Indian Economic Update

- RBI absorbed liquidity to the tune of INR 2997.62 billion (net) under Liquidity Adjustment Facility (LAF) (including fixed and variable rate repos and reverse repos) as of Mar 11. It injected Marginal Standing Facility (MSF) of INR 0.2 billion and Special Refinancing Facility of INR 18.15 billion.

- The Indian Government increased duties on petrol and diesel by Rs 3 per litre, the steepest hike since 2012. The Centre notified a Re 1 per litre increase in road and infrastructure cess collected as an additional excise duty and Rs 2 per litre increase in special excise duty.

Global Update

- Federal Reserve in another emergency move slashed its Fed fund rates by one percentage point to 0-0.25% and announced a boost its bond holdings of USD 700 billion. The Fed also reduced its reserve requirement ratio to 0% and lowered the primary credit rate by 150 basis points to 0.25%, effective Mar 16, 2020 along with other intra-day credit facility.

- China data plunged more sharply than expected as shown in its latest monthly release of February. Industrial output plunged 13.5% in January and February from a year earlier, versus a median estimate for a 3% contraction. Retail sales fell 20.5% in the period, compared to a projected 4% fall. Fixed-asset investment dropped 24.5%, versus a forecast of 2% decline. The unemployment rate jumped to 6.2%, the highest on record.

- oronavirus cases topped 1,66,000 worldwide as deaths exceeded 6,400. Governments worked to slow the spread of the outbreak. New York City and Los Angeles limited restaurants and bars to takeout and delivery service, and shut entertainment venues. Germany announced it will impose temporary controls on its borders with France, Switzerland, Austria, Denmark and Luxembourg on Monday.

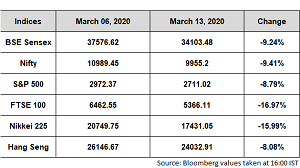

Benchmark equity indices staged a rebound after triggering a circuit breaker in early morning trade for the first time since 2009. However, domestic equity swung sharply after a 10% fall, tracking the rebound in global equities on hopes of more policy stimulus.

During the week Sensex lost 9.24% to close at 34103.48 while Nifty declined 9.41% to close at 9955.2.

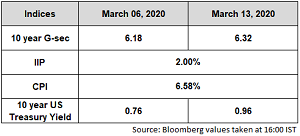

Indian bonds ended sharply lower due to sharp outflow of foreign investors as the coronavirus scare continued to plague sentiment. Domestic bonds yield also mirrored the move in global yields as investors moved to hold cash in the current panic situation. Some recovery in oil prices also weighed on domestic yields.

The 10Y benchmark yield ended at 6.32% as compared to the previous week’s close of 6.18%.

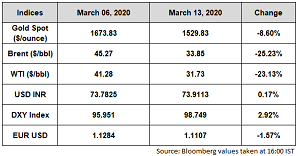

Oil is trading 5.8% higher. Russia has still not shown any interest in agreeing to further output curbs with the Organisation of the Petroleum Exporting Countries (OPEC). Russian oil producers met Energy Minister Novak on Thursday but did not discuss a return to the deal Brent and West Texas Intermediate (WTI) are currently trading at USD 35.1 per barrel and USD 33.1 per barrel, respectively.

Gold is trading 0.7% higher. Financial markets showed signs of stabilisation after a deep sell off driven by concerns over the coronavirus. Gold dipped as much as 4.5% on Thursday as panic selling forced investors to cover margin calls in other assets. Gold is trading at USD 1587.5 per ounce.

The Indian currency appreciated against the Dollar on likely RBI intervention in today’s trade. The USD/INR pair reached a session high of 74.56 earlier today reaching its record high on continued risk off sentiment. However, aggressive intervention by the RBI supported the Rupee sharply as it fell below the 74 handle and traded at 73.90 levels in the evening session.

Source: ICICI Bank Research, Private Banking Investment Strategy Team, Bloomberg and CRISIL.

Related Content

09.03.2020

28.02.2020

20.02.2020