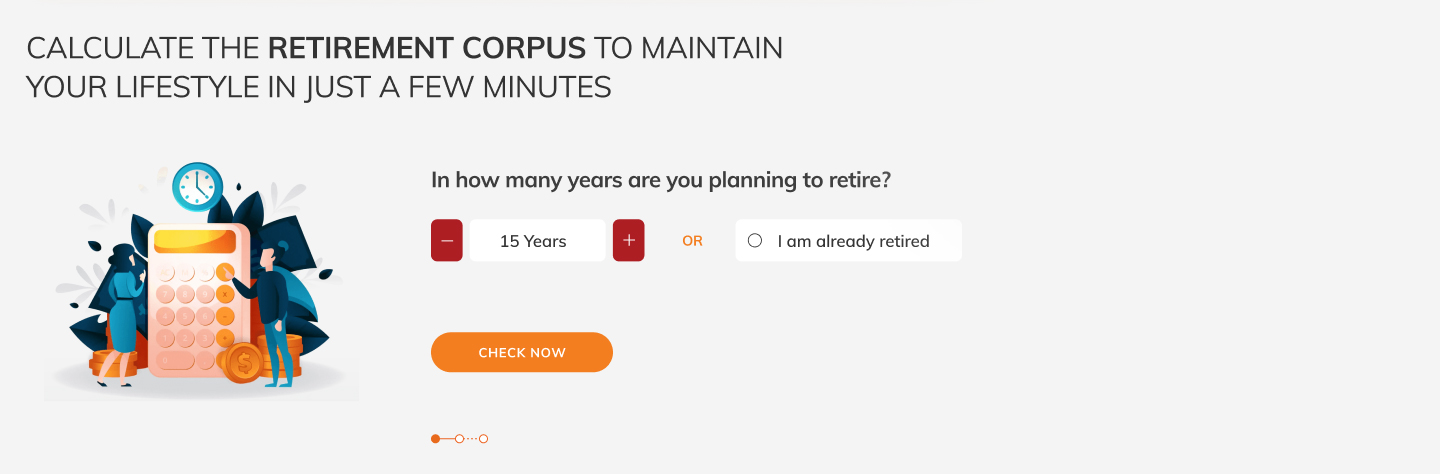

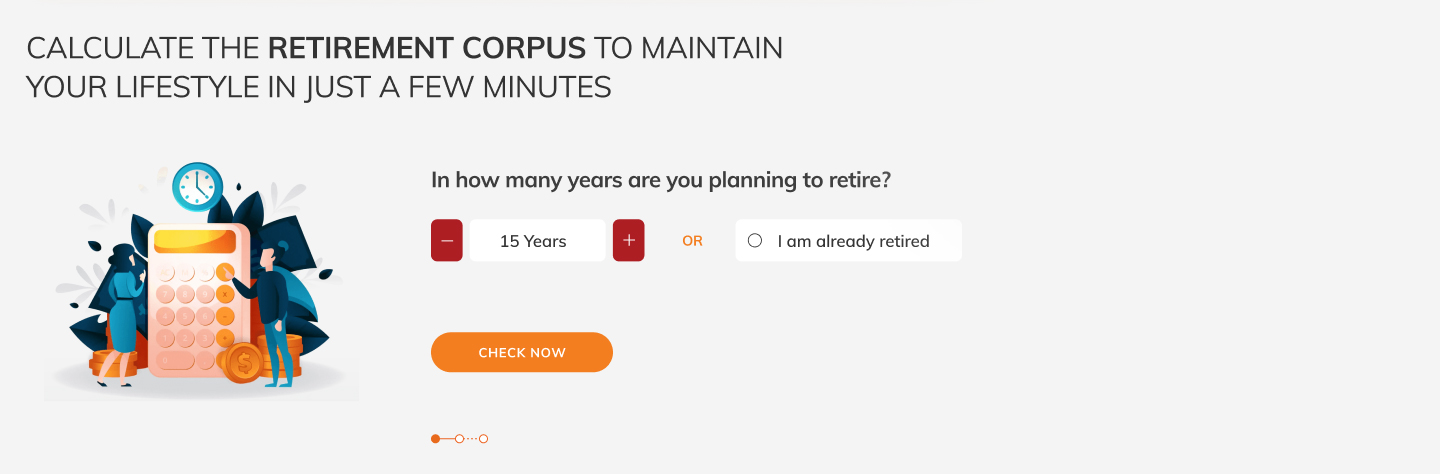

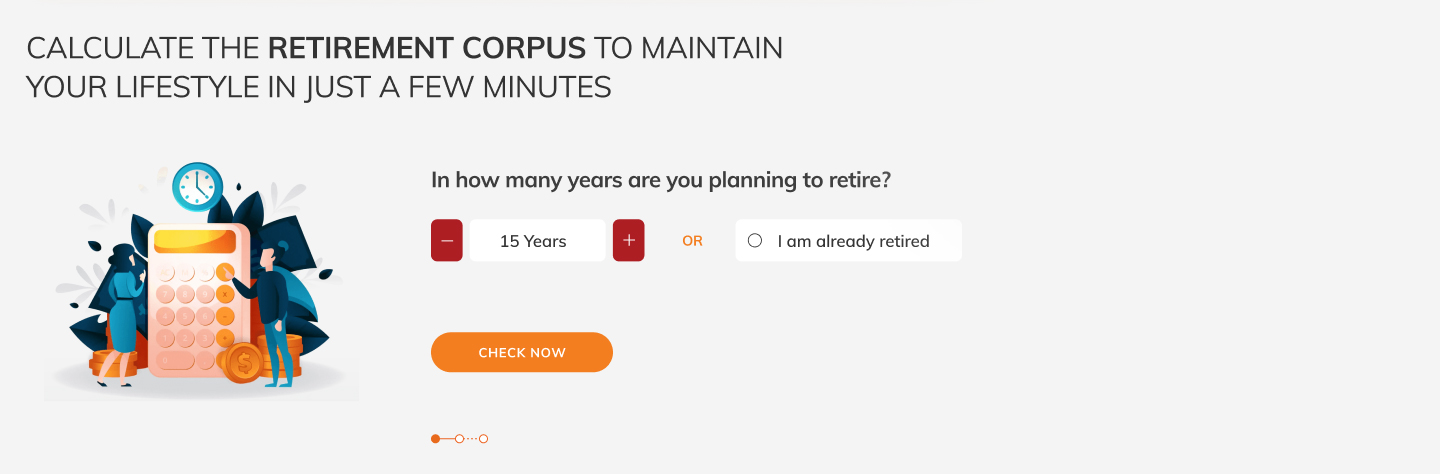

How close are you to retirement?

You are in time to start planning towards your retirement. Take a look, how the golden years programme can help you.

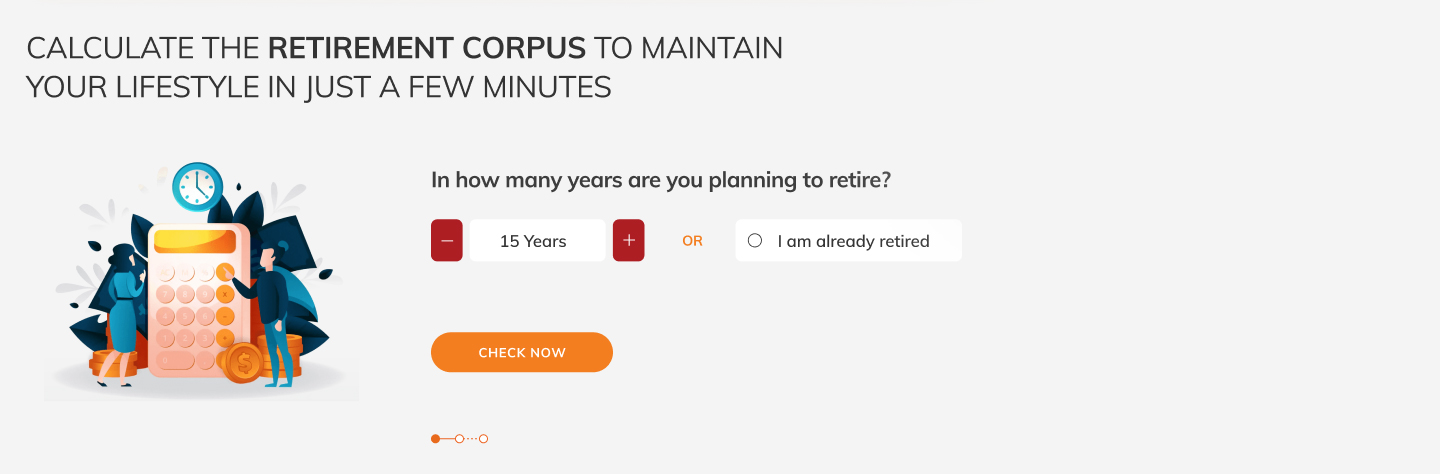

Plan your Retirement

Set the building blocks in your retirement planning journey

Be it exotic holidays, pursuing a passion or children’s marriage, retirement is the time to fulfil your bucket list.

With the Golden Years programme, you can plan for your dreams and convert them into reality. Grow your savings with our customised solutions and meet your retirement goals to enjoy a fulfilling life ahead.

Earmarking investments will keep you on track in meeting your retirement goals.

Our experts recommend allocating investments towards your goals as it brings accountability and a purpose to the retirement plan.

Having a clear vision along the road to retirement will set you on the path of meeting your goals.

Break down your goals into smaller financial milestones with ease. Identify the difference between how much you need and what you have saved towards your retirement.

Your retirement needs are unique and requires expert guidance at every step of the journey.

Save yourself from the hassle of searching for the most suitable options. Our experts have hand-picked solutions for your retirement.

-

Existing Customer?

Login -

New Customer?

-

Need personalised assistance?

Request a Call back

Manage your Progress

Transition smoothly into your retirement years

Enjoy your Retirement

Live life to the fullest with a worry-free retirement

