ICICI Bank launches ‘iMobile Pay’; India’s first app that offers payments and banking services for all

December 07, 2020

- Customers of any bank can link their bank account, generate a UPI ID and start paying and shopping immediately

- They also get instant access to the entire range of ICICI Bank’s banking services

- They can transfer money to any bank account, payment app and digital wallet

Mumbai: ICICI Bank today announced that it has transformed its state-of-the-art mobile banking app, iMobile, into an app that offers payments and banking services to customers of any bank. Called ‘iMobile Pay’, the app offers a unique combination of facilities of a payment app-- such as enabling customers to pay to any UPI (Unified Payments Interface) ID or merchants, pay bills and do online recharges among others-- with instant banking services namely savings account, investments, loans, credit cards, gift cards, travel cards and much more. The users of ‘iMobile Pay’ can also transfer money to any bank account, payment app and digital wallet.

Another prominent feature of ‘iMobile Pay’ is ‘pay to contacts’ which enable users to automatically see the UPI IDs of their phone book contacts, registered on the ICICI Bank UPI ID network, of any payment app and digital wallet. This unique functionality provides users a significant convenience of inter-operability, as they no longer have to remember the UPI IDs and can easily transfer money across payment app and digital wallet.

A first-of-its-kind facility in India, ‘iMobile Pay’ extends the ambit of mobile banking apps which are hitherto restricted to only the customers of the respective banks. At the same time, ‘iMobile Pay’ eliminates the need to maintain multiple apps—be payments or banking—as it empowers customers to undertake all transactions. In the process, it also offers compelling reasons for users to link their multiple bank accounts to this app.

To get started on ‘iMobile Pay’, customers of any bank in the country can download the app, instantly link their bank accounts and generate a UPI ID (which is simply their mobile number e.g. xxxxxx1234.imb@icici) to avail all the facilities.

Speaking on the initiative, Mr. Anup Bagchi, Executive Director, ICICI Bank said, “ICICI Bank has always been at the forefront of introducing pioneering innovations. These innovations have played a key role in transforming the way digital India banks. In line with this rich tradition, we introduced the country’s first mobile banking app, iMobile, in 2008.

In the recent past, we have captured two user insights while interacting with them. One, many of them, who are not our customers, are keen to use iMobile. Two, customers are tired of using multiple apps for difference purposes and they really want to know if an app can take care of all banking and payments requirements. Armed with these insights, we are delighted to extend the ambit of our mobile banking app. Now on, customers of any bank can experience the ease, speed and safety of our mobile banking app. They can link all their bank accounts to this app. It means they can continue to bank with any bank and still use ‘iMobile Pay’ for all their digital transactions. Also, they can undertake all transactions, which they were so far doing through a gamut of payments app, through this app.

We believe that users will like this innovation as it offers them the unique benefit of payment apps and banking apps in one single place. “

Mr. Dilip Asbe, MD & CEO, NPCI said, “We are delighted to facilitate ICICI Bank in transforming its mobile banking app empowered with UPI and interoperable with all other UPI based payment apps. This is yet another initiative that will inspire the ecosystem to integrate interoperability on digital platforms. UPI is known to provide seamless, secure and convenient payment experience to its users and it is our belief that the large scale adoption of UPI will strengthen the ecosystem and help in achieving the common goal of less- cash society.”

Over the years, marquee research agencies have adjudged iMobile as one of the best banking apps in the world for its large array of services, user-friendly functionalities and intuitive design. For example, iMobile has been rated among top ranking apps for the past five consecutive years by Forrester, a reputed global research firm.

The key features of ‘iMobile Pay’ are:

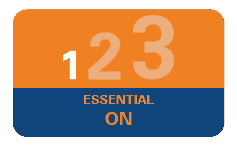

- Open for all: ‘iMobile Pay’ enables customers of all banks to download this app and experience the quick transactions backed by best-in-class security features

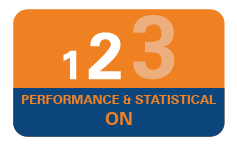

- Acts like a payments app: It allows customers to scan a QR code of any payments app and send money to any UPI ID, bank account, self. It helps the users to transfer the money instantly to anyone free-of-cost. Further, users can pay using the app at a host of establishments including petrol pumps, grocery stores, restaurants, pharmacies, hospitals, multiplexes and much more. Further, they can transfer money to any bank account, payment app or digital wallet.

As an industry-first, users can simply use the ‘Pay to contact’ feature without remembering UPI IDs of friends. Using the feature, users can send or receive money to/from their phone contacts registered on any other popular payment app and digital wallet with an ICICI Bank UPI ID. The feature, relying on inter-operability, automatically displays upto three UPI IDs available for a contact to which one can pay. - Offers banking services: It also acts as a gateway for the customers to begin a new relationship with ICICI Bank. It allows them to open an ICICI Bank savings account digitally and instantaneously, apply for a credit card at zero joining fee and get instant approval for home/personal/car loans.

- Enables users to link multiple bank accounts: Users can transact using any of these linked accounts with a single UPI ID which is generated at the time of linking the first account.

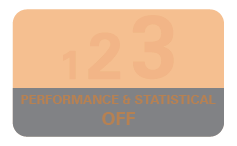

- Lot more to be added soon: The list of forthcoming exciting features include users can pay utility bills, recharge mobile phones, check CIBIL score, book travel tickets, buy travel and gift cards, invest in an FD, RD, mutual funds and insurances. They will also get a feature of spends tracker, that will provide an overview of spends, with all transactions are bucketed into specific categories, to help them track their balances.

Here are the simple steps to start using the app:

- Download: Download the app, ‘iMobile Pay’, from Google Play Store, open it and set up a four-digit log-in PIN. Users also have the option of logging in using their fingerprint. Please note that it will soon be available for iOS devices.

- Link account/s: On the welcome screen, tap on ‘link account’ and enter the required details to link the savings account of any bank. Users can also link multiple bank accounts.

- Generate UPI ID: Upon successful linking of the account/s, a UPI ID will be generated, which can be used to start making transactions. The UPI ID generated will remain the same for all the linked bank accounts. Users can simply select the account of their choice, while making a transaction.

To know more on the facility, visit: https://www.icicibank.com/mobile-banking/imobilepay.page ; To download the app, visit Google Play Store.

For news and updates, visit www.icicibank.com and follow us on Twitter at www.twitter.com/ICICIBank

About ICICI Bank: ICICI Bank Ltd (BSE: ICICIBANK, NSE: ICICIBANK and NYSE:IBN) is a leading private sector bank in India. The Bank’s consolidated total assets stood at ₹14,76,014 crore at September 30, 2020. ICICI Bank's subsidiaries include India's leading private sector insurance, asset management and securities brokerage companies, and among the country’s largest private equity firms. It is present across 15 countries, including India.

Certain statements in this release relating to a future period of time (including inter alia concerning our future business plans or growth prospect s) are forward - looking statements intended to qualify for the 'safe harbor' under applicable securities laws including the US Private Securities Litigation Reform Act of 1995. Such forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward - looking statements. These risks and uncertainties include, but are not limited to statutory and regulatory changes, international economic and business conditions; political or economic instability in the jurisdictions where we have operations, increase in non - performing loans, unanticipated changes in interest rates, foreign exchange rates, equity prices or other rates or prices, our growth and expansion in business, the adequacy of our allowance for credit losses, the actual growth in demand for banking products and services, investment income, cash flow projections, our exposure to market risks, changes in India’s sovereign rating, as well as other risks detailed in the reports fi led by us with the United States Securities and Exchange Commission. Any forward looking statements contained herein are based on assumptions that we believe to be reasonable as of the date of this release. ICICI Bank undertakes no obligation to update forward - looking statements to reflect events or circumstances after the date thereof. Additional risks that could affect our future operating results are more fully described in our filings with the United States Securities and Exchange Commission. These filings are available at www.sec.gov