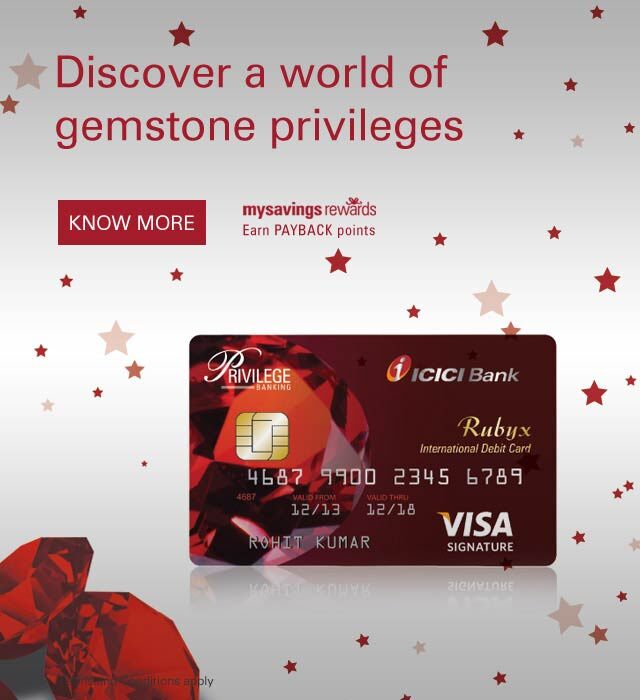

- Rubyx Debit Card

- How to Apply

- Special Privileges Overview

- Financial Planning

- How to Apply

- How to Apply

- Eligibility

- Privilege Delights

- How to Apply

- Eligibility

- Apply Online

- Eligibility

- Tools & Calculators

- Planning for Retirement

- How to Apply

- Existing Customers

- How to Apply

- Eligibility

- Providing for your family

- Eligibility

- How to Apply

- Eligibility

- Eligibility

- Documents Required

- Extended Privileges for Family

- Reports

- How to Apply

- How to Apply

- Eligibility

- Eligibility Criteria

- Turn Dreams into Reality

- Eligibility

- Eligibility

- Education for Your Children

- Service by Appointment

- Eligibility

- Caring for Your Parents

- How to Apply

- Insurance

- How to Apply

- Eligibility

- Eligibility

- How to Apply

- Documents Required

- How to Apply

- How to Apply

- Dedicated Service Area

- Eligibility

- Investment Insights

- How to Apply

- Special Privileges

- Fees and Benefits

- Indulge Yourself

- Eligibility

- Eligibility

- How to Apply

- Relationship Privileges

- Priority Service

- Eligibility

- Rubyx Credit Card

- Illness/ Disability

- How to Apply

- Eligibility

- Save for your Future

- How to Apply

- Eligibility

- Bill Pay

- Car Loan

- Current Accounts

- e-Locker

- Foreign Exchange Services

- Family and You

- Family Banking

- Fixed Deposit

- Gold Debit Card

- Gold Privilege Savings Account

- Home Loan

- iMobile

- Internet Banking

- Mutual Funds

- Personal Loan

- Advantage

- Protecting Your Loved Ones

- Public Provident Fund Account

- Recurring Deposits

- Resource Centre

- Retirement

- Early Days

- Titanium Debit Card

- Titanium Privilege Savings Account

- Value Added Services

- Your Lifestage

- Accounts & Deposits

- Investments

- Loans

- Credit and Debit Cards

- Products

- Enjoying Retirement

- Pure Gold

- Pure Gold apply

- Pure Gold eligibility

- Disc Visa Asia

- Disneyland Trip

- Financial Goal Planner

- Investment Calculator

- Retirement Solution

- Future Wealth Calculator

- FAQ

- More

Want us to help you with anything?

Request a Call back

Rubyx Debit Card

ICICI Bank introduces Rubyx Debit Card:

- A feature-rich, fee-based debit card on the VISA Signature platform, specially crafted for discerning customers like you.

- Rubyx Debit Card is packed with host of benefits and special privileges.

- Enjoy shopping, savings with special discounts, higher Reward Points earnings and the complete security of not having to carry large amounts of cash around with you.

To book your movie ticket and for detailed Terms & Conditions, please click here.

ICICI Bank Rubyx Debit Card Benefits:

High cash withdrawal limit & transaction limit

Enjoy a high cash withdrawal limit of Rs.1.5 lac per day and transaction limit of Rs.2.5 lac per day.

Online transactions

You can use your ICICI Bank Rubyx Debit Card on the internet for buying travel or movie tickets, paying your bills and much more. All you need to do is register your Rubyx Debit Card for “Verified By Visa”.

Zero Surcharge on Fuel Purchases

Fuel surcharge would not be applicable for the transactions done on ICICI Bank swipe machines at selected government fuel petrol outlets (HPCL/ IOCL/ BPCL).

ICICI Bank Debit Card holders who transact on Non-ICICI Bank swipe machines at any fuel petrol outlet would be levied surcharge amount at the discretion of the member/ acquiring bank and the surcharge shall be reversed once we receive the refund from the respective acquiring bank.

For list of fuel outlets pumps where surcharge will not be levied, click here.

Insurance

Air Accident insurance of Rs. 3 Crores, Personal Accident insurance of Rs. 15 lakh and Purchase Protection of Rs. 5 lakh.

Zero Liability Protection

The ICICI Bank Rubyx Debit Card comes with the added security of Zero Liability, a unique feature which protects your debit card against unauthorised purchases on loss, theft or misplacement. All you need to do is call our 24-hour Customer Care within 15 days to report loss or misuse and provide the necessary documents. The balance in your account will be restored.

Effective August 1, 2011, the Terms and Conditions of Zero Liability Protection on your Debit Card has changed. Click here for more details.

Better tracking

Receive instant SMS alerts on transaction made at merchant establishments.

PAYBACK Rewards

Earn 6 points on every Rs 100 spent at merchant establishment in India.

- You can earn points as follows:

| At merchant establishment in India | At Indian Websites | At merchant establishment located outside India | |

|---|---|---|---|

| PAYBACK points per Rs. 200 | 6 | 6 | 10 |

Note:W.e.f 1-April-2012 you will not earn reward points on mutual fund and insurance premium payment made through your ICICI Bank Debit Card.

Itemized billing

Your ICICI Bank Rubyx Debit Card allows you to track your spends on a regular basis. The details of the purchases made on your card, along with the date, merchant's name and amount are mentioned in your bank statement.