Want us to help you with anything?

Request a Call back

corporate fixed deposit

Safe Investment Instrument. Higher Returns.

Accredited with CARE “AAA” and ICRA “MAAA” rating

Flexible tenure starting at 7 days

Fixed Deposit amount starting from ₹10,000

Grow your money with ICICI Bank's Corporate Fixed Deposit

-

Traditional

Fixed Deposits -

Cumulative

Fixed Deposits -

Callable

Fixed Deposits -

Non-Callable

Fixed Deposits

Traditional Fixed Deposits

Interest is credited at regular intervals (quarterly/monthly) on the basis of the tenure.

Minimum tenure is 7 days.

- Multiple Interest payout options.

*AAA rated & accredited by CARE. T&C Apply.

Cumulative Fixed Deposits

Interest accrued is added to the principal amount on a quarterly basis until maturity.

Minimum tenure is 6 month.

Receive a lump-sum amount after maturity.

*AAA rated & accredited by CARE. T&C Apply.

Callable Fixed Deposits

A deposit that allows you to redeem/withdraw before the maturity date.

Competitive Interest rates.

Partial and Premature withdrawals.

Auto renewal facility.

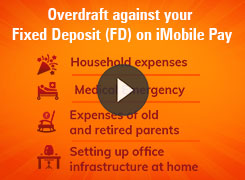

Credit facility against Fixed Deposit.

*AAA rated & accredited by CARE. T&C Apply.

Non-Callable Fixed Deposits

A deposit wherein you cannot withdraw before the maturity date.

High interest rates.

Fixed lock-in period.

No Credit facility can be availed.

*AAA rated & accredited by CARE. T&C Apply.

Corporate Fixed Deposit Videos