Now you don’t need to find a network hospital or file for reimbursement claims. With our plan, you will receive the lump sum claim amount as soon as diagnosis is made, so that you can get treated at a hospital of your choice.

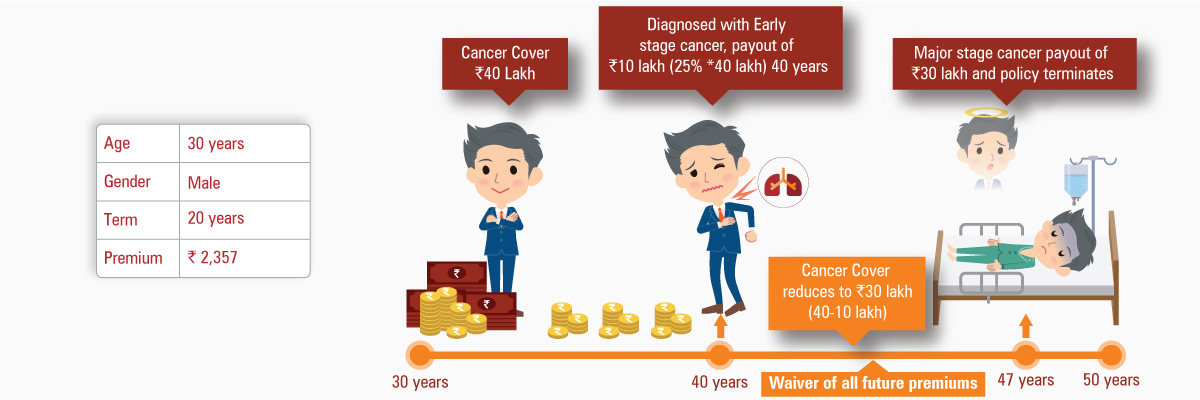

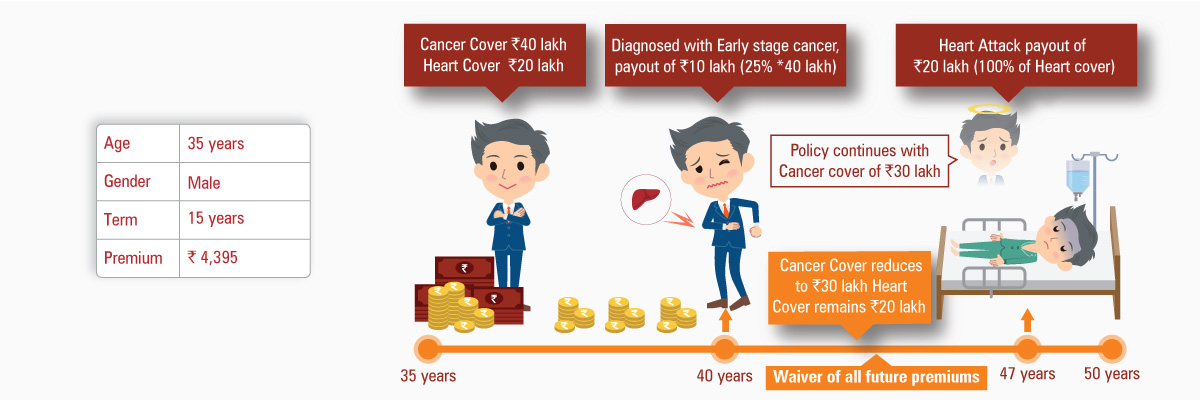

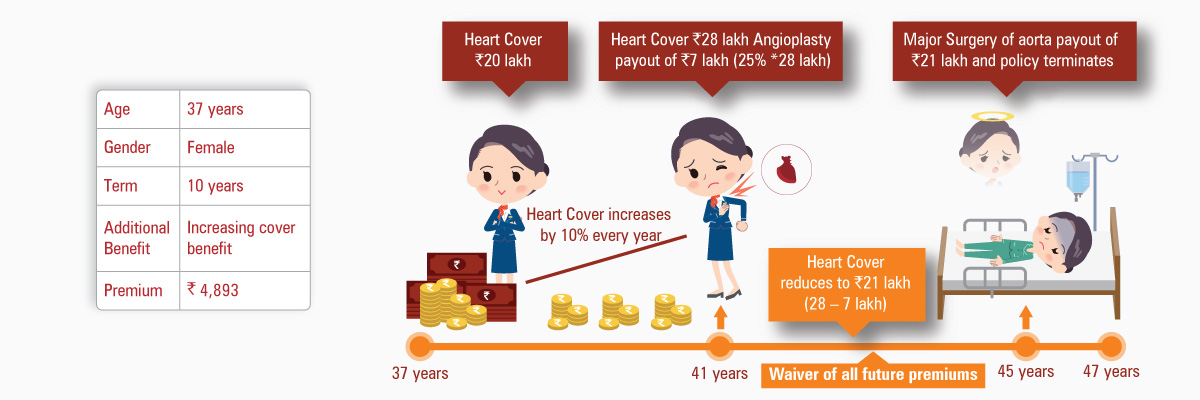

The plan will pay the rest of your future premiums if you are diagnosed even with a minor condition or are permanently disabled. This means that you enjoy full cover at no cost or zero premiums^.

