THE

ORANGE

HUB

Evolving as a popular asset class for accumulating wealth for various life goals, mutual funds have gained significant traction of late. Campaigns such as ‘Mutual Funds Sahi Hain’, coupled with enhanced financial literacy, has made them highly desirable among the masses.

Recategorisation of mutual funds by market regulator Securities and Exchange Board of India (SEBI) last year has made them more transparent, and today there are 36 different types of mutual funds available to invest. In this article, we will state the types of funds that you can opt for accomplishing various life goals.

Money for emergency

Emergencies arrive unannounced and can derail even the soundest financial plan. Hence, it’s essential to be prepared for them in advance and build a corpus for the same. Liquidity is an important factor to consider while parking money for a contingency. It means the money should be readily accessible.

Liquid funds are an ideal avenue to invest money for building an emergency corpus. These funds invest in securities with a maturity period of 91 days and generally offer better returns than a Savings Account. Also, recent SEBI norms have made them more liquid.

As per the recent mandate, liquid funds need to maintain at least 20% in assets like cash and government securities to maintain enough liquidity. Redemption is quick and fast. Once you apply to redeem, the money is credited into your account in one working day.

Corpus for child’s higher education

Higher education of children is an essential financial goal for parents. Education inflation is higher than general inflation and this calls for investing early in an asset class offering inflation-beating returns.

Equity mutual funds can help you build a sizeable corpus for your kid’s education. You can opt for large-cap equity funds which invest at least 80% of their assets in the top 100 companies by market capitalisation.

These funds have given 8.42% return in five years. Apart from offering stable and decent returns, large-cap funds are better structured to contain losses during a market downturn.

Retirement nest

A goal that’s often procrastinated, it’s imperative to build a substantial retirement nest to ensure your golden years are stress-free. Thanks to advancement in medical sciences, post retirement years can stretch up to 15-20 years or even more.

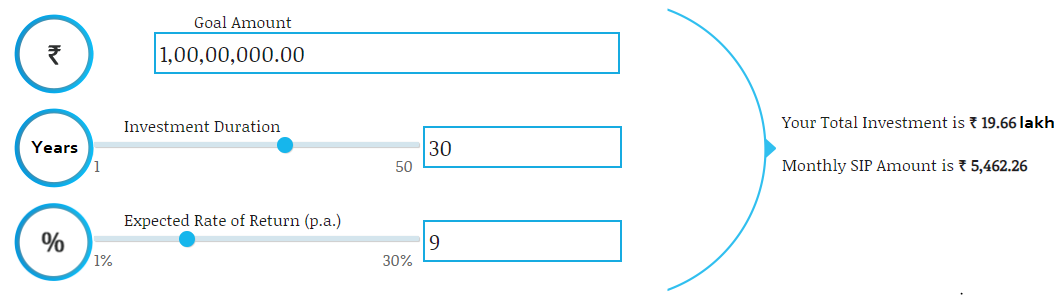

The relentless march of inflation makes it crucial to have a vast reservoir of funds that outlives you. Here again, equity mutual funds can serve the purpose. For instance, if you wish to accumulate Rs 1 crore for your retirement, 30 years down the line, investing Rs 5,462 in an equity fund offering annualised return of 9% can do the job for you (see figure).

Tax planning

An important exercise of personal finance, effective tax planning helps you lower your tax liability. What’s also crucial is to align tax planning with financial goals. Equity-Linked Savings Scheme (ELSS) is a category of mutual funds that help you hit two birds with one stone.

Investing in ELSS qualifies for tax exemption under Section 80C of the Income Tax Act, 1961. At the same time, you can build wealth in the long-term as these funds are equity-oriented. ELSS also has the shortest lock-in period among all tax-saving instruments – 3 years.

The final word

Professional management of mutual funds makes them an ideal investment vehicle for retail investors to venture into stock market investment. Aiding you to accomplish critical life goals, starting a Systematic Investment Plan (SIP) can reap rewards in the long term.

If you are a Customer, apply here for better returns on your mutual funds investment.

If you are a Non-Customer, apply here for better returns on your mutual funds investment.

