No restriction on fund usage

There is no restriction to using the funds; you can use the money for paying your child’s education fees, meet wedding expenses, buy an expensive lifestyle product, go on a vacation etc. No matter what your purpose of applying for a Personal Loan, you can get a loan of up to Rs 50 lakh.

Instant approval

At ICICI Bank, we ensure that you have a stress-free borrowing experience. Once approved, the funds are credited in your account within three seconds.

Flexible tenure

We give you the flexibility to choose the loan tenure; you can apply for a loan from 12 to 72 months, as per your repayment capacity.

Online services

At ICICI Bank, we have a seamless Personal Loan application process, and your loan application is granted with just a few clicks. You would need to give your location address and select a few details like the loan amount and your preferred tenure, along with a few more steps. In case of any queries you can seek assistance from ICICI Bank 24 x 7.

Minimum documents

We have a minimal documentation process, which makes the application process a breeze for all.

Fixed Interest

The interest rates for ICICI Bank Personal Loans are calculated, basis fixed interest rates and not floating interest rates, so the interests do not vary for the entire loan tenure.

No collateral needed

For Personal Loans, we don’t ask for any collateral or security.

How to apply for a Personal Loan online?

Fill and submit your Personal Loan application and check your eligibility

Select Loan amount and tenure, as per your requirement

Check your Personal Loan approval status

Personal Loan for approved application, will be disbursed in your Savings Account

To apply for a Personal Loan, you must be

Personal Loan Eligibility Criteria

- Over 23 years old and a resident of India

- Salaried individual, having a regular monthly income of ₹ 30,000+

- Having a good bureau score

- Having a Savings Account with any of the banks in India

Loan for Medical Emergency

Medical emergency can emerge anytime and erode your savings. It not only affects you financially but also affects your mental well-being. The only way to pay for your medical bills without disturbing your savings is to opt for a loan for medical emergencies. With ICICI Bank, you can avail a Personal Loan for medical emergencies and safeguard your savings.

Loan for marriage expenses

Wedding is a one-time affair, and it shouldn’t be anything short of what you’ve dreamed it to be and can be possible with a Personal Loan. Taking a loan for a wedding helps you keep your savings intact while you can still get it the way you wanted. Avail a Personal Loan for a wedding and have the wedding of your dreams.

Home renovation

Turning your house into a home could be expensive, but it’s worth it. We make it easier for you with ICICI Bank’s Personal Loans. This home renovation loan can also be taken over and above your Home Loan. So, avail a Personal Loan for renovating your home from ICICI Bank and transform it the way you wanted.

Loans for appliances and gadgets

It’s time to upgrade your appliances and gadgets for a smooth lifestyle, which can be done with an ICICI Bank’s Personal Loan. Make the process smoother by availing a Personal Loan for home appliances from ICICI Bank. You can utilise the loans for buying gadgets, home appliances or upgrade your freezer and much more.

Loan for Travel

Travelling experiences are priceless and every travel enthusiast would agree that taking a Personal Loan for travel is worth it. Most of us try to save a part of our funds for travelling, which may not suffice for the entire trip. A loan for travel can substitute any shortage, so you can have fun. Avail a Personal Loan to travel and enrich yourself with unforgettable memories.

Loan for online courses

Upgrading your skills is easier than ever, so why let low funds be a hindrance? You can always upgrade your skills by taking a Personal Loan for online courses. In fact, if you wish to get a higher degree you can do that by taking a Personal Loan for education. Avail a Personal Loan for online courses and upgrade your skills now.

Visit our website to secure an instant loan with ICICI Bank. After checking your pre-approved offer, check your eligibility and fill in and submit your Personal Loan application. Select the Loan amount and tenure as per your requirement. Check your Personal Loan approval status. You will receive an instant loan approval and the amount will be disbursed into your Account immediately.

Documents required to avail an Instant Personal Loan with ICICI Bank:

For Salaried Individuals:

- Proof of Identity: Passport/Driving Licence/Voters ID/PAN Card (any one)

- Proof of Residence: Leave and Licence Agreement/Utility Bill (not more than 3 months old/Passport (any one)

- Latest 3 months Bank Statement (where salary/income is credited)

- Salary slips for the last 3 months

- 2 Passport size photographs.

For Self-Employed:

KYC Documents: Proof of Identity, Address proof and DOB proof.

- Proof of Residence: Leave and Licence Agreement/Utility Bill (not more than 3 months old)/Passport (any one)

- Income proof (audited financials for the last two years)

- Latest 6 months Bank Statement

- Office address proof

- Proof of residence or office ownership

- Proof of continuity of business.

*Conditions apply.

*ICICI Bank reserves the rights to call upon additional documents at its discretion.

No, ICICI Bank offers its customers a collateral-free Personal Loan without any security. Visit our website to apply for an Instant Personal Loan online.

ICICI Bank offers Personal Loans starting at Rs 50,000 up to Rs 25,00,000.

ICICI Bank currently offers a Personal Loan at interest rates ranging from 10.50% to 19%.

ICICI Bank Personal Loan tenure ranges from 12 months to 72 months.

The loan approval process at ICICI Bank is simple, quick and instant. Once a customer's Personal Loan is approved it takes only 3 seconds for the amount to be disbursed into your Account.

The advantages of ICICI Bank Personal Loan are:

- Attractive Interest Rates

- Flexible Tenure Options

- Low EMI Amount

- Easy Application Process

- Pre-Approved Offers

- No Collateral Required

- Quick Disbursement

- Quick Assistance

- Digital Process

- No Restrictions on Usage

- Minimal Documentation.

Personal Loan foreclosure facility is extended to all customers availing a Personal Loan with ICICI Bank. Customers can foreclose their Personal Loan after the payment of at least one EMI. However 5% of foreclosure charges (and taxes) will be applicable.

No, there are no tax benefits and tax deductions for Personal Loans.

Eligibility criteria for salaried individuals:

- Age: 23 years to 58 years

- Monthly Income: Rs 30,000 and above (The minimum salary requirement will differ depending on the profile of the customer.)

- Work Experience: 2 years

- Years in current residence: 1 year.

Eligibility criteria for self-employed individuals:

- Age: 28 years (self-employed individuals) and 25 years (for doctors); Maximum age - 65 years

- Minimum Turnover: Rs 40 lakh for non-professionals; Rs 15 lakh for professionals; as per audited financials

- Minimum Profit After Tax: Rs 2 lakh for Proprietorship Firm/Self-employed Individuals and Rs 1 lakh for non-professionals as per the audited financials

- Business Stability: 5 years minimum for the current business and 3 years minimum for doctors

- Existing relationship with ICICI Bank: Minimum 1 year liability relationship (Current or Savings Account) or Asset relationship (loan) either live or closed in the last 36 months; repayment track record as required.

- Attractive Interest Rates

- Flexible Tenure Options

- Low EMI Amount

- Easy Application Process

- Pre-Approved Offers

- No Collateral Required

- Quick Disbursement

- Quick Assistance

- Digital Process

- No Restrictions on Usage

- Minimal Documentation.

OTHER TYPES OF PERSONAL LOANS

New Personal Loan

Looking for a fresh Personal Loan? Check your eligibility by filling personal and professional details and select a loan amount, which suits your requirement.

Need more funds over and above your existing Personal Loans from ICICI Bank? Opt for our Top-up Loan at attractive rates of interest.

Do you have an existing Personal Loan from another bank? Transfer your existing Personal Loan to ICICI Bank at a lower rate of interest.

Looking for a Personal Loan, just after your first salary at your first job? Check your eligibility now and fulfil your dreams with Personal Loan.

Looking for a short-term instant credit? Avail of a line of credit overdraft facility and pay interest on the amount you use and for the period you use it for.

Are you working abroad and looking for a Personal Loan? Apply for a collateral free Personal Loan with a simplified documentation process.

Looking for personalised offers with minimal documentation? Apply now, and get the benefit of an online easy application process.

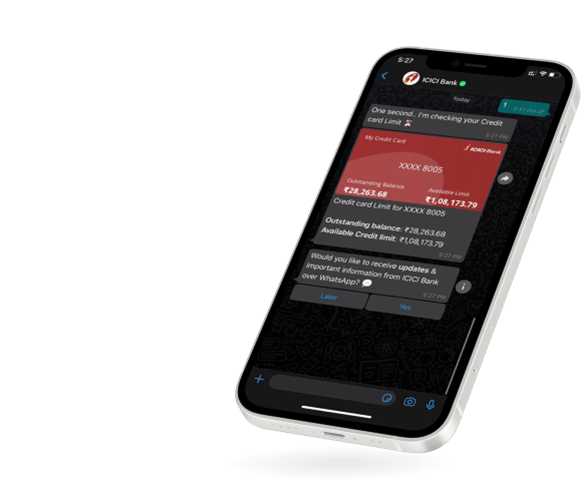

Looking for an instant Personal Loan in just few clicks? Check your eligibility for a pre-approved offer and avail of a Personal Loan within just 3 seconds.

Are you a self-employed professional looking for a loan? Apply for an unsecured loan, similar to a Personal Loan; but specifically designed for your business use.

RELATED PERSONAL LOAN LINKS

Relationship Based Loans

E-mandate

EMI net banking

Personal Loan Application Process

Documents

Online Application Process

DIGITAL BANKING

- Mobile Banking

- Net Banking

- WhatsApp Banking

DIGITAL BANKING

Quick tips and helpful product demonstration videos - ICICI Bank Online Demos & Videos

Explore Now

ghjgj

.png)

.png)