Branches across India

ATMs/CRMs across India

Exciting rewards and cashback

with a single Savings Account

Safe, Smart and Trusted

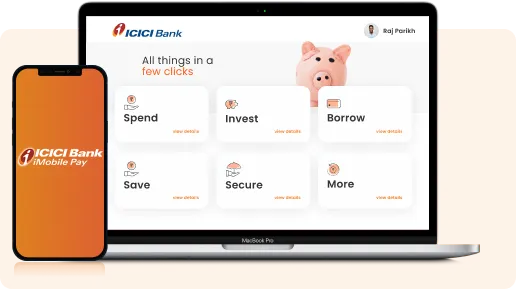

Unlock a full stack of digital Accounts instantly.

Enjoy an unmatched online banking experience 24x7.

Fast, Secure and Convenient

Experience a range of world-class payment services at ease.

Power packed payment solutions at your fingertips.

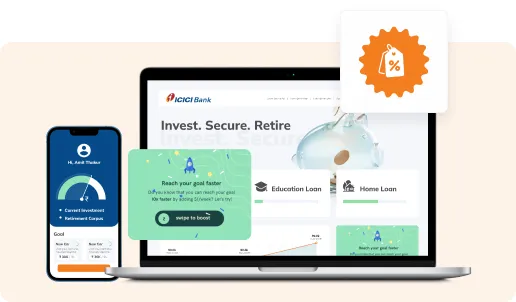

Transparent, Insightful and Advanced

Grow your money with smart investment solutions.

Online investments made easy.

Smart, Safe and Convenient

Add stability to your portfolio by investing online in Government-backed schemes.

Online Government schemes.

Personalised, Exciting and Rewarding

Make your spends rewarding with exciting offers.

Explore offers of your choice.

Tailor-made, Easy and Flexible

Live your dreams by availing exclusive pre-approved offers on loans.

Instant disbursement

Powerful, Rewarding and Effortless

Embark on a journey of unparalleled privileges with ICICI Bank Credit Cards.

Manage your Cards conveniently.

Instant, Trusted and Secure

Safeguard yourself and lead a happy & comfortable life.

Secure yourself and your loved ones with the best protection plans.

Savings Account Offers

Open a Savings

Account in just

3 steps:

- 01. Start with your basic details

- 02. Authenticate your Aadhaar

- 03. Complete with a Video KYC.

Savings Account features

Online PPF, NPS and

other Government-

backed schemes

Enjoy tax benefits and experience the advantage of assured returns in the long-run.

Goal Based Savings

An iWish plan for your dreams without compromising on your present.

iMobile Pay App

Join 8 million+ users enjoying a simplified banking experience.

Pre-approved offers

handpicked for your needs

Enjoy pre-approved offers crafted just for you.

Savings Account Blogs

Savings Account FAQs

A Savings Account is a fundamental financial product offered by ICICI Bank, designed to help individuals save and grow their money. With ICICI Bank Savings Account, customers can enjoy the convenience of easy access to their funds, competitive interest rates and a range of digital banking services. Start your journey towards saving money with our Savings Account today.

To open an ICICI Bank Savings Account online, follow these simple steps -

- Click here to apply for an ICICI Bank Savings Account online.

- Keep your Aadhaar Card and PAN Card handy

- Complete your KYC.

The following are the eligibility criteria to open an ICICI Bank Savings Account:

- Applicants must be at least 18 years old. If the applicant is a minor, parents or legal guardians can open an Account on behalf of the minor

- Applicants must be citizens of India

- Valid, government-approved identity proof is required for Account opening.

The following are the documents required to open an ICICI Bank Savings Account online:

- Aadhaar Card or E-Aadhaar letter issued by the Government of India

- PAN Card.

ICICI Bank ensures competitive returns on your deposited funds. With a focus on financial growth and increased savings, we offer attractive interest rate of <3 - 3.50>%. By opening a Savings Account with ICICI Bank, you can enjoy the benefits of reliable and secure banking.

ICICI Bank Savings Account provides an easy way to save money and offers a fixed rate of interest. A minimum balance of up to Rs. 10,000 per month is required to be maintained in ICICI Bank Savings Account.

The Monthly Average Balance (MAB) is calculated based on simple average of the day end balances for a calendar month. The MAB is calculated by adding the closing ledger balance of the Account of each day from the start of the month till the end of the month. Then the total sum is divided by the number of days in that month.

No monthly fee is charged on a Savings Account. However, you are required to maintain a minimum Monthly Average Balance (MAB) of Rs. 10,000 but in the case of Insta Save FD no minimum Monthly Average Balance is required to be maintained.

Yes, a Debit Card will be sent to your communication address once you open a Savings Account with us.

Leaving so soon?

When you can open a Digital Savings Account in just 3 simple steps