Don’t have an ICICI Bank Current Account? That’s okay.

Now, avail our industry-first business banking solutions, even without having a Current Account. Log in as a ‘Guest User’ and avail of a multitude of offerings, to get kick-started on an accelerated business growth journey.

Manage your Current Account

Stay 24x7 updated on your business transactions.

- View your Account balance & Bank Statements

- Manage your FD, online

- Track deliverables

- Manage approvals.

- Open a Current Account instantly with Video KYC

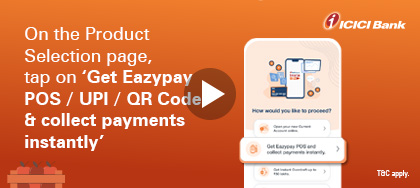

Start instant collections with Eazypay

Customer payments were never simpler.

- Instant Overdraft basis your POS swipes

- Instant settlement & voice alerts for all UPI/QR transactions

- Payment collections through an SMS link

- Tap on phone to accept card payments

- Earn Reward Points on every collection

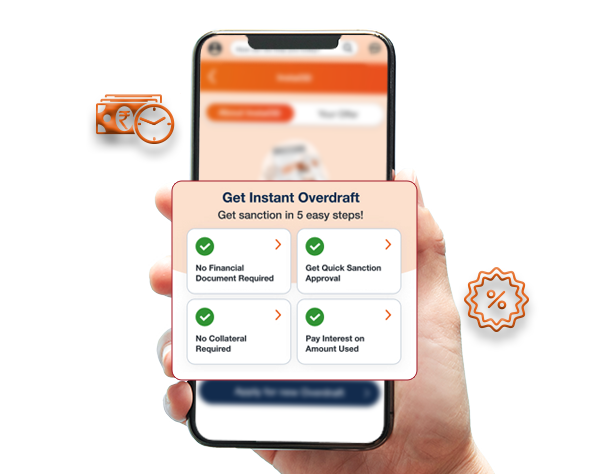

Grow your business with Instant Overdrafts & Business Loans

Hassle-free access to loans.

- Loan offers for instant OD

- Secured Working Capital Loans

- Overdraft on an ICICI Bank Fixed Deposit

- Loan application tracker

Manage all your payments & collections

Enabling seamless payments & collections.

- Collect single invoice via link/QR

- Easy reconciliation with ERP integration

- Maker-checker facility for easy workflow

- Virtual Account collection

Carry out Export-Import transactions with ease

Round-the-clock Export-Import Banking.

- Settle Inward Remittances & initiate Outward Remittances

- Instantly convert EEFC Account balances into INR

- Regularise Bill of Entry

- Apply for Bank Guarantees

- Initiate Export Bill Regularisation

- Activate Trade Online – a comprehensive digital portal for all your trade transactions

- Trade Emerge – explore value-added services

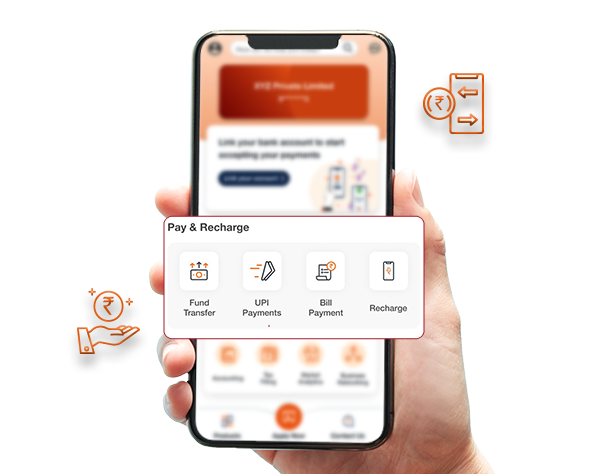

Manage your daily banking needs in just a few clicks

Enjoy instant payments on the go

- Express pay for up to Rs 20,000 instantly

- Pay bills, FASTag recharges & travel bookings using UPI/QR

- Cash withdrawal with delivery at your premise

- Share payment receipt on WhatsApp

- Funds Transfer.

