6,004

Branches across India

16,881+

ATM/CRM across India

Exciting

Rewards and cashback

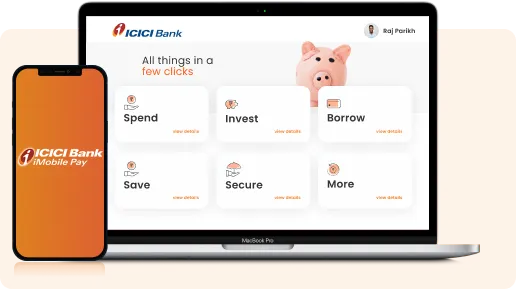

Spend, Save, Invest, Borrow, Secure and more

with a single Account

Safe, Smart & Trusted

Unlock a full stack of digital Accounts instantly.

Enjoy an unmatched online banking experience 24x7.

Faster, Safer and Convenient

Experience a range of world-class Payment services at ease.

Power-packed Payment solutions at your fingertips.

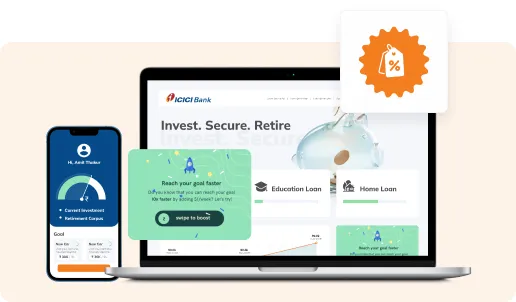

Transparent, Insightful and Advanced

Grow your money with smart investment solutions.

Online investments made easy.

Smart, Safe and Convenient

Add stability to your portfolio by investing online in Government-backed schemes.

Online Government schemes.

Personalised, Exciting and Rewarding

Make your spends rewarding with exciting offers on online spends.

Explore offers of your choice.

Tailor-made, Easy and Flexible

Live your dreams by availing exclusive pre-approved offers on loans.

Instant disbursement

Powerful, Rewarding and Effortless

Feel privileged with ICICI Bank’s Credit Cards.

Manage your Cards conveniently.

Instant, Trusted and Secure

Safeguard yourself and lead a happy & comfortable life.

Secure yourself and your loved ones with the best protection plans.

Insta Save Account is packed with

Exciting Offers

on your favourite brands.

Open a Savings

Account in just

3 Steps:

- 01. Start with your basic details

- 02. Authenticate your Aadhaar

- 03. Complete with a Video KYC.

What makes us unique?

Our Products & Features.

Online PPF, NPS and

other Government-

backed schemes

Enjoy tax benefits and experience the advantage of assured returns in the long run.

Goal Based Savings

An iWish plan for your dreams without compromising your present.

iMobile Pay

Join 8 million+users enjoying a simplified banking experience.

Pre-approved offers

hand-picked for your needs

Enjoy pre-approved offers crafted just for you.

Savings Account Blogs

Savings Account FAQ's

To open a Savings Bank Account online, follow these simple steps -

Click here to apply for a Savings Bank Account online.

Keep your mobile phone, Aadhaar and PAN card handy as you will be required to enter these details wherever necessary.

Following this, you need to complete your KYC.

When it comes to the interest rate for a Savings Account, ICICI Bank ensures competitive

returns on your deposited funds. With a focus on financial growth, we offer attractive interest

rate of 3 - 3.50% that help your savings grow. By opening a Savings Account with ICICI Bank, you can enjoy the benefits of reliable and secure banking.

The Monthly Average Balance (MAB) is calculated on a simple average of day-end balances for a calendar month. The MAB is calculated by adding the closing ledger balance of the account of each day from the start of the month to the end of the month. Then the total sum amount is divided by the number of days in that month.

No, there is no monthly fee. You have to maintain a minimum Monthly Average Balance (MAB) of Rs 10,000 if you open an Savings Account and no minimum monthly balance is required in the case of Insta Save FD.

Yes. You will be receiving a Debit Card on your communication address once your account is successfully opened.

Leaving so soon ?

When you can open a Digital Savings Accounts in just 3 simple steps