Did you know?

A resident savings account can be converted only to an NRO account. When your resident savings account is converted to NRO account .

| Details of principal and grantee | Reasons of PoA | Others |

|---|---|---|

|

|

|

The PoA can be cancelled by the Grantor at any time before the actions mentioned in the PoA are complete.

Did you know?

Similar to converting your resident savings bank account to an NRO account, you are required to convert your residential Demat account to an NRO Demat account to continue investing in the Indian stock market.

Did you know

**Relative is defined under section 2 (77) of the Companies Act, 2013. This includes their parents (including stepparents), son (including stepson), son’s wife, daughter, daughter’s husband, siblings (including stepsiblings), and children

Stepper with Alphabetic Outlining NRE, NRO and FCNR bank accounts

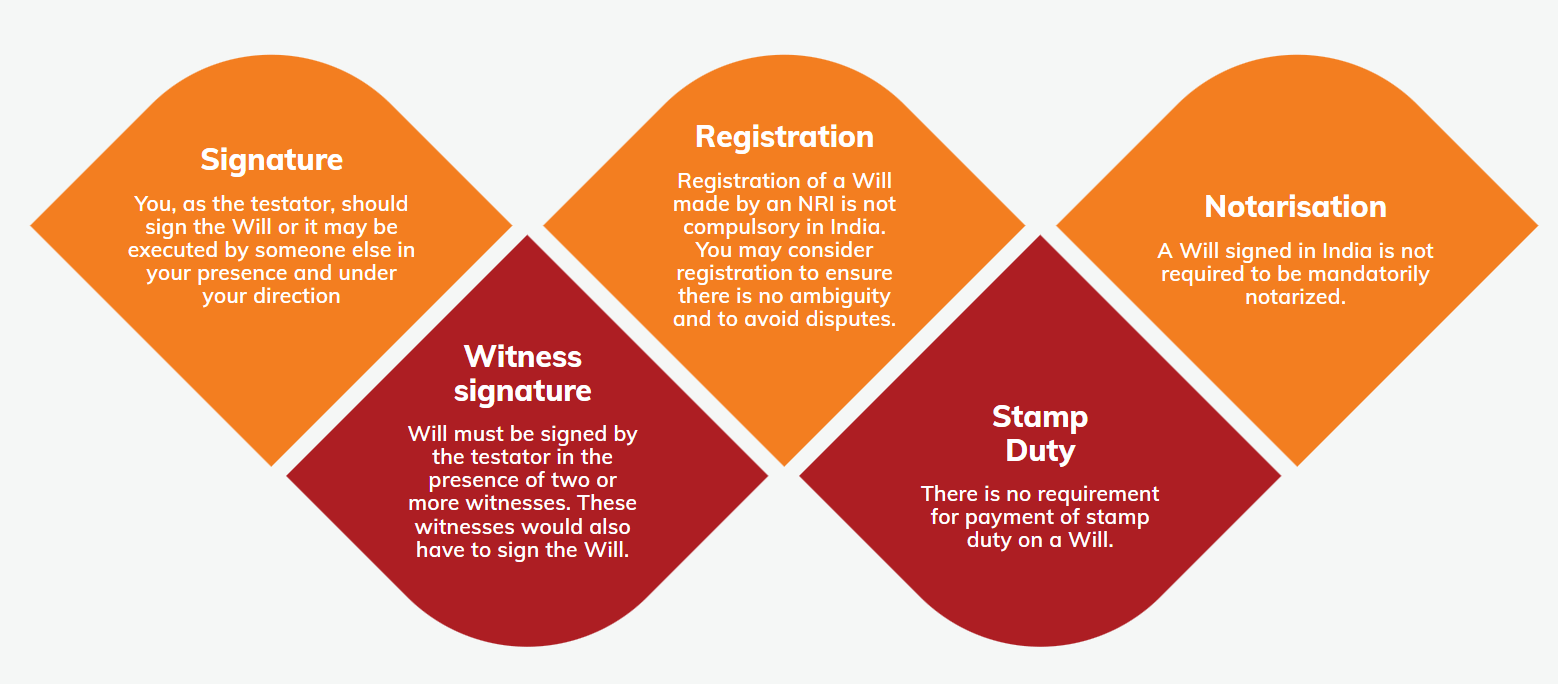

- Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly.

Stepper with Number Outlining NRE, NRO and FCNR bank accounts

- Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly.Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly.Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly.

