Grow your money with ICICI Bank’s

Corporate Fixed Deposit

Traditional Fixed Deposit

- Interest is credited at regular intervals (quarterly/monthly) based on the customers’ choice

- Minimum tenure of 7days

- Option for multiple interest pay-out frequency.

*AAA rated & accredited by CARE. T&Cs.

Cumulative Fixed Deposits

- Interest accrued is added back to the principal amount in quarterly intervals until maturity

- Minimum tenure of 6 months

- Customer will receive a lump-sum amount after maturity

*AAA rated & accredited by CARE. T&Cs.

Callable Fixed Deposits

A deposit which allows the issuer to redeem/withdraw before the maturity date.

- Competitive Interest rates

- Partial and Premature withdrawal

- Auto renewal facility

- Overdraft facility against deposit

*AAA rated & accredited by CARE. T&Cs.

Non-Callable Fixed Deposits

A deposit wherein the issuer cannot withdraw before the maturity date.

- Higher interest rates

- Fixed lock-in period

- Overdraft Facility against Deposit

*AAA rated & accredited by CARE. T&Cs.

4 ways to book Corporate Fixed Deposits

ICICI Bank’s versatile Internet Banking platform helps corporates to book an FD in just 4 steps and avail OD against FD online. For existing CIB Users:

- 01. Login to CIB Dashboard

- 02. On Dashboard > click on Open New FD

- 03. Feed the details

- 04. Book FD

New to Bank/CIB? Please click on the ‘Get in Touch’ tab or connect with your Account Manager.

New to Bank/CIB? Please click on the ‘Get in Touch’ tab or connect with your Account Manager.

Use ICICI Bank’s innovative user friendly mobile app to book FDs instantly. For existing InstaBIZ customers:

- 01. Login to your account on InstaBiz

- 02. Go to dashboard > Urgent & important

- 03. Open your fixed deposit instantly!

New to Bank/InstaBIZ? Please click on the ‘Get in Touch’ tab or connect with your Account Manager.

New to Bank/InstaBIZ? Please click on the ‘Get in Touch’ tab or connect with your Account Manager.

- 01. For existing customers:Manage your Fixed Deposit needs from your own ERP/Portals by using ICICI Bank FD APIs.

- 02. For new customers: To know more, fill out the form (Select Corporate API Suite in the dropdown), connect to Account Manager or click on ‘Get in Touch’.

New to Bank/API? Please click on the ‘Get in Touch’ tab or connect with your Account Manager.

- 01. Existing Customers – To experience our customer centric service, connect with your Account Manager or Relationship Manager to avail Corporate Fixed Deposit/Overdraft against FD service

- 02. New Customers - To avail Corporate Fixed Deposit/Overdraft against FD service, click on the ‘Get in Touch’ tab or visit the nearest branch.

Overdraft against

Fixed Deposits

Fulfill short-term and long-term fund requirements through OD against FD and avoid premature withdrawals.

- Get instant OD against FD through CIB

- Fulfill urgent fund requirements

- Instantly avail up to 90% of Overdraft on your FD

T&Cs.

Get started with Corporate Fixed Deposit

Corporate Fixed Deposit FAQs

What is a Fixed Deposit

A Fixed Deposit (FD) is an investment product offered by banks to the customers. An FD promises guaranteed returns that is calculated on the basis of interest offered at the time of opening the FD Account. Interest rates may differ depending upon the tenure and amount invested.

Who can invest in an ICICI Bank Fixed Deposit?

Proprietorships, Partnership, LLP, Private LTD, Public Limited, Trust, government entity, society’s etc. can book Corporate Fixed Deposits.

At what frequency will I receive interest on my FD?

Interest pay-outs can be done monthly, quarterly or on maturity.

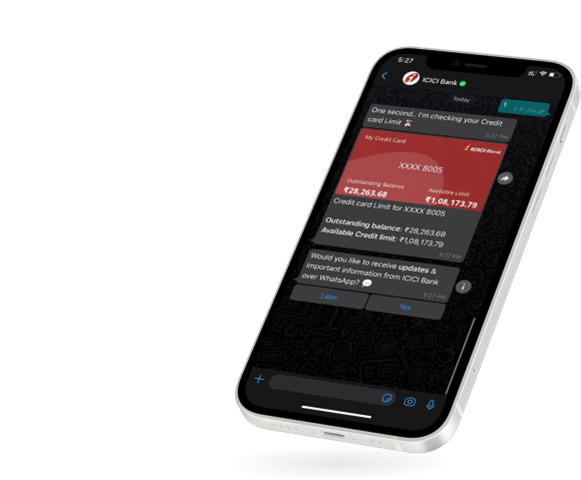

Invest Anywhere,

Anytime

Mobile Banking | Net Banking

WhatsApp Banking