Indian Economic Update

- The Reserve Bank of India (RBI) announced plans for two more long-term repurchase auctions in the coming weeks. RBI will offer INR 250 billion each in the next two Long Term Repo Operations (LTROs) for 3-year tenures as part of its plan to inject a total of INR 1 trillion.

- US President Mr Donald Trump announced the United States would sign a USD 3 billion defence deal with India. He emphasised that the US would become India's premier defence partner.

- The key takeaway from the Feb 2020, RBI Monetary Policy Committee (MPC) Minutes is that while the committee is inclined to support growth (with the Governor underscoring its importance for financial stability) through further rate action, concerns on elevated inflation is leading it to be on a hold.

Global Update

- More coronavirus cases were reported in countries other than China in the past 24 hours. New infections were diagnosed in countries from Pakistan to Brazil, which reported the first case in Latin America, while Italy and Iran confirmed additional patients with the disease.

- Hong Kong Financial Secretary Mr Paul Chan announced an HKD 120 billion (USD 15.4 billion) relief package, in an effort to shore up economic confidence in a city battered by political unrest and the coronavirus.

- Bank of Korea unexpectedly maintained status quo in its policy despite a downgrade to its growth forecast for the year.

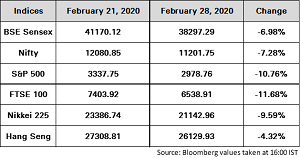

Indian equity markets ended lower throughout the week. The rising risk from the spread of coronavirus, profit warnings by companies and sustained slowdown in economic growth have made investors bearish.

During the week Sensex lost 6.98% to close at 38297.29 while Nifty declined 7.28% to close at 11201.75.

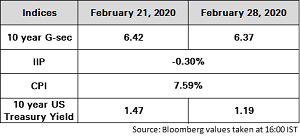

Indian Government bonds ended higher amid the fall in global yields and a sharp fall in oil prices. India 10-year benchmark yield fell to its lowest since August last year. RBI’s announcement of the remaining 500 billion worth of LTRO in the 3-year segment further aided the longer end of the curve along with the absence of G-Sec auctions.

The 10Y benchmark yield ended at 6.37% as compared to the previous week’s close of 6.42%.

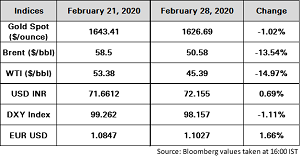

Oil was on course for its biggest weekly loss since 2014 as the fast-spreading coronavirus roiled global markets. This intensified speculation that Organisation of Petroleum Exporting Countries (OPEC) and its allies will strike a deal to support prices. According to reports, Saudi Arabia is now pushing for collective OPEC+ production cuts of an additional 1 million barrels a day, which it would bear the brunt of while Kuwait, the United Arab Emirates and Russia would split the rest.

Gold remained stable, as investors booked profits, but a spike in coronavirus cases outside China capped bullion’s losses.

The Indian Rupee ended lower against the Dollar as global risk aversion prompted Foreign Portfolio Investment (FPI) outflows from local equities.

The Dollar index has remained fairly range-bound as investors wait for more news on the spread of Coronavirus.

The EUR/USD benefitted from unwinding of carry trades. Further support also came from much better than expected Euro-zone confidence surveys. However, the GBP/USD pair is trading lower reflecting continued ‘Brexit’ uncertainty. The USD/JPY pair has broken lower reflecting risk aversion and some concerns about the US growth outlook.

Source: ICICI Bank Research, Private Banking Investment Strategy Team, Bloomberg and CRISIL.

Related Content

09.03.2020

20.02.2020