Open Current Account Online

ICICI Bank Business Banking offers comprehensive banking solutions to suit the banking needs of every MSME. From a wide range of Current Account products to convenient banking solutions like Corporate Internet Banking, InstaBIZ and Tax Payments, we make your banking easy and hassle free.

Accelerate your business growth with an instant Current Account online.

Types of Current Account

Family 360° Banking

- Single Current Account for domestic & international transactions

- Grouping: Enjoy pricing benefits by grouping your Family, Personal & Business Accounts

- Single view: View & transact using all your linked Current Accounts on Corporate Internet Banking & InstaBIZ

- CASA pooling: Easy pooling of funds between your Current Account & Savings Account

Smart Business Account 2.0 Ivy Current Account

- A special Smart Business Account with special privileges catering to high end businesses

- Minimum Quarterly Average Balance (QAB) requirement of Rs 10,00,000 with no non maintenance charges

- Unlimited outward cheque returns, cheque leaves, branch transactions, Demand Drafts (DDs)/Pay Order (POs)

Smart Business Account 2.0 Gold Current Account

- Flexible free limits as per the average balance maintained. Minimum Quarterly Average Balance (QAB) requirement of Rs 1,00,000

- Free 10 outward cheque returns per month

- Flexible branch transactions, cheque leaves, IMPS transactions and DD/PO limits basis balance maintained

RCA Standard Current Account

- Minimum Monthly Average Balance (MAB) requirement of Rs 10,000

- Free RTGS and NEFT transactions done online

- Free cheque collection and payment anywhere across the country

Escrow Current Account

- Catering to a wide range of transactions such as sale-purchase, real estate, mergers & acquisitions, etc.

- DigiEscrow- an innovative platform to execute online transactions

- Quick turnaround for implementation of structure requirements and simplified documentation

Exchange Earner Foreign Currency (EEFC) Account

- A non-interest bearing Current Account with authorised foreign exchange dealer banks

- Retain foreign exchange in the currency you earn and earmark it for later payments, without conversion

- Online conversion of the EEFC balance to your INR operated Current Account

Trade Gold Current Account

- Fungibility to maintain minimum Monthly Throughput of USD 20,000 or Monthly Average Balance of Rs 1,00,000

- Flat charges of Rs 500 per bill on trade transactions like advance import, direct import and bills

- Free FIRC and discounted rates for SWIFT and courier charges

Trade Platinum Current Account

- Fungibility to maintain minimum Monthly Throughput of USD 80,000 or Monthly Average Balance of Rs 5,00,000

- Flat charges of Rs 200 per bill on trade transactions like advance import, direct import and bills

- No charges on Foreign Inward Remittance Certificates (FIRC), SWIFT, courier, and Export Letter of Credit (LC) Advising

Eazypay web

- A single platform for multiple collection modes which facilitates single Management Information System (MIS) reconciliation for all collection modes

- Available as bill upload, payment gateway and open payment mode

- Customised MIS with facility to upload bills

UPI QR

- Accept payments from any bank

- Instant settlement to your bank account

- No transaction charges up to Rs 2,000 per transaction

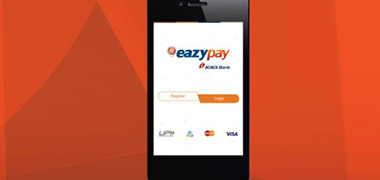

Eazypay App

- A mobile based application which allows you to collect through multiple modes like – Unified Payment Interface (UPI), Credit Card, Debit Card, Internet Banking or Pockets wallet

- 24×7 instant credit through UPI and Pockets and accepts multiple modes of payments

- Easy reconciliation

Business Gold Card

Joining fee: Nil | Annual fee: Nil

- 1% fuel surcharge waiver at HPCL petrol pumps*

- Accident cover up to Rs 10 lakh

- Reward points on international & domestic spends.*

*T&Cs.

Business Platinum Card

Joining fee: Rs 999+ GST | Annual fee: Rs 999 +GST

- 2 complimentary airport lounge accesses per quarter

- 1% fuel surcharge waiver at all petrol pumps*

- Accident cover up to Rs 25 lakh

- Handpicked reward points on international & domestic spends.*

*T&Cs.

Business Advantage Black Card

Joining fee#: Rs 1500+ GST | Annual fee#: Rs 1000+ GST

- 2 complimentary airport lounge accesses per quarter

- 1% fuel surcharge waiver at HPCL petrol pumps*

- Accident cover up to Rs 75 lakh

- Additional 0.20% cashback on outstanding payment within 7 days from the statement date.

#Reversal of joining and annual fees based on spending

*T&Cs.

Hand Picked Offers

Current Account FAQs

Current Account is a bank account for people who run businesses. It is designed for carrying out day-to-day business transactions easily.

A Current Account is a bank deposit that can be withdrawn by the depositor at any time. The depositor is at liberty to operate this account any number of times in a day unlike Savings Accounts where only limited transactions are allowed. This account is generally opened by people who are engaged in trade, businesses and professions.

Click here to open ICICI Bank Current Account in just a few clicks.

| Savings Account | Current Account | |

|---|---|---|

| Meaning | Meant for savings purpose | Meant for business purpose |

| Suitable for | People who are salaried employees or have a monthly income | Firms, Companies, Traders and entrepreneurs who need to access their accounts frequently |

| Transactions allowed | Limited transactions | Multiple transactions |

| Interest earned | <3.5% - 4%> per annum (usually) | No interest |

| Minimum Balance | Usually low | Usually high |

| Overdraft facility | Not offered/allowed | Overdraft facility provided |

Click here to open ICICI Bank Current Account in just a few clicks.

Open a current account online. Click Here

Open a Current Account by filling the physical form at the nearest ICICI Bank Branch.

For a list of documents required FAQs page link (Scroll down and check ‘Checklist of Documents required for opening Current Account’ section)

ICICI Bank offers various types of Current Accounts, keeping in mind the unique needs of every business. Some of them are:

• Smart Business Account 2.0 for MSMEs Know More

• iStartup 2.0 Account for Start-ups Know More

• Specialised Trade Accounts for Export & Import Business Know More

• Super Advantage Account for Merchants Know More

• Smart Business Account 2.0 for ERP Know More

For Individual: PAN, Aadhaar, Business Proof, Account Opening Cheque

For Proprietorship: Proprietor PAN, KYC of Proprietor, Government Issued Registration Certificate of the firm, FATCA, Account Opening Cheque

For Company and LLP: Entity PAN, Constitution documents of the Firm, KYC of Authorised Signatories and Beneficiaries, Owners PAN, Identity and Address Proof, Board Resolution/LLP Letter & FATCA, Account Opening Cheque

For Partnership: Entity PAN, Constitution documents of the Firm, KYC documents of Partners/Beneficial Owners - PAN, Identity and Address Proof, Partnership letter, FATCA, Account Opening Cheque.

Banks require Current Account holders to maintain a Minimum Average Balance for a month or a quarter. QAB* can vary between the Current Account Variants.

*QAB - Quarterly Average Balance calculated as average of daily closing positive balances of each day, spread over the quarter.

Recommended Products

Business Loans

Get loans to match your specific needs

Find ATM/ Branch

Bank 24/7 through widespread network of over 5,275

CMS

Services to efficiently process your receivables and payables

FAQs

Find relevant answers to frequently asked questions

Documentation

Simplified documentation for Current Account opening

Fixed Deposits

Invest your Idle funds in Fixed Deposit