How to Avail EMI

on PayLater?

- 01.Scan the QR and select EMI options in iMobile Pay Avail Now

- 02.Select from flexible EMI tenure options

- 03.EMI Loan Account is created

- 04.The loan amount is disbursed.

- ₹10,000

- ₹50,000

Total Amount

Payable

₹3,689

Interest

Rate p.a.

16%

Monthly

EMI

₹3,422

Total Interest

Payable

₹267

Additional Charges

A penal interest of 3% per month will be levied on the outstanding dues on default.

EMI on PayLater FAQs

What is PayLater EMI?

PayLater EMI is a loan linked with your PayLater credit limit. Customers with PayLater Account can avail this facility.

Go to iMobile Pay > Scan merchant QR > Select PayLater EMI > Tenure > Submit

*applicable only for transactions of more than Rs 10,000.

Who can avail the PayLater EMI facility?

Customers with PayLater Account can avail this facility.

Go to iMobile Pay > Scan merchant QR > Select PayLater EMI > Tenure > Submit!

*applicable only for transactions of more than Rs 10,000.

What is the bill cycle for PayLater EMIs?

PayLater EMI Loans booked between 1st to 20th of a month will have the first EMI due date as 1st of the next month. PayLater EMI Loans booked between 21st to the last day of a month will have the EMI due date as 1st of next to next month.

Example: If you book a PayLater EMI Loan between 1st to 20th Jan, your first EMI will be due on 1st Feb. If you book a PayLater EMI Loan between 21st Jan till 31st Jan, your first EMI will be due on 1st March.

Invest Anywhere,

Anytime

Mobile Banking | Net Banking

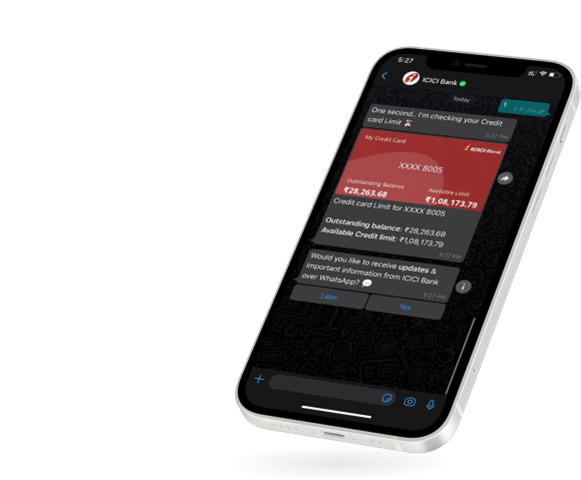

WhatsApp Banking