- ₹1

- ₹1 Cr

- 1 Year

- 50 Years

- 1%

- 100%

Please note, these calculators are designed to provide you an approximate amount. Consult an advisor/tax consultant prior to investing.

Total amount invested

₹10,000

Returns

₹10,000

What is an SIP Calculator?

An SIP Calculator is an online tool that allows you to estimate the returns on your Mutual Fund investments, usually before you invest in them through one or more Systematic Investment Plans. It is simply a roadmap to help an investor seamlessly integrate SIP investments in his/her portfolio. However, the actual returns offered by a Mutual Fund scheme varies depending on various factors.

Benefits of the SIP Calculator

An investor can get multiple benefits from investing in SIP over the long term. Here is a list of advantages you can get if you invest in that platform.

Helps in deciding the SIP amount

The SIP calculator helps you to decide how much money you need to invest in Mutual Funds through SIP to earn the desired returns.

User-oriented

You can easily estimate your investment needs with our user-friendly SIP calculator. It is suitable for anyone, is completely free of cost and can be used any number of times.

Informed decision making

The SIP calculator empowers users to make informed decisions and project future returns based on historical data and certain assumptions. It helps investors to make their investment choices. In today's complex and dynamic financial markets, this data-driven approach is invaluable.

Financial planning

The SIP return calculator is an essential component of financial planning. It enables individuals to create a systematic and well-thought-out investment plan that aligns with their financial objectives. It assists in setting clear financial goals and mapping out a path to achieve them.

Time efficiency

It saves time by automating complex calculations that would be time-consuming and error-prone if done manually. This time efficiency allows investors to focus on other critical aspects of their financial planning and management.

Risk management

Through its capability to project future returns, the SIP calculator empowers users to assess and manage potential risks, resulting in more secure investment choices.

How to use the Systematic Investment Plan calculator of ICICI Bank?

Step 1: Choose Your Mutual Fund Scheme

Begin by selecting an ICICI Prudential Mutual Fund scheme that matches your investment objectives and risk tolerance. The calculator will estimate the expected average return for the chosen fund.

Step 2: Determine Monthly SIP Amount

Next, decide on the monthly SIP investment amount that aligns with your financial capacity and willingness to invest consistently.

Step 3: Set Investment Tenure

Specify the number of years for which you plan to continue your SIP or select an investment horizon that corresponds to your financial goals.

Step 4: Calculate

Click the 'Calculate' button to generate results.

The ICICI SIP Calculator will display:

- Total invested amount

- Cumulative gains earned

- The projected future value: It combines the amount you've invested with the earnings.

Moreover, the ICICI SIP Calculator offers the flexibility to adjust your inputs related to the SIP amount and tenure. You can experiment with various SIP amounts and investment durations to observe the corresponding changes in results, enabling you to customise your investment strategy as needed.

Explore Our Mutual Fund Videos

SIP Calculator FAQs

How can an SIP Calculator help investors?

An SIP Calculator acts like a financial guide. It takes the investment details - how much the investors are putting in regularly, for how long and the expected returns. It will then give the investors a glimpse into their financial future.

What details are required to use a SIP calculator online?

To use a SIP calculator online, you'll need a few key details:

- Investment amount: The initial amount you plan to invest

- SIP frequency: How often you'll make contributions (e.g., monthly)

- Expected return rate: The anticipated annual growth rate of your investment

- Investment tenure: The duration for which you plan to invest.

Once you input these details, the calculator will estimate your future earnings through Systematic Investment Planning.

Can an SIP calculator guarantee accurate future returns?

No, an SIP calculator cannot guarantee accurate future returns. It can provide estimates based on historical data and assumptions, but market conditions are unpredictable and investments carry risks. Actual returns may vary significantly from the calculator's projections, making it essential to use SIP calculators as a rough planning tool rather than a guarantee of future performance.

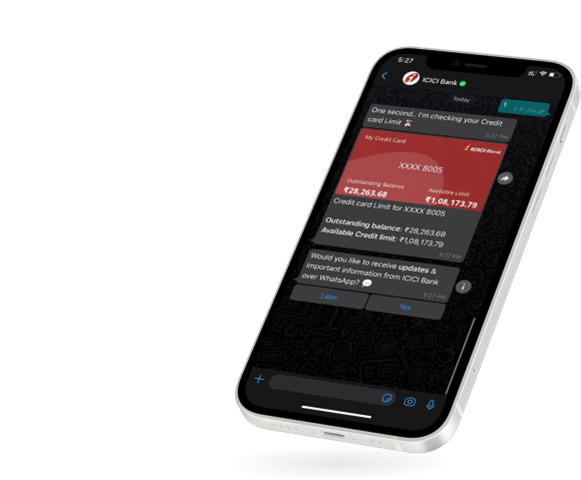

Invest Anywhere,

Anytime

Anytime

Mobile Banking | Net Banking

WhatsApp Banking

Disclaimer

Mutual fund investments are subject to market risks, please read all scheme related documents carefully. ICICI Bank Limited shall not be liable or responsible for any loss or shortfall resulting from the operations of the Mutual Fund scheme. Terms and conditions of ICICI Bank and third parties apply.