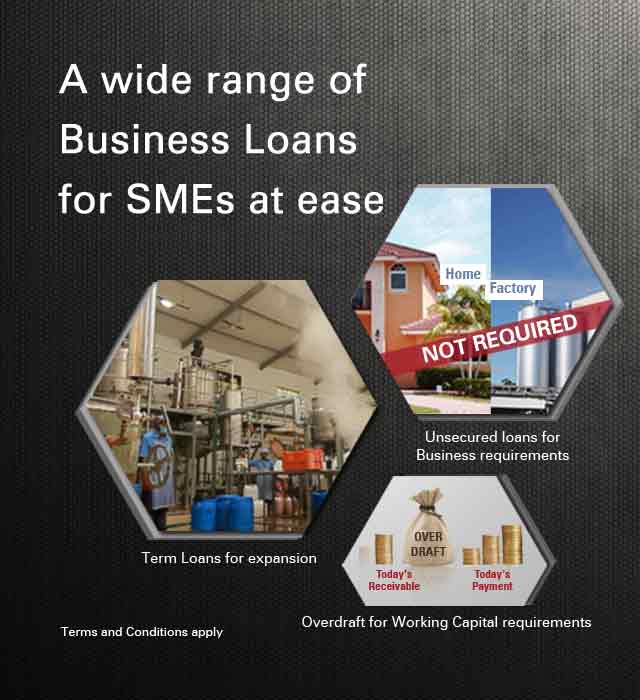

Innovative financing designed to fuel your business

Managing finance is unarguably the most important component of any business. For SMEs, timely finance is the key to making the most of business opportunities. Keeping this in mind, we at ICICI Bank have designed a package of loans to best suit their business requirements.

Fund your expansion and asset purchases

Avail ICICI Bank’s Term Loans to make long term capital investments, whether in plant and machinery or commercial assets.

Avail Overdraft facility against property up to ₹ 20.0 mn on the basis of Goods and Services Tax (GST) returns, with no financials requirement.

Protect your business from exigencies

Avail overdraft facility with minimal documentation basis banking transaction with no financial requirement

Get loans to match your specific needs. Our tailor made loans for SMEs let you choose the option most convenient and suitable for your business.

The initial period is most difficult for a new business startup. Get working capital, cash credit facility and other loans from ICICI Bank after just a year of operations

Get cash credit and term loan through a government backed CGTMSE loan up to Rs. 2 crore

Business loans based on past transaction history

Get Export Finance, Letter of Credit, Bank Guarantees and foreign currency loans to support your business.

Insta-Secured Overdraft Facility is an Online lending platform to cater your working capital requirements by providing secured overdraft facility.

Your network circle influences business growth. Join BizCircle GlobalLinker and connect with buyers & sellers. For details, visit BizCircle GlobalLinker. T&C.