Why Mutual Fund through ICICI Bank ?

How to invest in

Mutual Funds?

Explore Our Mutual Fund Videos

Mutual Fund FAQs

What is Mutual Fund and how it works?

A mutual fund is a professionally-managed trust that pools the savings of many investors and invests them in securities like stocks, bonds, short-term money market instruments. Investors in a mutual fund have a common financial goal and their money is invested in different asset classes in accordance with the fund’s investment objective. Any investment in such a financial instrument is termed mutual fund investment. Knowledge about a mutual fund scheme can be obtained from its Scheme Information Document (SID) and Fund Fact Sheet.

What is the process to invest in a Mutual Fund through ICICI Bank?

You can invest in Mutual Funds by logging in to ICICI Bank Internet Banking. Click on the ‘Investments and Insurance’ section > Invest online > Invest in Mutual Funds.

Alternatively, you can invest in MF through ICICI Bank’s iMobile Pay > click on the ‘Invest & Insure’ section > Invest > Mutual Funds..

Is Mutual Fund a good investment?

Mutual Funds are a good investment option for investors looking to diversify their portfolios. Instead of taking exposure to only one company or industry, a Mutual Fund investor invests in different securities and minimises your portfolio's risk.

Disclaimer

Terms and Conditions of ICICI Bank, as available on www.icicibank.com and Terms and Conditions of the third parties apply. ICICI Bank is not responsible for third party products, goods, services and offers. Customers shall be deemed to have read, understood and consented to these Terms and Conditions.

Nothing in this document is intended to constitute advice of any kind including legal, tax, security or investment advice or opinion regarding the appropriateness of any investment(s) or an offer, invitation or solicitation for any product(s) or service(s) and does not intend to create any rights or obligations.

The use of any information set out herein is entirely at the recipient’s own risk. ICICI Bank does not accept any responsibility for any errors whether caused by negligence or otherwise or for any loss(es) or damage(s) incurred by anyone by placing reliance on anything set out in this document, including any loss(es) or shortfall(s) resulting from the operations of the Mutual Funds. The information set out herein may be subject to updation, completion, revision, verification and amendment.

For a "Fund of Funds" scheme, investors may please note that they will be bearing the recurring expenses of the relevant Fund of Funds Scheme in addition to the expenses of the underlying schemes in which the Fund of Funds Scheme makes investment.

ICICI Bank is acting merely as a distributor/corporate agent/point of service for the third party(ies). Any investment(s) in such third party product(s)/service(s) shall constitute a contract between the investor and the third party. ICICI Bank shall not be liable or responsible for any loss(es) resulting from the third party’s product(s). The contract, with regard to the Mutual Fund is between the asset management company and the investor and not between ICICI Bank and the investor. Participation by ICICI Bank’s customers is on a purely voluntary basis and there is no direct or indirect linkage between the provision(s) of the banking services offered by the Bank to its customers and their usage of the product(s) or participation in the scheme. Please visit www.icicibank.com/Personal-Banking/investments/mutual-funds/disclosure page for more details.

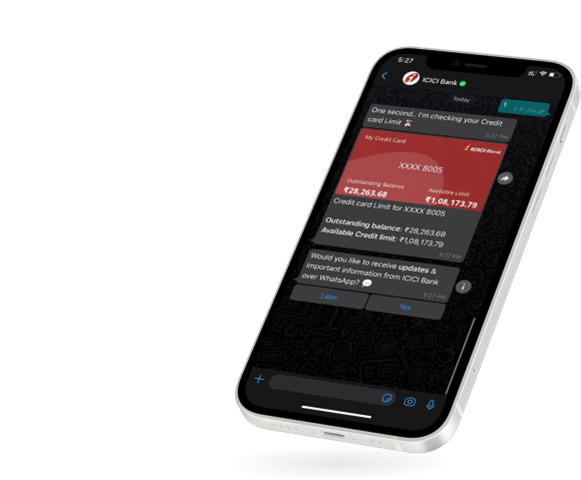

Invest Anywhere,

Anytime

Mobile Banking | Net Banking

WhatsApp Banking