market

- Solutions for Domestic Business

- Guarantee Apply For

- Trade Solution for Exporters

- Trade Solution for Importers

- Supplier in Domestic Market

- Trade Solution for Service Providers

- Import Plus

- FAQ's

- Export Finance

- Forex Channels

- Forex and Currency Risk Management

- More

Want us to help you with anything?

Request a Call back

Forex

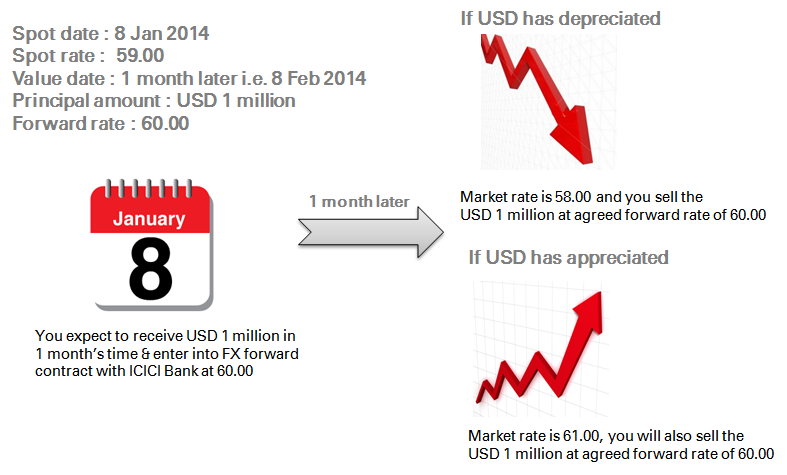

To exchange one currency for another at an agreed Exchange Rate on an agreed date for a particular amount is termed as Forward contract which enables you in faster, secure and error free execution of deal.

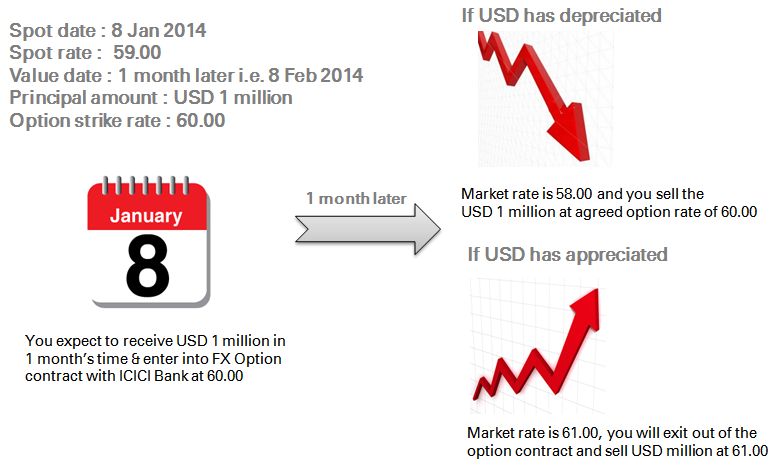

Forwards is an ideal hedging solution for you when you have strong view on currency movement, whereas Options helps you in protecting your downside while providing you the flexibility of upside in case of favourable movement. In this way both forwards & options helps in safeguarding your foreign currencies (payable & receivables) against a fluctuating currency rate.

How Forwards work

How Options work

The ICICI Bank edge

- Fully integrated Forex services through state of the art dealing rooms

- Forward contract to protect yourself against foreign currency fluctuation risk

- Flexibility to do your business in 26 currencies

- Competitive exchange rates