Indian Economic Update

- The Reserve Bank of India and the Government put a private bank under a moratorium and placed curbs on withdrawals till Apr 03, 2020, in response to deterioration in condition. This has led to volatility in Indian markets.

- RBI Governor said the RBI will be proactive in dealing with threats stemming from the coronavirus outbreak and will be in better position to assess growth impact of coronavirus by the time of the next Monetary Policy Committee (MPC) meet.

- RBI absorbed liquidity to the tune of INR 2678.4 billion (net) under Liquidity Adjustment Facility (LAF) (including fixed and variable rate repos and reverse repos) as of Feb 26. It injected Marginal Standing Facility (MSF) of INR 30.8 billion and Special Refinancing Facility of INR 20.3 billion.

Global Update

- Oil markets crashed more than 30% after the disintegration of the Organisation of the Petroleum Exporting Countries (OPEC)+ alliance triggered by an all-out price war between Saudi Arabia and Russia that is likely to have sweeping political and economic consequences. The inability to reach an agreement on the quantum of production cuts after Mar 31, 2020 was the main trigger by the sharp fall seen in global crude prices. The upshot is that the expectations of an all-out price war has removed the floor in global crude prices as investors position for an over-supplied market in the near-term.

- The coronavirus has increased the risk of a global recession this year, credit rating agency Moody's said on Mar 06. It said that advanced economies including the United States, Japan, Germany, Italy, France, Britain and Korea could all fall into recession in an "adverse scenario". China's Gross Domestic Product (GDP) growth would fall below 4% even with substantive economic stimulus it added.

- China reported 30 more deaths from coronavirus, with all but one in Hubei province, pushing the national toll to 3,042. The number of confirmed cases rose to 80,552. The head of the World Health Organisation threatened to name countries that are not doing enough to fight the outbreak. Fatalities moderated in China, and cases appeared to slow in South Korea. Infections surged in Iran. The UK and Switzerland reported their first fatalities.

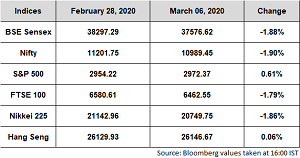

The benchmark indices ended sharply lower, down to its lowest levels since October last year. Adding to the woes of the coronavirus scare was the takeover of a private bank by the RBI. The weakness was broad based and most sectors ended in the red today. On a weekly basis, Sensex dropped 1.8 per cent while Nifty lost 1.89 per cent.

During the week Sensex lost 1.88% to close at 37576.62 while Nifty declined 1.90% to close at 10989.45.

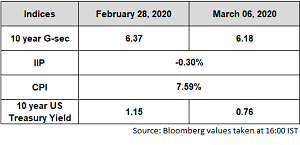

Indian bonds ended sharply higher. The Indian 10Y benchmark yields plummeted to its lowest levels since the demonetisation period as US 10 year yields fell to a record low below the 0.7% level. In addition, fall in oil prices as reports suggested Russia was not board for the production cut pushed yields further lower.

The 10Y benchmark yield ended at 6.18% as compared to the previous week’s close of 6.37%.

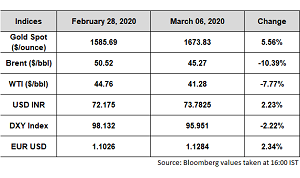

Oil is trading 4.8% weaker amid reports that Russia will not agree to steeper oil output cuts recommended by OPEC and its allies to support prices. Brent and West Texas Intermediate (WTI) are currently trading at USD 47.5 per barrel and USD 43.7 per barrel, respectively.

Gold is trading 0.9% higher as the global spread of the coronavirus dimmed growth prospects and sent investors towards safe haven. Reflecting the dismal market mood, the 10-year US Treasury bond yield plummeted to a fresh all-time low below the 0.7% mark on Friday. Gold is trading at USD 1,687.5 per ounce.

The Indian rupee saw its worst week against the dollar in nearly seven years as risk appetite weakened on rising cases of the coronavirus in India. The global risk off sentiment also weighed on the broader Emerging Markets (EM) basket. Some intervention by the RBI in the early hours on Friday capped the movement of the USD/INR pair after it briefly breached the 74 handle. The Rupee traded at 73.75 versus previous close of 73.5.

Source: ICICI Bank Research, Private Banking Investment Strategy Team, Bloomberg and CRISIL.

Related Content

28.02.2020

20.02.2020