Repo rate linked interest rates

Benefit from low EMIs with higher tenure

Young salaried professionals can avail higher eligibility on Home Loans

Online sanction in 5 simple steps

Need Assistance?

If you need more assistance, we are here for you. Here is how you can get in touch with us.

![]() Missed call number 9022499400

Missed call number 9022499400

![]() Email us : customer.care@icicibank.com

Email us : customer.care@icicibank.com

Request A Callback

Please fill in these details,

so we can call you back and assist you.

Explore a vast database of 40K+ ICICI Bank approved projects by leading developers, across 44 locations in India.

Are you looking to buy a resale property? ICICI Bank is here to assist you in your resale property transactions.

Track your loan status online anytime, anywhere with our TrackMyLoan service

Make the journey towards your dream home

The journey towards your dream home begins with a few careful and well-planned steps

READ MOREYou can apply for a home loan from ICICI Bank through our website (www.icicibank.com). Or, you could visit the branch of ICICI Bank that’s nearest to you to submit your application for a loan. To apply for a home loan, click here

To apply for a home loan, you need to submit documents such as a proof of identity, a proof of address, a loan application form that has been duly filled and your financial documents. To know more about this, click here.

We determine your eligibility after considering various factors, including your monthly income, your monthly financial obligations, your current age and your retirement age, among other things. To check if you’re eligible for our home loan, click here.

The EMI is calculated on the basis of specific factors like the amount of the loan, its tenure and the rate of interest.

To calculate the EMI for your home loan, click here.

A floating rate of interest is linked to a benchmark rate. As per guidelines of RBI, floating rate Home Loans from banks are linked to external benchmark rates. ICICI Bank’s floating rate of interest is linked to Repo Rate declared by RBI from time to time. So, rate of interest of your housing loan changes in line with the Repo Rate. As a result, the EMI or the tenure of your loan will increase or decrease, depending on the change in the rate of interest.

A fixed rate of interest on a home loan means that the rate of interest does not change throughout the tenure of the loan. So, the EMI will also remain fixed.

Yes, you can claim the amount paid towards the repayment of the principal and the interest components as deductions in your income tax return. The limits on the amount deductible are governed by the applicable income tax laws.

- Mobile Banking

- Net Banking

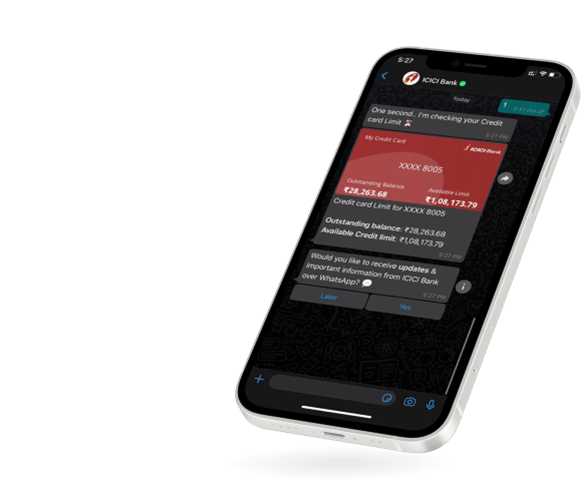

- WhatsApp Banking

Quick tips and helpful product demonstration videos - ICICI Bank Online Demos & Videos

Explore Now

.jpg)