Bullet Point with Aalphabats ?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean vulputate semper pretium. Donec porta orci non ex sollicitudin accumsan. Aenean at lacinia lorem. Nam sed placerat lectus, vel vestibulum felis. Etiam lobortis quam eget tristique bibendum. Vivamus vestibulum pretium dui, vel pharetra turpis tempus at. Maecenas a tempus ex, eget laoreet felis. Sed aliquam rhoncus odio nec sodales. Aliquam accumsan venenatis vulputate. Duis molestie risus ipsum, maximus dapibus purus interdum eget. Nam ultricies mollis dignissim. Fusce in hendrerit lorem, quis aliquam libero. Phasellus blandit quam id enim euismod venenatis eu vel quam.

- This account is maintained funds in Indian Rupees.

- Manage your income from Indian sources.

- This account is maintained funds in Indian Rupees.

- Phasellus blandit quam id enim euismod venenatis eu vel quam.

- Manage your income from Indian sources.

Sub-bullet Styling

- Format

- Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly.

- Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly.

- Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly. - Format

Indian law does not prescribe any specific format. However it is important that the will expresses your intentions clearly.

Bullet Point with ticket mark?

- This account is maintained funds in Indian Rupees.

- Manage your income from Indian sources.

- This account is maintained funds in Indian Rupees.

- Phasellus blandit quam id enim euismod venenatis eu vel quam.

- Manage your income from Indian sources.

Procedure for creating a power of attorney for NRI

You can choose to have your PoA executed within or outside of India.

In either case, you will need to ensure that your Grantee is:

- At least 18 years old;

- Of sound mind and character; and

- Trustworthy.

Bullet Point with Plus?

- This account is maintained funds in Indian Rupees.

- Manage your income from Indian sources.

- This account is maintained funds in Indian Rupees.

- Phasellus blandit quam id enim euismod venenatis eu vel quam.

- Manage your income from Indian sources.

Bullet Point with Minus?

- This account is maintained funds in Indian Rupees.

- Manage your income from Indian sources.

- This account is maintained funds in Indian Rupees.

- Phasellus blandit quam id enim euismod venenatis eu vel quam.

- Manage your income from Indian sources.

Bullet Point with Cross mark?

- This account is maintained funds in Indian Rupees.

- Manage your income from Indian sources.

- This account is maintained funds in Indian Rupees.

- Phasellus blandit quam id enim euismod venenatis eu vel quam.

- Manage your income from Indian sources.

What is Lorem Ipsum?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean vulputate semper pretium. Donec porta orci non ex sollicitudin accumsan. Aenean at lacinia lorem. Nam sed placerat lectus, vel vestibulum felis. Etiam lobortis quam eget tristique bibendum.

What is Lorem Ipsum?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean vulputate semper pretium. Donec porta orci non ex sollicitudin accumsan. Aenean at lacinia lorem. Nam sed placerat lectus, vel vestibulum felis. Etiam lobortis quam eget tristique bibendum. Vivamus vestibulum pretium dui, vel pharetra turpis tempus at. Maecenas a tempus ex, eget laoreet felis. Sed aliquam rhoncus odio nec sodales. Aliquam accumsan venenatis vulputate. Duis molestie risus ipsum, maximus dapibus purus interdum eget. Nam ultricies mollis dignissim. Fusce in hendrerit lorem, quis aliquam libero. Phasellus blandit quam id enim euismod venenatis eu vel quam.

Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Etiam euismod lectus id ipsum vulputate auctor. Sed ipsum metus, congue ut odio quis, fringilla dictum turpis. Aenean eros odio, sagittis vitae porta vel, posuere eget erat. Donec efficitur, lorem quis semper convallis, erat felis ultricies risus, eget rhoncus nulla metus ullamcorper augue. Curabitur eleifend libero sit amet placerat dictum. Aliquam ex felis, placerat eu ex gravida, viverra lobortis odio. Morbi facilisis risus purus, a tristique eros porta ut. Morbi dui mi, hendrerit eget arcu ut, efficitur sollicitudin arcu. Proin eget bibendum risus, et lacinia nulla. Vivamus rutrum velit gravida, dignissim purus quis, dapibus ipsum.

