- ₹1

- ₹1 Cr

- 1 Year

- 50 Years

- 1%

- 100%

Please note, these calculators are designed to provide you an approximate amount. Consult an advisor/tax consultant prior to investing.

Total amount invested

₹10,000

Returns

₹10,000

Total wealth accumulated

₹10,000

FAQs

What is ICICI Bank PayLater facility?

ICICI Bank PayLater is a pre-approved Credit Line on UPI. Customers can check their offer eligibility under ‘Pre-approved Loans/Offers’ section on iMobile Pay. Customers can also check the eligible offers through Net Banking in the ‘Offers’ section and avail the required offers in just one click.

How can I get the PayLater facility?

ICICI Bank PayLater facility is available to customers on an invitation basis only. Customers for whom the facility is available can activate it using iMobile Pay or Internet Banking:

iMobile Pay > Pre-approved Loans/Offers > PayLater > Activate Now

Internet Banking > Log in > Apply Online > Offers for you > PayLater > Activate Now

What is the limit offered in ICICI Bank PayLater?

The limit of your PayLater Account can range between Rs 7,500 to Rs 50,000, based on your eligibility. The limit is already set for the customers to whom the invite is sent.

Invest Anywhere,

Anytime

Mobile Banking | Net Banking

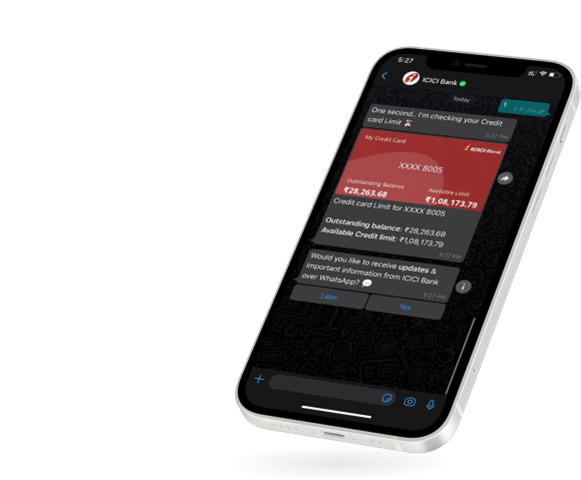

WhatsApp Banking