Want us to help you with anything?

Request a Call back

CORPORATE

BOND DESK

-

Leading participant in the Indian fixed income markets

-

End-to-End services related to origination and placement of bonds & commercial papers

-

Time-tested expertise in the domestic debt market

-

Strong relationships with bank treasuries, mutual funds, insurance companies

Key Features

Product diversity

ICICI Bank manages one of the oldest and largest treasury books in the country. We are an active player in Government securities, corporate bonds, commercial papers and certificate of deposits, both in primary and secondary markets.

Debt syndication

ICICI Bank has been consistently ranked among the leading Arrangers for debt private placements. We have been associated with debt placements of public sector undertakings, central/state government entities, banks, financial institutions, NBFCs and private corporates.

Client coverage

Our dedicated Treasury sales and corporate relationship teams provide pan-India coverage of debt issuers and investors across multiple segments. We leverage our global presence at key investor locations to provide access to Indian issuers for raising funds through international debt capital markets.

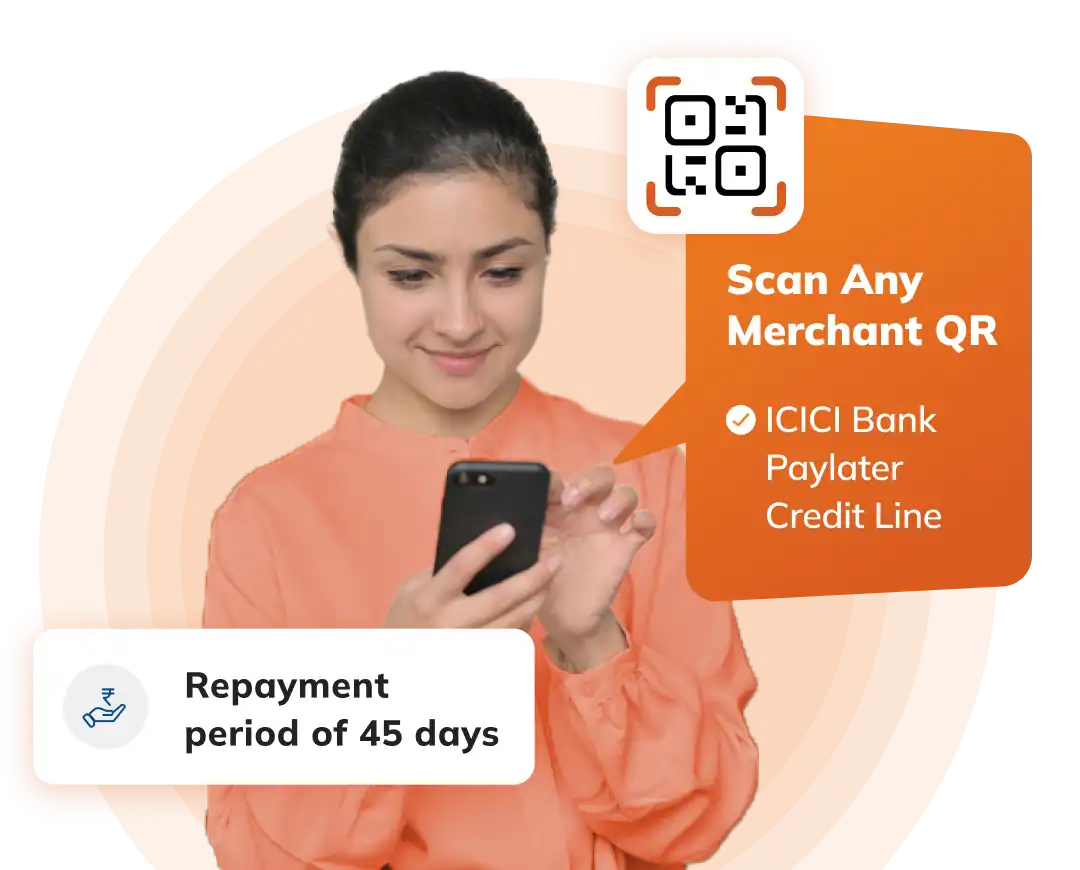

Scan this QR on your mobile to download/open iMobile Pay

Provide end-to-end solutions to both regular and first-time issuers for raising short-term and long-term funds through debt capital markets.

Facilitate placement of debt securities across various investor segments.

Make two-way markets in fixed income securities across various product segments.