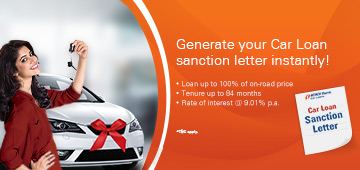

Check your eligibility for either a new Car Loan or a pre-owned Car Loan with our easy-to-use eligibility calculator

Instantly calculate your monthly payments

Find service charges for an ICICI Bank Car Loan

Quick, easy and minimal documentation required

Pre-Owned Car Loan

ICICI Bank also offers pre-owned Car Loans. With faster processing, the ICICI Bank Pre-Owned Car Loan makes it possible to own a wide range of certified/pre-owned cars, conveniently

Feature

- Insta Car Loan customers can avail a loan with up to 80% of the offer amount

- Loan tenure can be up to 8 years

- You get an attractive rate of interest

- Easy documentation

Refinance Car Loan

Refinance refers to granting a loan on an existing car, which is not hypothecated to any bank/financial institution or is hypothecated but has zero outstanding. Maximum refinance that can be availed, is up to 140% of the car’s valuation.

Feature

- Easy documentation

- You get an attractive rate of interest

- Your loan gets processed faster

Top-Up Car Loan

Existing Car Loan customers of ICICI Bank can also avail additional top-up loans. These loans can be used for any other requirements such as business development, wedding, personal engagements, home renovation, etc.

Feature

- Easy documentation

- You get an attractive rate of interest

- Your loan gets processed faster

Upgrade your Car Loan

As technology advances, car models get better and better. Existing ones get remodelled and new variants are launched quite frequently, making it difficult to resist the temptation to upgrade to a model with the latest technology.

These new models are complemented by various financing schemes offered by ICICI Bank Car Loans, making it easier to upgrade to the car of your choice at an attractive rate of interest.

So when should you upgrade?

- Warranty of your existing car: Cars these days are pretty good and if you take care of your car properly, then there should not be a need to take advantage of the warranty. However, few people like to have that safety net in place at all times. In this case, they might look to change their car before their coverage expires

- The finance: With the availability of ICICI Bank Car Loans, upgrade to your favourite car even if your current loan is functional.

Two Wheeler Loan

Our Two-Wheeler Loans can be applied online, with zero hassle.

Pre Owned Used Car Loan

Pre-owned Car Loan interest rates are attractive.

Loan Against Car

These loans can be used for any additional requirements.

The purpose of trackmyloan is:

- To view the status of loan application in real time

- To instantly get in touch with us in case of any query

Yes, trackmyloan is available for all the customers who have applied for Mortgage Loans with ICICI Bank.

Yes, trackmyloan is available on iMobile app.

No, currently trackmyloan can be used to track the status of your loan application from the stages of login till sanction.

The contact numbers of your relationship manager, sales personnel and Customer Care executive will be displayed on your trackmyloan dashboard. You can contact them in case you have a query in your Home Loan journey.

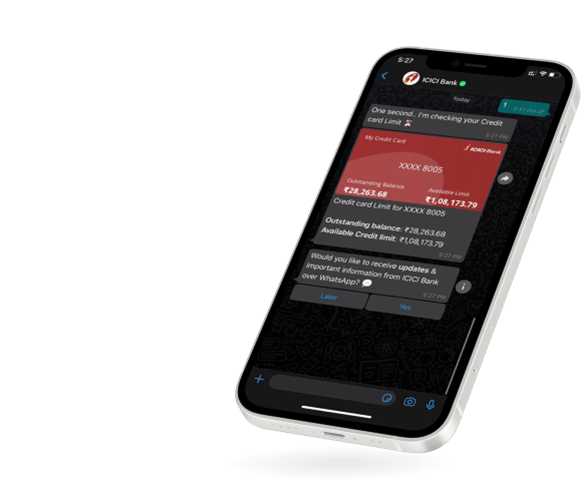

- Mobile Banking

- Net Banking

- WhatsApp Banking

Quick tips and helpful product demonstration videos - ICICI Bank Online Demos & Videos

Explore Now

Moments that matter the most, can sometimes bring their own set of financial considerations. Now, take informed decisions towards your financial plans, with us.