Want us to help you with anything?

Request a Call back

Eligibility & Benefits of Corporate Fixed Deposit

Safe Investment Instrument. Higher Returns.

Accredited with CARE “AAA” and ICRA “MAAA” rating

Flexible tenure starting at 7 days

Fixed Deposit amount starting from ₹10,000

Why book a Corporate Fixed Deposit with us?

Exchange favouring FDs for trading limits to brokers

Earn interest by investing idle funds meant for short term provision, in Fixed Deposits

Secure and steady investments for regulatory entities & public sector undertakings with limited avenues for investments

Secure tenders and contracts by opening Fixed Deposits to meet contractual obligations

Assured returns on lien marked Fixed Deposits for bank guarantees

Better returns for trusts on the donations received

Fixed Deposits provide predictable returns in times of high market volatility

Safer and better returns on deposit for recurring expenses of societies

Who can book a Corporate Fixed Deposit with us?

Businesses

Businesses

Public Limited Companies, Private Limited Companies, MNCs, MSMEs, Limited Liability Partnerships, Sole Proprietorships & Partnerships, etc.

Capital Markets

Capital Markets

Exchange houses, Brokerage Firms, Financial Institution Groups, Alternative Investment Funds (AIFs), Custody Groups, etc.

Government Bodies

Government Bodies

Central and State Governments, Public Sector Undertakings, Regulatory Bodies, Government Departments, etc.

Trusts

Trusts

Trusteeship Companies, Securitisation Trusts, Family Trusts, House Trusts, etc.

Scan this QR on your mobile to download/open iMobile Pay

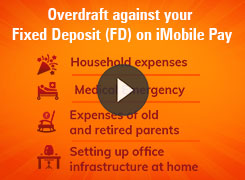

Corporate Fixed Deposit Videos