- ₹30,000

- ₹1 Cr

- ₹0

- ₹1 Cr

- 12 Months

- 84 Months

You are eligible for a

total amount of

Your EMI

will be

Disclaimer: Personal Loan Eligibility Calculator provides tentative eligible loan Amount. Actual Loan amount is subject to ICICI Bank's verification and other factors

Personal Loan Eligibility Criteria

See how easy it is to get Personal Loan! Watch Now

Popular Personal Loan FAQs

What is a Personal Loan?

Personal Loan is an unsecured Loan and one of the best loans for marriage expenses, paying medical bills or planning your dream vacation. Personal Loans can act as a financial cushion for you at the time of emergency. Whatever your financial goals are, ICICI Bank Personal Loans cater to all your needs. Availing a Personal Loan is not restricted to just emergencies, you can apply for a Personal Loan to fund your vacation as well. You can also check Personal Loan EMIs with our Personal Loan EMI calculator.

You can apply for a Personal Loan online from our ICICI Bank website and meet your diverse financial needs. You can avail a Personal Loan up to Rs <50> lakh and meet a sudden personal emergency. The process of Loan application is instant and convenient and can be done online from the comfort of your home. The instant Personal Loan approval process ensures you have a seamless and stress-free borrowing experience. Also, with our instant Personal Loan online services, you can get access to funds within 3 seconds.

How does one avail an instant Personal Loan online with ICICI Bank?

Visit our website to secure an instant Loan with ICICI Bank. After checking your Pre-approved Offer, check your eligibility, fill in and submit your Personal Loan application. Select the Loan amount and tenure as per your requirement. Check your Personal Loan approval status. You will receive an instant Loan approval and the amount will be disbursed into your Account immediately.

What are the required documents for a Personal Loan with ICICI Bank?

Documents required to avail an Instant Personal Loan with ICICI Bank:

For Salaried Individuals:

- Proof of Identity: Passport/Driving License/Voter ID/PAN Card (any one)

- Proof of Residence: Leave and License Agreement/ Utility Bill (not more than 3 months old)/ Passport (any one)

- Last 3 months’ Bank Statement (where salary/income is credited)

- Salary slips for the last 3 months

- 2 Passport size photographs.

For Self-Employed:

KYC Documents: Proof of Identity, Address proof and DOB proof.

- Proof of Residence: Leave and License Agreement/ Utility Bill (not more than 3 months old)/ Passport (any one)

- Income proof (audited financials for the last two years)

- Last 6 months’ Bank Statement

- Office address proof

- Proof of residence or office ownership

- Proof of continuity of business.

*Conditions apply.

*ICICI Bank reserves the right to call upon additional documents at its discretion.

Apply for Personal loan

at your convenience

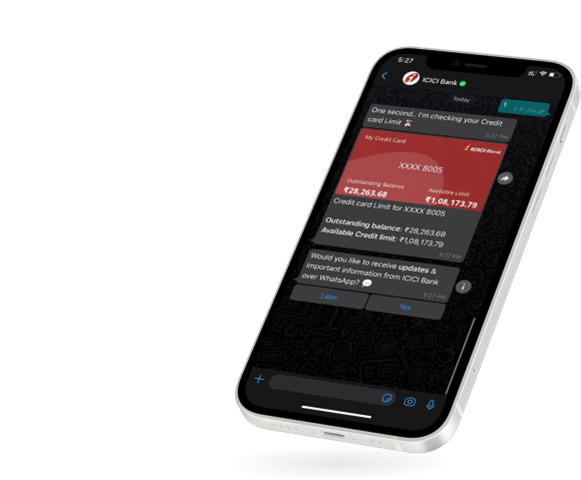

- Mobile Banking

- Net Banking

- WhatsApp Banking

Apply for Personal loan

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking