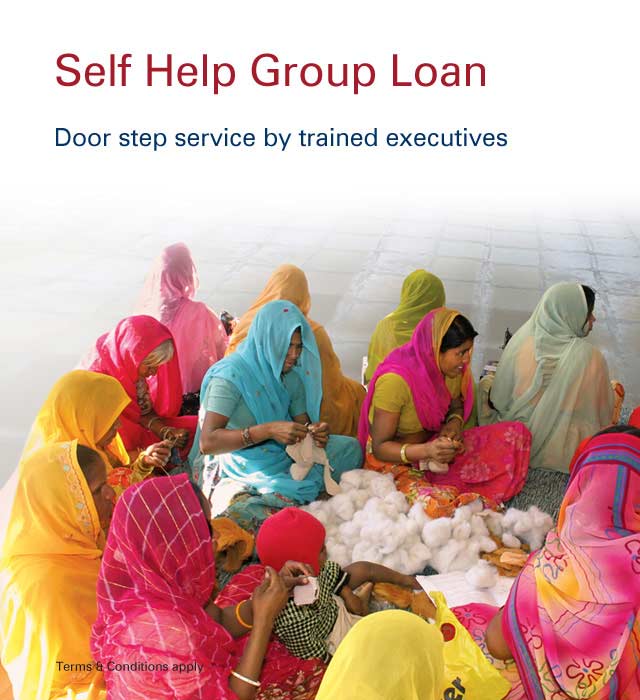

Self Help Groups

Our Self Help Group-Bank Linkage Programme (SBLP) aims to deliver financial products & services to the section of Indian population that lacks access to formal banking. This segment, often from the lower income, meets its financial needs through informal sources such as money lenders, traders, family and friends etc. However, these sources have their own limitations.

Under SBLP, 10-20 individuals are organised in groups known as Self Help Groups (SHGs) by NGOs commonly known as Self Help Promoting Institutions (SHPI). The SHGs are also encouraged to take up livelihood activities, for which skill training is provided by certain NGOs. The members of the SHG are encouraged to save and internally lend the savings to members during times of need. SHPIs also provide knowledge on managing books of accounts.

SHGs get linked to banks via NGOs, for opening savings account and for their credit requirements. Banks lend to SHGs after assessing their credit worthiness on parameters such as group discipline, regularity of meetings, savings, rotation of funds, maintenance of books of accounts, group record keeping, repayment of loans etc.

Self Help Groups (SHGs) are a homogenous group of 10-20 individuals who come together for saving and internally helping each other in times of need. Group members are engaged in livelihood activities such as running a retail shop, cattle rearing, zari work, tailoring jobs, making candles, artificial jewellery etc. Each individual saves a fixed amount on a monthly basis.

- SHG should be in existence for at least 6 months

- Group of 10-20 women

- A minimum Savings/Corpus of Rs 5,000

- Acceptable level of financial and administrative discipline in running of the SHG

One SHG is eligible for a maximum loan amount of Rs. 7, 50, 000 for loans transferred from other bank and for ICICI Bank cases up to a maximum of Rs. 10,00,000

No

Interest Rate Range:

| Product | Maximum | Minimum | Mean |

|---|---|---|---|

| SHG | 21.31% | 7.00% | 14.46% |

Notes:

- The range of interest rates provided above is with respect to individual loans disbursed during Quarter-I: FY22.

- Mean rate = Sum of rate of all loan accounts / Number of all loan accounts.

Self Help Group:

| Description of charges | Charges |

|---|---|

| Non Refundable Loan Processing Fees and documentation charges | PF to be charged if: (Total Loan Amount Sanctioned/ Number of SHG members) > 25000 |

| Stamp Duty | Actuals |

| Prepayment Charges | Nil |

| Bounce Charges | Rs. 129 (Inclusive of GST) |

| Penal Interest Rate | Applicable Rate + 6% |

| Cash transaction charge for repayment of EMI dues at Branches | ₹ 100 |

Annual Percentage Rate:

The Annual Percentage Rate (APR) is a method to compute annualised credit cost, which includes interest rate and processing fee.

To calculate the same, please click here to download the APR calculator. The APR calculator does not include the charges like stamp duty.

The loan has to be repaid in a maximum time period of 36 months. A fresh loan can be provided subject to fulfilment of the sanction criteria.

SHGs use this loan for the following needs:

- Income generation activities/ business expansion

- Livelihood activities

The following documents are required to be obtained/verified from the SHG before extending credit:

KYC Documents

- Constitution documents which can be used as KYC are

- Recommendation letter/Sanction letter/ Loan Recommendation letter from Block Development Officer (BDO) or a Class I Gazetted officer working in the same department

- Inter-se Agreement (either registered or unregistered) executed by all members of the SHG communicating their decision to open a Savings Account with the bank and identifying two or three members to jointly operate the account

- Identity Proof of the SHG

- Letter of Certification from empanelled SHPI certified by NABARD Official empowered at the village or taluka level.

- Recommendation letter/Sanction letter/ Loan Recommendation letter from Block Development Officer (BDO) or a Class I Gazetted officer working in the same department; or

- SHG Registration certificate (if registered); or

- Copy of passbook of existing account with a public sector bank; or scheduled commercial bank

- Original letter of introduction from a bank official of a public sector bank; or

- Copy of passbook /statement of an existing account with a Regional Rural Bank/ Co-operative Bank/Systematically Important NBFCs/ Credit Co-operative Society along with a letter of introduction from SHPI/the Village Sarpanch/ Village Administrative Office (VAO)

- KYC Certification by duly empanelled Business Correspondent of the Bank.

- In case of SHGs sourced under the Direct Sourcing Mode who do not have an existing bank account, a letter of introduction from the Village Sarpanch / Village Administrative Office (VAO) in rural locations would be accepted.

- Address Proof of the SHG

- Same as Constitution Documents; or

- Same as Identity Documents if it contains the address.

- Photographs of Authorized Signatories

- Identity and Address Proofs of Authorized Signatories

- Voter ID card

- Bank pass book (bearing photograph of client) issued by SBI and its subsidiaries or Nationalized Banks where account has been opened at least 3 months prior, can be accepted along with an account opening cheque drawn on the same account.

- Sarpanch Letter

- Documents required other than KYC

- Duly filled Facility Application Form

- Loan Authorisation Letter

- Direct Debit Form/ECS Mandate/PDC Declaration

- Inter Se Agreement executed by all members of SHGs

- SHPI Recommendation Letter

- Repayment track record if the SHG has credit linkage with any other bank or financial institution

Explore the power of simpler and smarter banking. Bank online with over 300+ services

Bank on the go with our Mobile Banking services. Download app or use SMS

VISA powered Universal payment wallet. Download today

Bank 24/7 through a widespread network of over 5,275 branches and 14,121 ATMs