You are in time to start planning towards your retirement. Take a look, how the golden years programme can help you.

Plan your Retirement

Set the building blocks in your retirement planning journey

-

Existing Customer?

Login -

New Customer?

OPEN SAVINGS ACCOUNT INSTANTLY

Manage your Progress

Transition smoothly into your retirement years

Enjoy your Retirement

Enjoy a worry-free life in your retirement years

You are in time to start planning towards your retirement. Take a look, how the golden years programme can help you.

Plan your Retirement

Set the building blocks in your retirement planning journey

-

Existing Customer?

Login -

New Customer?

OPEN SAVINGS ACCOUNT INSTANTLY

Manage your Progress

Transition smoothly into your retirement years

Enjoy your Retirement

Enjoy a worry-free life in your retirement years

Orange Book Blogs

*Source: PGIM India Mutual Fund Retirement Readiness Survey 2020.

Disclaimer: The content herein is only for information and does not amount to an offer, invitation or solicitation to buy or sell, and is not intended to create any rights or obligations. It is also not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to law or would subject ICICI Bank Limited (“ICICI Bank”) or its affiliate(s) to any licensing or registration requirements. Nothing contained herein is intended to constitute advice or opinion; please obtain professional advice before relying on any information contained herein. ICICI Bank disclaims any liability with respect to accuracy of information or any error or omission or any loss or damage incurred by anyone in reliance on the contents herein.