- Types of Mutual Funds for Various Life Goals

- Best SIP Plans to Invest in 2024

- ELSS Mutual Funds: Know About Tax Saving Mutual Funds

- Questions to ask before investing in mutual funds

- Mutual Fund Investment for your child’s future

- Debt Funds Versus Fixed Deposits: A Comparative Study

- 8 mistakes to avoid while investing in Mutual Funds | ICICI Bank Blogs

- How to Invest in a Mutual Fund for Beginners – 5 Tips for being a Successful Investor

- Avoiding Redemption of MF Amid COVID-19 Scare

- What is Mutual Fund: Definition, Working, Types, & Benefits

- Which is Better to Invest in - Stocks or Mutual Funds

- Investment Strategy 7 Tips To Get Better Results in Mutual Fund Investment

- Understanding Mutual Fund Holding Ratio? – ICICI Blog

- Tracking the Performance of Your Mutual Funds – ICICI Blog

- A Brisk Understanding of How to Invest in a Mutual Fund Scheme – ICICI Blog

- what-are-hybrid-funds-and-types-of-hybrid-fund

- Plan Your Retirement with Mutual Fund Investment | ICICI Blogs

- Mutual funds and what to know about mutual funds |ICICI Blogs

- 7 Important Reasons why you should invest in Mutual Funds today!

- What are Liquid Funds: Benefits and How it works

- What are Debt Funds: Types & How to Invest

- Effective SIP Investment Monitoring and Tracking Tips

- Why Investment is Important in your 20s: Top 8 reasons

- Mutual Fund Riskometer: Measure Risk in Mutual Fund Investment

- Difference between Active Mutual Funds & Passive Index Funds

- All You Need to Know About Mutual Funds: A Comprehensive Guide

- How to Invest in ELSS Funds : A Comprehensive Guide

- All You Need to Know About Aggressive Hybrid Funds

- Mutual Fund Riskometer: Measure Risk in Mutual Fund Investment

- Average Maturity, Macaulay Duration, and Modified Duration of Debt Funds

- How to Build a Mutual Fund Portfolio: A Beginner’s Guide

- SIPs: Your Best Ally for Financial Growth Success

- Best Flexi Cap Mutual Fund: Optimize Returns Smartly

- Best Gold Mutual Funds to invest in 2024

- Best Long Term Bond Mutual Funds to Invest

- Best Multi Cap Mutual Funds in India to Invest

- Best SIP Plans to Invest in 2024

- Commodity Mutual Funds: Types and Benefits

- Equity Funds - Meaning, Types, & Benefits

- Equity Funds - Meaning, Types, & Benefits

- What is Alpha and Beta in Mutual Funds

- What is the Key Difference Between NPS And ELSS

- What is the Key Difference Between NPS And ELSS

- Expense Ratio: Meaning, Components & Formula

- Hedge Funds - Meaning, Types, Strategies, and More

- Exchange Traded Fund (ETFs): Know Meaning & Benefits

- How Do Balanced Advantage Funds Manage Your Money?

- High Dividend Paying Stocks & Mutual Fund Schemes

- How To Choose Investments For Short-Term Goals

- Debt Funds vs FD (Fixed Deposit): Why Debt Funds are Better

- Focused Equity Fund - Definition & Major Advantages

- Short Term Capital Gain – STCG Tax on Mutual Fund

- SIP Vs Lump Sum Investing: Which One Is Better?

- What Is Exit Load in Mutual Fund? How Is It Calculated?

- Debt Fund Taxation: Know The Facts

- Index Mutual Funds - Best Index Funds to Invest in 2024

- Debt Fund Taxation: Know The Facts

- What are Core and Satellite portfolios?

- How to Avoid Capital Gains Tax in Mutual Funds?

- Top 5 Mutual Funds To Invest In India

- What is Focused Equity Fund

- What is Net Asset Value, Types, Formula and its Roles

- The Best Technology Mutual Funds For you to invest

- Tips for Maximizing Returns on Mutual Fund SIP

- Rolling Returns: Definition, Example, and How To Analyze

- SEBI Issues New Rules For Multi-cap Funds. What Should The Investors Do?

- Top Blue Chip Mutual Funds in India

- Sectoral Mutual Funds: Meaning, Advantages & How To Invest

- Total Expense Ratio (TER)_ Meaning & Calculation in Mutual Funds

- Things To Remember Before Redeeming Your Mutual Fund Investments

- Tax Benefits Of Mutual Funds For NRI Investors

- What is the New Fund Offer (NFO) of Mutual Funds?

- Understanding Passive Mutual Funds: Definition, Meaning, & Types

- What is Asset Allocation?

- What is Beta in Mutual Fund?

- Know Difference Between Open Ended and Close Ended Funds

- Know About Equity Funds and Its Types

- Is It A Smart Investment Strategy To Invest In Smart Beta Funds

- Why Chasing Top-Performing Mutual Funds is Not a Good Idea?

- Importance Of Mutual Funds In Medical Emergency

- Importance Of Mutual Funds In Medical Emergency

- Most Common Myths about Mutual Fund NAV (Net Asset Value) Busted

- International Mutual Funds: Meaning, Types & Advantages

- What are the Pros and Cons of Investing in Mutual Funds in a Minor’s Name?

- What is CAGR (Compound Annual Growth Rate)?

- What are Thematic Mutual Funds?

- What are Target Maturity Funds?

- What are Liquid Funds? How are They Taxed?

- Which Is Better – Liquid Funds Or Liquid ETFs?

- What is a Short Term (Low Duration) Mutual Fund Investment?

- What are Value Funds Definition and Advantages

- What are Small Cap Mutual Funds

- Overnight Funds – Meaning and How to Invest?

- Large Cap vs Mid Cap Mutual Fund

- Best Hybrid Mutual Fund to invest in India

- Long-Term Capital Gains Tax (LTCG): What It Is & How It Works?

- Indexation in Mutual Fund: A Crucial Part of Knowledgeable Investing

- Managing Investments: Exploring Assets Under Management

- ETF Vs Mutual Fund: What's the Difference?

- ETF Vs Mutual Fund: What's the Difference?

- How to Earn 1 Crore Through SIP: A Comprehensive Guide

- Mutual Fund Taxation – How Mutual Funds Returns are Taxed?

- Best Midcap Fund Tips to Select a Midcap Fund for Investing

- Which one is better? Daily SIP or Monthly SIP?

- Does High or Low NAV Matter in Mutual Funds?

- How To Redeem ELSS Funds: ELSS Withdrawal Rules

- List of Top 10 Short term SIPs to Invest - ICICI Bank

- List of Top 10 Short term SIPs to Invest - ICICI Bank

- SIP Vs Mutual Fund: What is The Difference?

- Mutual Fund Nomination: All You Need to Know

- Mutual Fund Nomination: All You Need to Know

- International Mutual Funds: What are they and How to Choose the Right One

- Pure Equity Vs Asset Allocation: Which is better?

- 6 Ways To Measure Mutual Funds Risk

- The Common Habit of Successful Investors

- What is a Growth Fund? Definition and Benefits

- What are Large Cap Mutual Funds?

- What Is Portfolio Overlap in Mutual Funds & How to Reduce it?

- What is Standard Deviation in a SIP - ICICI Bank

- What are Mid Cap Funds? How It Works & Its Benefits

- What is thematic fund: List of best Thematic Funds in India

- What Is XIRR in Mutual Funds | Meaning & Importance

- What is Yield to Maturity & Why it Matters?

- P/E Ratio: Meaning, Formula, Calculation & Its Types?

- How SIPs Help You Benefit from Volatile Markets?

- How to Build a Healthy Mutual Fund Portfolio?

- Best Investment Options in India to Get High Returns

- What is CAGR in Mutual Fund and How it works

- What Is The Best Time to Invest in Debt Funds?

- When Should You Start Investing in SIP

- How Capital Gains Tax Rules Work for Different Investments in India

- How to Claim Mutual Fund Investments After Death of the Investor

- How to Invest for Children’s Future in Mutual Fund: Efficient Financial Plan Tips

- How Much Should You Invest In Mutual Funds?

- What are ESG Funds? Should You Invest in Them?

- What are Money Market Mutual Funds?

- What is Lumpsum Investment? A Guide to One-time Investments in Mutual Funds

- More

Want us to help you with anything?

Request a Call back

Scroll to top