THE

ORANGE

HUB

Types of Mutual Funds for Various Life Goals

Evolving as a popular asset class for accumulating wealth for various life goals, mutual funds have gained significant traction of late. Campaigns such as ‘Mutual Funds Sahi Hain’, coupled with enhanced financial literacy, has made them highly desirable among the masses.

Recategorisation of mutual funds by market regulator Securities and Exchange Board of India (SEBI) last year has made them more transparent, and today there are 36 different types of mutual funds available to invest. In this article, we will state the types of funds that you can opt for accomplishing various life goals.

Money for emergency

Emergencies arrive unannounced and can derail even the soundest financial plan. Hence, it’s essential to be prepared for them in advance and build a corpus for the same. Liquidity is an important factor to consider while parking money for a contingency. It means the money should be readily accessible.

Liquid funds are an ideal avenue to invest money for building an emergency corpus. These funds invest in securities with a maturity period of 91 days and generally offer better returns than a Savings Account. Also, recent SEBI norms have made them more liquid.

As per the recent mandate, liquid funds need to maintain at least 20% in assets like cash and government securities to maintain enough liquidity. Redemption is quick and fast. Once you apply to redeem, the money is credited into your account in one working day.

Corpus for child’s higher education

Higher education of children is an essential financial goal for parents. Education inflation is higher than general inflation and this calls for investing early in an asset class offering inflation-beating returns.

Equity mutual funds can help you build a sizeable corpus for your kid’s education. You can opt for large-cap equity funds which invest at least 80% of their assets in the top 100 companies by market capitalisation.

These funds have given 8.42% return in five years. Apart from offering stable and decent returns, large-cap funds are better structured to contain losses during a market downturn.

Retirement nest

A goal that’s often procrastinated, it’s imperative to build a substantial retirement nest to ensure your golden years are stress-free. Thanks to advancement in medical sciences, post retirement years can stretch up to 15-20 years or even more.

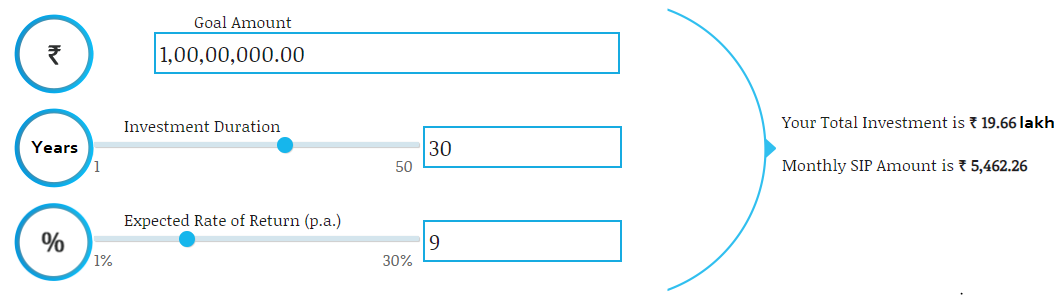

The relentless march of inflation makes it crucial to have a vast reservoir of funds that outlives you. Here again, equity mutual funds can serve the purpose. For instance, if you wish to accumulate Rs 1 crore for your retirement, 30 years down the line, investing Rs 5,462 in an equity fund offering annualised return of 9% can do the job for you (see figure).

Tax planning

An important exercise of personal finance, effective tax planning helps you lower your tax liability. What’s also crucial is to align tax planning with financial goals. Equity-Linked Savings Scheme (ELSS) is a category of mutual funds that help you hit two birds with one stone.

Investing in ELSS qualifies for tax exemption under Section 80C of the Income Tax Act, 1961. At the same time, you can build wealth in the long-term as these funds are equity-oriented. ELSS also has the shortest lock-in period among all tax-saving instruments – 3 years.

The final word

Professional management of mutual funds makes them an ideal investment vehicle for retail investors to venture into stock market investment. Aiding you to accomplish critical life goals, starting a Systematic Investment Plan (SIP) can reap rewards in the long term.

If you are a Customer, For better returns apply for mutual funds investment here.

If you are a Customer, For better returns apply for mutual funds investment here.

If you are a Non-Customer, For better returns, apply for mutual funds investment here.

Scroll to top