- ₹ 10,000

- ₹ 50,00,000

- 1%

- 30%

- ₹ 500

- ₹ 50,000

- 12 Months

- 72 Months

₹1,50,94,665

₹76,000

₹19,372

₹24,000

What is SWP Calculator?

The Systematic Withdrawal Plan or SWP calculator is a financial tool that helps you to compute your monthly income from the SWP scheme. The SWP offers regular income and returns at the end of the tenure. Under this scheme, you have the provision to withdraw funds, fixed or variable, after a pre-decided period, which can be monthly, quarterly or annually.

With the help of this online calculator, you can find out the final value of your investment. And for that, you need to enter the total investment amount, withdrawal amount, tenure and expected interest return. The calculator will show the accurate output instantly.

How does the SWP calculator work?

This SWP Calculator will show you the regular cash flow throughout your systematic withdrawal tenure. It calculates the output using this formula:

A = PMT ((1+r/n)^nt-1)/(r/n))

where,

- 'A' is the final value of your investment.

- 'PMT' is the payment amount for each period.

- 'n' is the number of periods over which the compounding will happen.

- 't' is the tenure of your investment.

Your calculator will show the final value of the investment, total investment and withdrawal amount.

How to use the SWP calculator?

You can calculate your SWP return easily with the online SWP calculator. The steps are simple and as follows -

Step 1: Enter the total amount of your investment.

Step 2: Enter your withdrawal amount per month.

Step 3: Fill in the expected return rate.

Step 4: Enter the tenure of your investment.

The calculator will automatically show you the total investment, total interest, total withdrawal amount and the final value of your investment.

Let’s consider an example to substantiate the point. Suppose Mr X invested Rs 1,50,000 for 12 months and withdrew Rs 5,000 per month. The interest rate was 10% per annum. In this case, Mr X, at the end of 12 months will end up earning Rs 12,356 as interest income.

The table below shows the exact breakdown of the investment and the interest-earning process.

| Month | Balance at Month Start | Monthly Withdrawal | Interest Earned |

|---|---|---|---|

| 1 | 1,50,000 | 5,000 | 1,208 |

| 2 | 1,46,208 | 5,000 | 1,177 |

| 3 | 1,42,385 | 5,000 | 1,145 |

| 4 | 1,38,530 | 5,000 | 1,113 |

| 5 | 1,34,643 | 5,000 | 1,080 |

| 6 | 1,30,723 | 5,000 | 1,048 |

| 7 | 1,26,771 | 5,000 | 1,015 |

| 8 | 1,22,785 | 5,000 | 982 |

| 9 | 1,18,767 | 5,000 | 948 |

| 10 | 1,14,715 | 5,000 | 914 |

| 11 | 1,10,629 | 5,000 | 880 |

| 12 | 1,06,510 | 5,000 | 846 |

SWP Calculator FAQs

What are the benefits of using ICICI Bank’s SWP Calculator

· This calculator helps you to identify the best monthly withdrawals from your scheme. With this, you can plan your expenses and meet them without any difficulty

· The calculator helps you to calculate your monthly returns and ROI on the total investment. It helps you strategise your investment and make the right call

· You can easily change the withdrawal amount on the calculator and get your expected return within a few seconds. It helps you to plan your investment easily

· It is a user-friendly online calculator. You don't need any expertise to handle this tool. You just need to input a few parameters for the calculation to show the output instantly

· Most importantly, it is free to use.

What factors should I consider while using the SWP Mutual Fund Calculator?

While using the SWP Calculator, consider the following factors:

- Financial goals: Define your specific financial objectives.

- Risk tolerance: Assess your comfort level with market fluctuations.

- Investment horizon: Determine the duration of your investment.

- Investment amount: Input the accurate invested amount.

- Withdrawal frequency: Choose the frequency of your withdrawals.

- Anticipated returns: Provide realistic estimates for investment returns.

- Regular assessment: Periodically reassess and adjust your SWP strategy.

- Market conditions: Stay informed about prevailing market conditions.

- Alignment with overall financial plans: Ensure your SWP plan aligns with your broader financial goals and plans.

How accurate are the calculations of SWP Calculators?

SWP Calculators provide estimations based on certain assumptions and their accuracy depends on the precision of these assumptions. They generally take the rate of return as an average, which might not perfectly mirror real market conditions.

Market fluctuations, fees and unforeseen events can impact actual outcomes. While SWP calculators offer valuable insights, it is advisable to regularly review and adjust your plan based on changing circumstances to enhance accuracy.

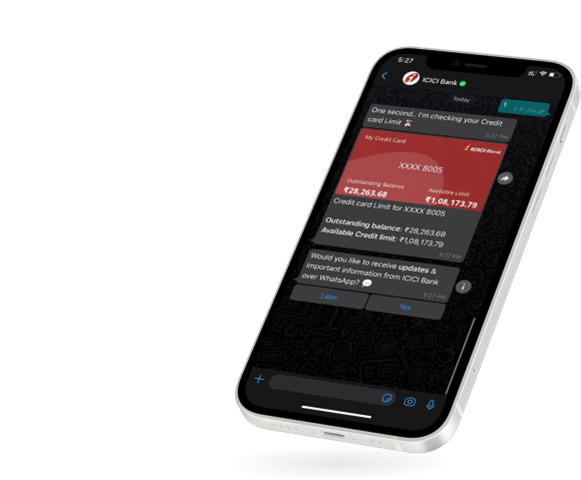

Invest Anytime,

Anywhere

Mobile Banking | Net Banking

WhatsApp Banking