How to apply for a Personal Loan online?

Fill and submit your Personal Loan application and check your eligibility

Select Loan amount and tenure, as per your requirement

Check your Personal Loan approval status

Personal Loan for approved application, will be disbursed in your Savings Account

To apply for a Personal Loan, you must be

Personal Loan Eligibility Criteria

- Over 23 years old and a resident of India

- Salaried individual, having a regular monthly income of ₹ 30,000+

- Having a good bureau score

- Having a Savings Account with any of the banks in India

Visit our website to secure an instant loan with ICICI Bank. After checking your pre-approved offer, check your eligibility and fill in and submit your Personal Loan application. Select the Loan amount and tenure as per your requirement. Check your Personal Loan approval status. You will receive an instant loan approval and the amount will be disbursed into your Account immediately.

Documents required to avail an Instant Personal Loan with ICICI Bank:

For Salaried Individuals:

- Proof of Identity: Passport/Driving Licence/Voters ID/PAN Card (any one)

- Proof of Residence: Leave and Licence Agreement/Utility Bill (not more than 3 months old/Passport (any one)

- Latest 3 months Bank Statement (where salary/income is credited)

- Salary slips for the last 3 months

- 2 Passport size photographs.

For Self-Employed:

KYC Documents: Proof of Identity, Address proof and DOB proof.

- Proof of Residence: Leave and Licence Agreement/Utility Bill (not more than 3 months old)/Passport (any one)

- Income proof (audited financials for the last two years)

- Latest 6 months Bank Statement

- Office address proof

- Proof of residence or office ownership

- Proof of continuity of business.

*Conditions apply.

*ICICI Bank reserves the rights to call upon additional documents at its discretion.

No, ICICI Bank offers its customers a collateral-free Personal Loan without any security. Visit our website to apply for an Instant Personal Loan online.

ICICI Bank offers Personal Loans starting at Rs 50,000 up to Rs 25,00,000.

ICICI Bank currently offers a Personal Loan at interest rates ranging from 10.50% to 19%.

ICICI Bank Personal Loan tenure ranges from 12 months to 72 months.

The loan approval process at ICICI Bank is simple, quick and instant. Once a customer's Personal Loan is approved it takes only 3 seconds for the amount to be disbursed into your Account.

The advantages of ICICI Bank Personal Loan are:

- Attractive Interest Rates

- Flexible Tenure Options

- Low EMI Amount

- Easy Application Process

- Pre-Approved Offers

- No Collateral Required

- Quick Disbursement

- Quick Assistance

- Digital Process

- No Restrictions on Usage

- Minimal Documentation.

Personal Loan foreclosure facility is extended to all customers availing a Personal Loan with ICICI Bank. Customers can foreclose their Personal Loan after the payment of at least one EMI. However 5% of foreclosure charges (and taxes) will be applicable.

No, there are no tax benefits and tax deductions for Personal Loans.

Eligibility criteria for salaried individuals:

- Age: 23 years to 58 years

- Monthly Income: Rs 30,000 and above (The minimum salary requirement will differ depending on the profile of the customer.)

- Work Experience: 2 years

- Years in current residence: 1 year.

Eligibility criteria for self-employed individuals:

- Age: 28 years (self-employed individuals) and 25 years (for doctors); Maximum age - 65 years

- Minimum Turnover: Rs 40 lakh for non-professionals; Rs 15 lakh for professionals; as per audited financials

- Minimum Profit After Tax: Rs 2 lakh for Proprietorship Firm/Self-employed Individuals and Rs 1 lakh for non-professionals as per the audited financials

- Business Stability: 5 years minimum for the current business and 3 years minimum for doctors

- Existing relationship with ICICI Bank: Minimum 1 year liability relationship (Current or Savings Account) or Asset relationship (loan) either live or closed in the last 36 months; repayment track record as required.

- Attractive Interest Rates

- Flexible Tenure Options

- Low EMI Amount

- Easy Application Process

- Pre-Approved Offers

- No Collateral Required

- Quick Disbursement

- Quick Assistance

- Digital Process

- No Restrictions on Usage

- Minimal Documentation.

Looking for a fresh Personal Loan? Check your eligibility by filling personal and professional details and select a loan amount, which suits your requirement.

Need more funds over and above your existing Personal Loans from ICICI Bank? Opt for our Top-up Loan at attractive rates of interest.

Do you have an existing Personal Loan from another bank? Transfer your existing Personal Loan to ICICI Bank at a lower rate of interest.

Looking for a Personal Loan, just after your first salary at your first job? Check your eligibility now and fulfil your dreams with Personal Loan.

Looking for a short-term instant credit? Avail of a line of credit overdraft facility and pay interest on the amount you use and for the period you use it for.

Are you working abroad and looking for a Personal Loan? Apply for a collateral free Personal Loan with a simplified documentation process.

Looking for personalised offers with minimal documentation? Apply now, and get the benefit of an online easy application process.

Looking for an instant Personal Loan in just few clicks? Check your eligibility for a pre-approved offer and avail of a Personal Loan within just 3 seconds.

Are you a self-employed professional looking for a loan? Apply for an unsecured loan, similar to a Personal Loan; but specifically designed for your business use.

Relationship Based Loans

E-mandate

EMI net banking

Personal Loan Application Process

Documents

Online Application Process

- Mobile Banking

- Net Banking

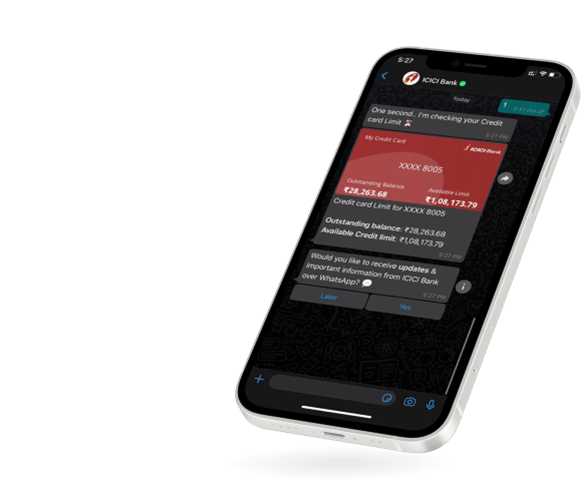

- WhatsApp Banking

Quick tips and helpful product demonstration videos - ICICI Bank Online Demos & Videos

Explore Now

.png)