Praesent volutpat libero aliquet faucibus dapibus. Aliquam erat volutpat. Ut sit amet mollis nunc, a congue quam. Integer sit amet metus dignissim, convallis ligula sed, volutpat massa. Suspendisse et tortor sollicitudin, dignissim felis id, elementum quam. In tortor est, blandit quis augue ut, tempor dictum massa. Phasellus aliquet erat lacus, non mattis eros auctor eget.

What is Lorem Ipsum?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean vulputate semper pretium. Donec porta orci non ex sollicitudin accumsan. Aenean at lacinia lorem. Nam sed placerat lectus, vel vestibulum felis. Etiam lobortis quam eget tristique bibendum. Vivamus vestibulum pretium dui, vel pharetra turpis tempus at. Maecenas a tempus ex, eget laoreet felis. Sed aliquam rhoncus odio nec sodales. Aliquam accumsan venenatis vulputate. Duis molestie risus ipsum, maximus dapibus purus interdum eget. Nam ultricies mollis dignissim. Fusce in hendrerit lorem, quis aliquam libero. Phasellus blandit quam id enim euismod venenatis eu vel quam.

- This account is maintained funds in Indian Rupees.

- Manage your income from Indian sources.

- This account is maintained funds in Indian Rupees.

- Phasellus blandit quam id enim euismod venenatis eu vel quam.

- Manage your income from Indian sources.

What is Lorem Ipsum?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean vulputate semper pretium. Donec porta orci non ex sollicitudin accumsan. Aenean at lacinia lorem. Nam sed placerat lectus, vel vestibulum felis. Etiam lobortis quam eget tristique bibendum.

What is Lorem Ipsum?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean vulputate semper pretium. Donec porta orci non ex sollicitudin accumsan. Aenean at lacinia lorem. Nam sed placerat lectus, vel vestibulum felis. Etiam lobortis quam eget tristique bibendum. Vivamus vestibulum pretium dui, vel pharetra turpis tempus at. Maecenas a tempus ex, eget laoreet felis. Sed aliquam rhoncus odio nec sodales. Aliquam accumsan venenatis vulputate. Duis molestie risus ipsum, maximus dapibus purus interdum eget. Nam ultricies mollis dignissim. Fusce in hendrerit lorem, quis aliquam libero. Phasellus blandit quam id enim euismod venenatis eu vel quam.

- This account is maintained funds in Indian Rupees.

- Manage your income from Indian sources.

- This account is maintained funds in Indian Rupees.

- Phasellus blandit quam id enim euismod venenatis eu vel quam.

- Manage your income from Indian sources.

Did you know?

Similar to converting your resident savings bank account to an NRO account, you are required to convert your residential Demat account to an NRO Demat account to continue investing in the Indian stock market.

Did you know

**Relative is defined under section 2 (77) of the Companies Act, 2013. This includes their parents (including stepparents), son (including stepson), son’s wife, daughter, daughter’s husband, siblings (including stepsiblings), and children

Illustration Infographic

Rahul, a US citizen who has permanently relocated to India (his resident country), earns capital gains from his investments in shares in the US market (his source country). When he calculates his tax liability in India, he can claim federal taxes paid in the USA as a credit against his Indian taxes, provided he satisfies the other conditions of the 'Relief from Double Taxation Article' of the India-US DTAA.

Rohan, an Indian national, is deputed by an Indian multinational company to work in the United States for 3 years and being resident in USA. During the deputation period, he receives a salary in India for the services provided in the USA. Rohan can claim an exemption for this salary under the Article 16(1) 'Dependent Personal Services' category in India.

Smriti is an NRI currently residing in India and is considered a resident of the USA under DTAA. She is eligible to apply for a special tax rate of 15% on the savings bank interest income earned in India (source country) under the DTAA.

Conclusion

NRE, NRO and FCNR (B) accounts serve specific purposes and offer different advantages. An NRI should choose which accounts to maintain basis their requirements.

This is sample bottom text

Home Loan FAQs

What is a home loan?

A home loan is essentially a financing option where funds are provided to an individual or an entity for the purchase, construction, extension, or renovation of a residential property.

How do I apply for a home loan?

You can apply for a home loan from ICICI Bank through our website (www.icicibank.com). Or, you could visit the branch of ICICI Bank that’s nearest to you to submit your application for a loan. To apply for a home loan, click here

What are the documents required to apply for a home loan?

To apply for a home loan, you need to submit documents such as a proof of identity, a proof of address, a loan application form that has been duly filled and your financial documents. To know more about this, click here.