ICICI Bank launches ‘Eazypay’, India’s first mobile app for merchants to accept payments on mobile phone through multiple digital modes

December 27, 2016

- It allows buyers to pay sellers through UPI, any credit / debit card, internet banking, and ‘Pockets’, digital wallet of ICICI Bank

Mumbai: ICICI Bank, India’s largest private sector bank by consolidated assets, today announced the launch of ‘Eazypay’, a mobile application to enable merchants, retailers and professionals to accept instant cashless payments on mobile phones from their customers through multiple digital modes. A first-of-its kind application, ‘Eazypay’ offers customers the improved convenience of paying by using their mobile phone through Unified Payment Interface (UPI), any credit / debit card & internet banking, and ‘Pockets’, digital wallet of ICICI Bank.

Any current account holder of ICICI Bank can instantly download ‘Eazypay’ app and start using it. A non-customer of ICICI Bank can also use the app after opening a current account with the bank. The app is available on smartphones with Android operating systems. It will be shortly available for smartphones using the iOS operating system.

Ms. Chanda Kochhar, MD & CEO, ICICI Bank said, “Since the announcement of the demonetisation, we have proactively undertaken various measures to accelerate the shift to a digital economy. ‘Eazypay’ is yet another initiative to fulfill the vision of Digital India. I believe that the Eazypay mobile application is a path-breaking concept as it facilitates millions of merchants, retailers and professionals across the country to accept digital payments from various modes on a single mobile application. I believe this application will have broad base usage as it allows merchants to collect any amount digitally without any hassles of a daily or monthly limit on collection. Additionally, it can be used by upto 30 employees of a merchant simultaneously to collect payment on their mobile phones at multiple counters ‘in-the-store’ as well as ‘on-the-go’ like home deliveries. The money collected through this app directly goes to the current account of the merchants and professionals. Our existing customers do not need to visit a branch or submit any document for using the app.”

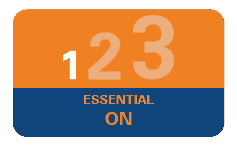

An illustration of the two easy steps to register for the mobile payment collection solution:

- Download ‘Eazypay’ application on the smartphone having the mobile number that is registered with ICICI Bank. The application automatically fetches information of ICICI Bank Current Accounts linked to the mobile number. The user can select the default Current Account for receiving payments. There is no requirement to submit any documents or visit the bank branch.

- Create an MPIN to login into Eazypay. Also user has to create their UPI ID for accepting payments through UPI. The UPI ID acts as a financial address for receiving money, without having to reveal your 16 digit bank account number and the 11 digit IFSC code.

Once downloaded, merchants can immediately begin to accept payments on the app over the counter. It is also possible to collect money in situations like home delivery of goods/services,telesales and payment-on-delivery options by e-commerce companies where the buyer and the seller are not physically present in the same location. The seller can raise an invoice in the app by simply entering the amount, selecting the preferred mode of payment by the buyer along with the buyer’s mobile number or VPA for UPI based payments. Thereafter, upon getting a notification on SMS, the buyer can simply enter his/her details to pay through credit / debit card / net banking or Pockets. For payment using UPI, the buyer can pay either by scanning a QR code displayed on the seller’s phone or directly through their VPA.

Eazypay comes with best-in-class security features. It allows only one registration for a unique mobile number and requires mandatory authentication with MPIN for every login, among others

The other unique features of ‘Eazypay’ are:

- For both over the counter payments and home deliveries: Eazypay is suitable for retail stores where the buyer pays at the counter. It can also be used to collect payment from the buyer during home deliveries, telesales and payment-on-delivery instances where the seller and buyer may not be physically present in the same location

- Set collection date options: For accepting payments through UPI, the seller can choose to collect payment immediately or set up a later date upto 45 days

- Easy reconciliation: Merchants get immediate payment confirmation in the ‘transaction history’ on the application as well as through SMS. The buyer also gets payment confirmation through SMS immediately for all the bills. The merchants get immediate credit to their current account for payments made using UPI and Pockets

- Enables multiple employees to collect payment: The unique ‘sub merchant creation’ feature allows upto 30 employees to collect payment on behalf of the merchant on their smartphone. It offers a convenient option for collecting digital payments at retail stores with multiple billing counters or during home deliveries

- No daily/monthly limits for accepting payments

To know more about ‘Eazypay’ mobile payment collection solution, please visit http://ow.ly/Oqvh307sPHy To apply for an ICICI Bank current account, one can send an SMS to 5676766

The launch of ‘Eazypay’ comes close on the heels of a slew of technology-led innovative initiatives and services by ICICI Bank recently to accelerate digital transactions in the country. These include the announcement of the creation of ‘100 Digital Villages’ in as many days, increase of daily usage limits of debit cards for use at Point of Sale (POS) and online transactions till December 31, 2016, deployment of POS machines at merchant outlets, petrol pumps as well as office establishments for convenient withdrawal of cash. Additionally, we have deployed mobile branches in remote unbanked villages and also for door-step service at public utilities like hospitals.

The Bank services its large customer base through a multi-channel delivery network of 4468 branches, 14,295 ATMs, call center, internet banking (www.icicibank.com), mobile banking and social media banking (as at September 30, 2016).

For news and updates, visit www.icicibank.com and follow us on Twitter at www.twitter.com/ICICIBank

About ICICI Bank: ICICI Bank Ltd (NYSE:IBN) is India’s largest private sector bank by consolidated assets. The Bank’s consolidated total assets stood at US$ 144.7 billion at September 30, 2016. ICICI Bank's subsidiaries include India's leading private sector insurance, asset management and securities brokerage companies, and among the country’s largest private equity firms. It is present across 17 countries, including India.

Except for the historical information contained herein, statements in this release, which contain words or phrases such as 'will', 'would', etc., and similar expressions or variations of such expressions may constitute 'forward looking statements'. These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward-looking statements. These risks and uncertainties include, but are not limited to our ability to obtain statutory and regulatory approvals and to successfully implement our strategy, future levels of non-performing loans, our growth and expansion in business, the adequacy of our allowance for credit losses, technological implementation and changes, the actual growth in demand for banking products and services, investment income, cash flow projections, our exposure to market risks as well as other risks detailed in the reports filed by us with the United States Securities and Exchange Commission. ICICI Bank undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date thereof. All reference to interest rates, penalties and other terms and conditions for any products and services described herein are correct as of the date of the release of this document and are subject to change without notice. The information in this document reflects prevailing conditions and our views as of this date, all of which is expressed without any responsibility on our part and is subject to change. In preparing this document, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. ICICI Bank and the "I man" logo are the trademarks and property of ICICI Bank. Any reference to the time of delivery or other service levels is only indicative and should not be construed to refer to any commitment by us. The information contained in this document is directed to and for the use of the addressee only and is for the purpose of general circulation only.