Certain health insurance plans require you to pay a part of your expense, while the rest is paid by the insurer. There is no co-payment in this plan and the plan provides the claim amount on the first diagnosis of illness irrespective of the actual amount spent on treatment.

Your ideal sum assured amount should be based on future cost of treatments, including recovery, medicines, hospitalization, additional living expenses and diagnostic tests.

Total Estimated Cost ₹ 23 Lakhs

Chemotherapy per Cycle

₹ 63,500 - 1,90,500

Therapy of 5-6 Sessions

₹ 20 Lakhs

PET- CT Scan

₹ 19,050 - 28,575

Life insurance is a payment made to your family in case of your death during the policy term or a payment made to you on surviving the policy term. In return for this payment, you make periodic fixed payments to the life insurance company.

Yes, life insurance policy is necessary for the financial well-being of your loved ones in your absence.

#Only doctor’s certificate confirming diagnosis needs to be submitted. The benefit is payable only on the fulfillment of the definition of the diagnosed level of listed condition

*Rs 20 lakh cancer cover at Rs 99 p.m. - This premium rate is for a 24 year old healthy non-smoker male for a term of 20 years, monthly premium payment frequency and without any additional benefits and is inclusive of all taxes.

~A lump sum is paid out on diagnosis of any of the listed conditions. This payout is based on the level of the condition. In any case, the total payout in the policy cannot exceed 100% of the Sum Assured of the cover selected. Please refer to the sales brochure to know about the payouts at different level of condition.

^The Company shall waive all future premiums on a claim of Minor condition under the chosen cover; or on the diagnosis of Permanent Disability (PD)of the Life Assured due to an Accident. This benefit is available only if the policy is in force as on the date of diagnosis of the condition/at the time of accident.

***Deduction from Taxable Income up to Rs 25,000 for self, spouse and dependent children (Rs 30,000 if the age of insured is 60 years or more) towards health insurance premium paid u/d 80D. Insurance premium for claiming deduction should be paid in any mode other than cash. Tax benefits are subject to conditions of section 80D and other provisions of the Income Tax Act, 1961. Tax laws are subject to amendments made thereto from time to time.

1Source: http://www.indiahealthcaretourism.com/average_cost_of_treatment.php

2Source: http://www.medgurus.org/cost-of-Cancer-treatment-in-india/

ICICI Prudential Life Insurance Company Limited. IRDAI Regn No. 105. CIN: L66010MH2000PLC127837

© 2016, ICICI Prudential Life Insurance Company Limited. Registered Address:- ICICI PruLife Towers, 1089, Appasaheb Marathe Marg, Prabhadevi, Mumbai-400025. Insurance is the subject matter of the solicitation. For more details on the risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale. Call us on 1-860-266-7766 (10am-7pm, Monday to Saturday, except national holidays and valid only for calls made from India) and on 91-22-6193-0777 (Valid for calls made from outside India) (10am-7pm (IST), Monday to Saturday, except national holidays). Tax benefits under the policy are subject to conditions u/s 80D of the Income Tax Act, 1961. Goods and Services Tax and Cesses will be charged extra over the premium amount as per the applicable rates. Tax laws are subject to amendments from time to time. ICICI Pru Heart/Cancer Protect. UIN: 105N154V02.

Advt. No.: W/II/1660/2020-21.

ICICI Bank Limited ("ICICI Bank") with registered office at ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, 390 007, Gujarat (CIN: L65190GJ1994PLC021012) is a corporate agent (Composite, IRDAI Reg No.: CA0112 valid till 31/03/2022) of ICICI Prudential Life Insurance Company Limited ("ICICI Prulife"). Insurance is underwritten by ICICI Prulife.

The products, services and benefits referred to herein are subject to terms and conditions governing them as specified by ICICI Prulife from time to time. ICICI Bank is acting merely as a corporate agent of ICICI Prulife. Purchase by ICICI Bank’s customer of any insurance products is purely voluntary, and is not linked to availment of any other facility from ICICI Bank.

ICICI Bank shall not be liable or responsible for any loss resulting from insurance company's products/services.

Time limit on the validity:

Subject to applicable laws, all the information given above is valid for the term of the policy purchased.

BEWARE OF SPURIOUS / FRAUD PHONE CALLS !

• IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums.

• Public receiving such phone calls are requested to lodge a police complaint.

- Mobile Banking

- Net Banking

- WhatsApp Banking

Quick tips and helpful product demonstration videos - ICICI Bank Online Demos & Videos

Explore Now

.png)