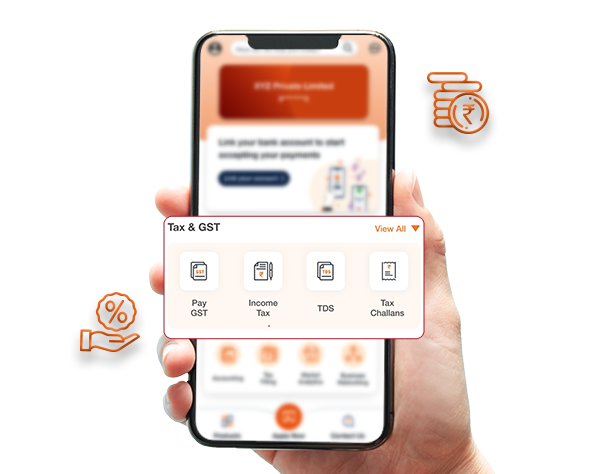

Never miss a tax payment deadline

Pay tax online in a few simple steps

- Make GST payment

- Income tax and TDS payment

- View & download tax challan/s

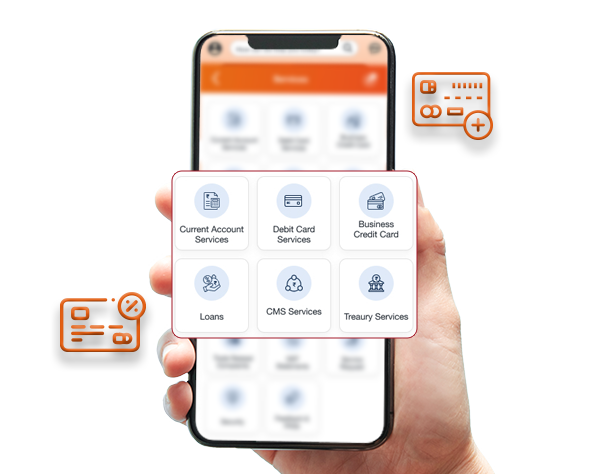

MANAGE BANKING SERVICES AT YOUR CONVENIENCE

Avail services anytime, anywhere.

- Order and manage cheque payments

- Apply for and manage debit card

- Update your address and nominee details

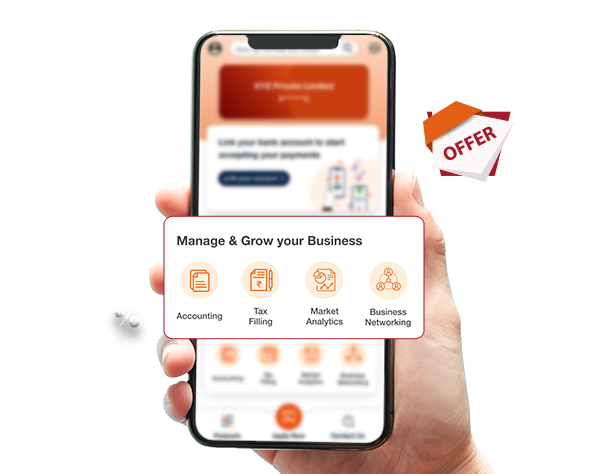

Banking +

Manage & grow your business: Special discounts & offers on our Partner Platforms to help you scale up your business.

- Finance and Accounting: Zoho Books, ClearOne

- Tax: IndiaFilings, ClearGST, ClearITR, Clear Popular Assisted Services

- Online Marketplace: IndiaMART, GlobalLinker

- Digital Transformation:

Airtel, Sherlock

Scroll to top

Security is our priority

Two-factor i-safe authentication

Role-based access: Maker/Approver

End-to-end 256-bit encryption

3 simple steps to start

Using InstaBIZ app

Download the InstaBIZ app

Activate the InstaBIZ app

Authenticate

& Log in

1.8 M+

App Downloads

4.6/5

Ratings

24K+

Reviews

InstaBIZ is a business banking super mobile app that provides all services under one roof to help you with your daily business needs. You can apply for an Overdraft, make payments, order a chequebook and do a lot more with the app on the go.

This app is now available for all customers, even customers of other banks.

Customers having an account with any bank can now use the InstaBIZ app, the super app for all business banking needs.

Steps to log in to the app:

For existing ICICI Bank Current Account Customers, download the app, set up your Login credentials and authenticate using OTP on your registered mobile number.

For non-ICICI Bank customers, download the app and register as a ‘Guest User’.

No, the InstaBIZ mobile app is open for all customers. Any bank’s customers can use the app, by registering as a ‘Guest User’.

You can make payments using InstaBIZ through multiple modes:

Using NEFT, RTGS, IMPS:

Go to ‘Fund Transfer’ > ‘Register a Beneficiary’ > ‘Authenticate’ > Enter amount > ‘Proceed’.

Using expressPay (for payments up to Rs 20,000):

Go to ‘Fund Transfer’ > Enter ‘Payee details’ > ‘Authenticate’ > ‘Proceed’.

You can use the InstaBIZ app for your daily banking transactions, payments, trade services, merchant collections, Debit Card and cheque related services, cash management services, and much more. Download the app now, and start experiencing the super app.

No. ICICI Bank does not charge a fee for using the InstaBIZ app. Your telecom operator may charge for the use of data (internet browsing) or for SMS service on your mobile device.

Yes, you can pay your Income Tax, TDS and GST, using the InstaBIZ mobile app.

As a ‘Guest User’, you can avail the following services on the InstaBIZ app:

- Link any Bank Account to start transacting

- Access Eazypay Merchant solutions

- Instant Merchant on-boarding, for POS/UPI/QR

- Instant Overdraft

- Open a Current Account instantly with video KYC

- Manage & grow your business with our partner offers and discounts

- Trade Emerge platform for all your import-export transactions

- Exclusive offers.

Yes, the InstaBIZ app is completely secure, with end-to-end encryption and single/dual authorisation using Grid value and OTP, to ensure all your transactions are protected.

Yes, role-based access allows login as either a Maker or a Checker. A Maker can raise an approval request and a Checker is able to approve the request using the InstaBIZ app.

*T&C apply.