Get started with UPI on iMobile Pay today!

With your International Mobile Number*

*NPCI guidelines allow UPI Payments to India in INR, via overseas numbers from selected geographies: Australia, Canada, Hong Kong, Oman, Qatar, Saudi Arabia, Singapore, UAE, UK and USA.

Enable UPI now on your registered Indian or International Mobile Number

Step 1: Log in to the iMobile Pay app

Step 2: Click on ‘UPI Payments’

Step 3: Verify Mobile Number

Step 4: Click on Manage > My profile

Step 5: Create UPI ID (select from the suggested options)

Step 6: Select Account Number > Submit

For UPI registration, an active International SMS pack is required.

Why use the iMobile Pay app for UPI payments?

-

Secure

All transactions are backed with Bank-level security

When in doubt, raise a query and also check its status

24x7 support available

-

Swift

No need to Log In

Here is a trick: long-press the iMobile Pay icon & ‘Scan any Indian QR’

-

Smart

Real-time payment status

Instant access to payment history with smart filters like:

Name | Date | Amount | Payment Type | Status

Frequently Asked Questions

How does Unified Payment Interface (UPI) work for NRIs?

UPI enables ICICI Bank Account Holders to send and receive money from their smartphones with a single identifier i.e. Virtual Payment Address (VPA), using their registered Indian or overseas mobile number from select geographies, i.e. Australia, Canada, Hong Kong, Oman, Qatar, Saudi Arabia, Singapore, UAE, UK and USA.

UPI can be used for transactions in Indian Rupees (INR) for:

- Sending money/ making payments to Indian merchants or UPI/ VPA IDs

- Scanning any UPI QR code to send money

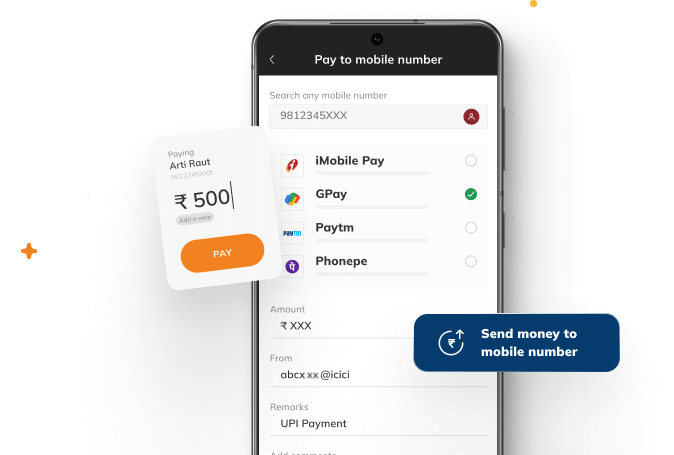

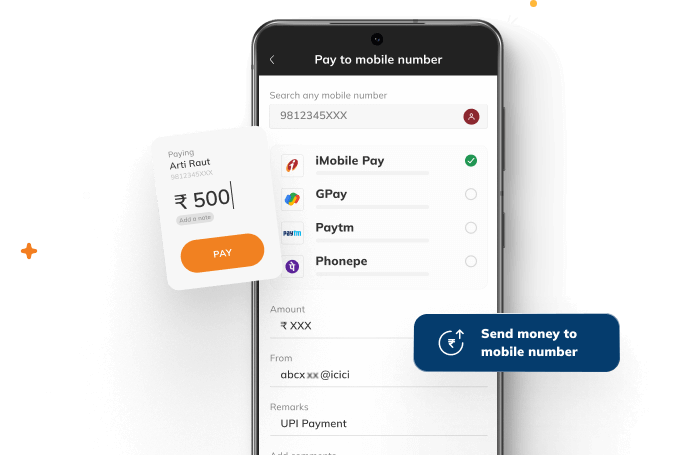

- Sending money to any Indian mobile number (if the mobile number is enabled for UPI)

- Sending money to an Indian bank account.

Can NRIs use UPI for transactions in India using their overseas mobile number?

Yes, NRIs can use UPI from their registered overseas mobile number from the approved geographies, i.e. Australia, Canada, Hong Kong, Oman, Qatar, Saudi Arabia, Singapore, UAE, UK and USA for INR transactions in India.

How can an NRI set up a UPI/ VPA ID?

NRIs can set up a UPI/ VPA ID using their ICICI Bank registered Indian mobile number or overseas mobile number from the approved geographies, i.e. Australia, Canada, Hong Kong, Oman, Qatar, Saudi Arabia, Singapore, UAE, UK and USA.

ICICI Bank NRI customers can register themselves for UPI by following these steps:

Log in to iMobile Pay application > UPI Payments > Verify Mobile Number > SMS Based Verification > Manage > My Profile > Create UPI ID and Select bank account (NRE/NRO) > Success.