Features & Benefits of Gold Loan

ICICI Bank Gold Loans offer various benefits that make it the ultimate solution for all your financial needs:

- Quick disbursal

- Attractive interest rates

- Simple documentation

- No EMIs. Repayment at the end of the loan tenure

- Complete safety of your jewellery

Just walk into the nearest ICICI Bank Branch offering Gold Loan against your jewellery and avail a Gold Loan, in a matter of minutes.

Gold Loan Interest Rate and Charges

ICICI Bank Gold Loan offers attractive interest rates and flexible repayment options to choose from. Know more about the Gold Loan interest rates and processing fees.

Documents Required for Gold Loan

You can avail an ICICI Bank Gold Loan, with only your KYC documents. No income proof is required. The documentation process is simple and executed as per your convenience. Know more about the documents required for a Gold Loan.

Calculate Eligibility

Use our calculator to know how much loan you can get against your gold ornaments.

![]() Give a Missed Call on 84448 84448

Give a Missed Call on 84448 84448

You can now walk-into any of our ICICI Bank branch offering Gold loans with your jewellery and you can avail gold loan for any value from Rs. 50,000 to Rs. 1 crore instantly. With our simple and easy documentation process, the loan can be availed across the counter instantly.

Safety

Your gold is absolutely safe with us. Your Gold is kept in Vault Safe in Strong Rooms of ICICI Bank giving you the guaranteed assurance of complete transparency and peace of mind. You Gold is valued in your presence, sealed and kept in Vault Safe. Whenever you wish to get your Gold back it will be given back to you in exactly the same state as you submitted in the first place.

Gold Loan Interest Rate and Charges

Give a Missed Call on 84448 84448

| Description | Minimum | Maximum |

|---|---|---|

| Loan Amount | Rs 50,000 | Rs 10,000,000 |

| Loan Tenure | 6 months | 12 months |

Interest rate range*: (Q4- JANUARY 2022 TO MARCH 2022)

| Minimum | Maximum | Mean | Penal Interest |

|---|---|---|---|

| 10% | 19.8% | 14.9% | 6% |

*Terms and Conditions applied

NOTE:

It includes various categories like loan amount, customer relationships etc.

Mean rate = Sum of rate of all loan accounts/ Number of all loan accounts

| Particulars | Twelve months product | Six months product |

|---|---|---|

| Processing Fees | 1.0%* of loan amount | 1.0%* of loan amount |

| Foreclosure charges | 1%, If a/c is closed within 11 months | 1%, If a/c is closed within 5 months |

| NIL, If a/c is closed after 11 months | NIL, If a/c is closed after 5 months | |

| Gold OD - 1% of the facility amount, if the facility is prepaid within 11 months or post 30 days of auto-renewal. | NA | |

| Valuation Charges | For loans: Up to 1 lakh: Rs 100 Greater than 1 lakh up to 2 lakh: Rs 200 Greater than 2 lakh up to 3 lakh: Rs 300 Greater than 3 lakh up to 4 lakh: Rs 400 Greater than 4 lakh up to 5 lakh : Rs 500 Greater than 5lakh up to 10 lakh : Rs 750 Greater than 10 lakh: Rs 1250 |

|

| Top Up Charges | 1% of Top Up amount* *Subject to minimum of Rs 250 |

|

| Documentation Charges* | Rs 199 | |

| Renewal Fees | For loans: Up to Rs 50,000: Rs 300 Greater than Rs 50,000 up to Rs 1 lakh: Rs 350 Greater than Rs 1 lakh up to Rs 2 lakh: Rs 500 Greater than Rs 2 lakh: Rs 1,000 |

|

| Stamp Duty and other statutory charges | As per Applicable laws of the State | |

| Overdue Handling Charges (delinquent accounts) | 750 where a notice has been delivered at the communication address and a paper publication is not required 1,700 where no notice has been delivered at the communication address and the paper publication is to be done 300 charge for sending auction notice, over and above the preceding points I) and II) 200 for sending loan recall notice over and above the preceding points I) and II) |

Notes:

GST, TDS, other government taxes, stamp duty, levies, etc. as per prevailing rate will be charged over and above these charges. The above fees will not be applicable for agricultural loans up to Rs 25,000 per customer.

*Applicable for flexi Gold Loan product.

The Annual Percentage Rate (APR) is a method to compute annualised credit cost, which includes interest rate and processing fee.

The APR calculator does not include charges like stamp duty, Prepayment charges etc.

To calculate the same, please click here to download the APR calculator.

*Terms and Condition apply

- Mobile Banking

- Net Banking

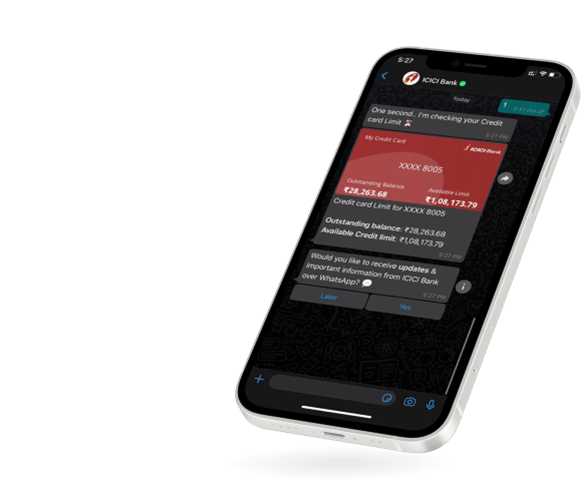

- WhatsApp Banking

Quick tips and helpful product demonstration videos - ICICI Bank Online Demos & Videos

Explore Now