- ₹5,000

- ₹1 Cr

- ₹0

- ₹1 Cr

- 3 Years

- 30 Years

- 7%

- 18%

- ₹5,000

- ₹1 Cr

Your Home loan eligibility can increase upto ₹ 73 Cr on the basis of your income.

Please get in touch with the nearest branch or call us for more details

You are eligible for a

total amount of

Your EMI

will be

Property cost

you can afford

₹1,100,000

Remaining

balance salary

₹ 6,946,954

Use ICICI Bank Home Loan Affordability Calculator to

Affordable Home Loan Eligibility Criteria

| Eligibility Criteria | Requirement |

|---|---|

| Age | 20 to 65 years for salaried individuals and 21 to 70 years for self-employed individuals |

| Income | Minimum salary of Rs. 25,000 |

| Employment Stability | Self-employed: Stable business track record |

| Credit Score | A good credit score of 700 and above |

| Nationality | Indian |

At the heart of the Home Loan Affordability Calculator lies a sophisticated algorithm that harmonises various financial elements to provide a nuanced and realistic picture of your borrowing potential.

The calculator meticulously considers Down Payment, Gross Monthly Income, Existing EMIs, Illustrative Interest Rate, and Tenure. By weighing these factors against each other, the calculator determines the Total Property Cost you can afford, your Home Loan Eligibility with ICICI Bank, the anticipated Home Loan EMI, and the Remaining Balance required to seal the deal on your property purchase.

Factors Affect Your Home Loan Affordability

FAQs on Home loan Affordability

What is the Rule for Home Loan Affordability?

The rule for home loan affordability revolves around ensuring that monthly repayments fit comfortably within your budget. The Home Loan Affordability Calculator adheres to this principle, providing a structured approach to balancing your aspirations with financial well-being.

How Do You Calculate Home Loan Affordability?

Home loan affordability is calculated by considering key factors such as Down Payment, Gross Monthly Income, Existing EMIs, Illustrative Interest Rate, and Tenure. This comprehensive analysis results in personalised insights into the loan amount you can afford.

How to Improve Home Loan Affordability?

Improving home loan affordability involves strategic steps such as enhancing your credit score, reducing existing debts, and increasing your income. The calculator reflects these improvements, potentially qualifying you for a higher loan amount.

Apply for Home loan

at your convenience

at your convenience

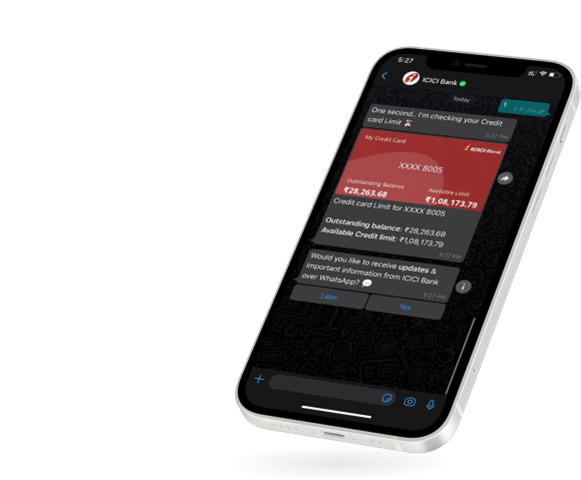

- Mobile Banking

- Net Banking

- WhatsApp Banking

Apply for Home loan

at your convenience

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking