5,200+

Branches across India

15,500+

ATM across India

Exciting

Rewards and cashback

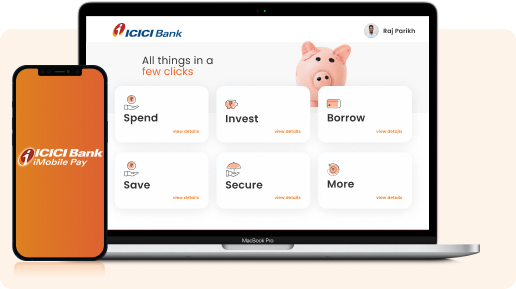

Spend, Save, Invest, Borrow, Secure and more

with a single Account

Safe, Smart & Trusted

Unlock a full stack of Digital Savings Account Instantly

Enjoy an unmatched online banking experience 24x7.

Faster, Safer and Convenient

Experience a range of world-class Payment services at ease.

Power-packed Payment solutions at your fingertips.

Transparent, Insightful and Advanced

Grow your money with smart investment solutions.

Online investments made easy.

Smart, Safe and Convenient

Add stability to your portfolio by investing online in Government-backed schemes.

Online Government schemes.

Personalised, Exciting and Rewarding

Make your spends rewarding with exciting offers on online spends.

Explore offers of your choice.

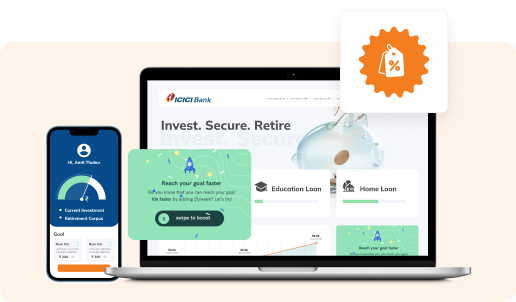

Tailor-made, Easy and Flexible

Live your dreams by availing exclusive pre-approved offers on loans

Instant disbursement

Powerful, Rewarding and Effortless

Feel privileged with ICICI Bank’s Credit Cards.

Manage your Cards conveniently.

Instant, Trusted and Secure

Safeguard yourself and lead a happy & comfortable life.

Secure yourself and your loved ones with the best protection plans.

The Insta Save Account is packed with

Exciting Offers

on your favourite brands.

Open an Insta Save

Account in just

3 Steps:

- 01. Start with your basic details

- 02. Authenticate your Aadhaar

- 03. Complete with a Video KYC.

What makes us unique?

Our Products & Features.

Online PPF, NPS and

other Government-

backed schemes

Enjoy tax benefits and experience the advantage of assured returns in the long run.

Goal Based Savings

An iWish plan for your dreams without compromising your present.

iMobile Pay

Join 8 million + users enjoying a simplified banking experience.

Pre-approved offers

hand-picked for your needs

Enjoy pre-approved offers crafted just for you.

Savings Account Blogs

The Monthly Average Balance (MAB) is calculated on a simple average of day-end balances for a calendar month. The MAB is calculated by adding the closing ledger balance of the account of each day from the start of the month to the end of the month. Then the total sum amount is divided by the number of days in that month.

No, there is no monthly fee. You have to maintain a minimum Monthly Average Balance (MAB) of Rs 10,000 if you open an Insta Save Account and no minimum monthly balance is required in the case of Insta Save FD.

Yes. You will be receiving a Debit Card on your communication address once your account is successfully opened.

Donate online for Kerala Relief fund

God’s own country needs your helping hand. Contribute to Chief Minister’s Distress Relief Fund. The donation is 100% exempted as per income tax rule Section 80G.

Donate online for Kerala Relief fund

God’s own country needs your helping hand. Contribute to Chief Minister’s Distress Relief Fund. The donation is 100% exempted as per income tax rule Section 80G.