How to apply?

-

Step 1: Locate your offer and apply

- Log in to the iMobile Pay app

- Click on Loans

- Click on Gold Loan – Check for Top-up eligibility

-

Step 2: Customise your Loan Account

- Please review

- Accept Terms and Conditions

- Click on Continue

-

Step 3: Verify and authorise the Top-up facility

- Select the Bank account or enter the Bank account details

- Verify amount and charges

- Verify and authorise the Bank account for funds' credit

Key features and Eligibility

Gold Loan FAQs

What is a Gold Loan?

A loan against your gold jewellery is known as a Gold Loan or a Jewel Loan. At ICICI Bank, a customer can quickly avail a Gold Loan of any value between Rs 50,000 to Rs 1 crore.

Features of Gold Loan like ease of documentation and instant disbursal make it an easy and convenient way of securing funds.

How does one get a Gold Loan?

To get a Gold Loan, you can walk into any ICICI Bank Branch offering a Gold Loan, with your jewellery and avail a Gold Loan of any value between Rs 50,000 to Rs 1 crore. With our simple documentation process (only KYC required), you can avail the loan across the counter, quickly. Alternatively, you can give a missed call on 84448 84448 or call us on 1800 1080 or apply online. Our representative will call you and guide you with all the necessary details. You can also check your Gold Loan eligibility with our Gold Loan calculator.

What is the interest rate of a Gold Loan?

ICICI Bank Gold Loan comes with a minimum interest rate of 10% p.a. based on the prevalent market situation. The Gold Loan interest rates will vary according to the product variants.

Apply for Gold loan

at your convenience

- Mobile Banking

- Net Banking

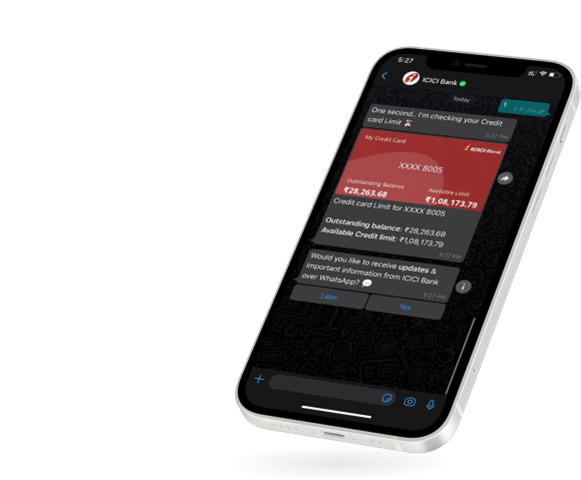

- WhatsApp Banking

Apply for Gold loan

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking