Indian Economic Update

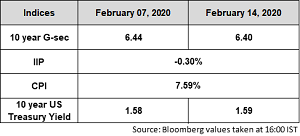

- Consumer Price Index (CPI) inflation surprised to the upside in January at 7.6% YoY vs. 7.35% YoY in the previous month. Food inflation moderated marginally to 13.6% YoY vs. 14.2% YoY in the previous month. Core inflation increased at a faster momentum to 4.2% YoY vs. 3.8% YoY.

- Headline industrial production re-entered negative territory in December after a respite of a month, printing at -0.3% YoY.

- Manufacturing output contracted in December, hampered by a high base, and a possible lack of domestic and external demand. 16 of 23 industry groups showed negative growth.

- On a volume basis, industrial production has clocked 0.5% YoY in the first nine months of FY2020 as compared to 4.7% YoY seen in Apr-Dec 2018.

- Standard and Poor's retained India's sovereign rating at 'BBB-' with stable outlook, saying the country's Gross Domestic Product (GDP) is likely to gradually recover towards longer-term trend rates over the next two to three years.

Global Update

- US non-farm payrolls rebounded sharply in Jan 2020 rising by 225,000 against expectations of 160,000 increase and an increase of 145,000 in Dec 2019.

- China's Hubei province reported 242 new deaths, double the prior day's toll, and confirmed 14,840 new cases on Feb 12. The rise in the number of cases, which came as officials adopted a new methodology for counting infections, is a sevenfold increase from a day earlier.

- Three of the European Central Bank’s (ECB) top policy makers defended their monetary stimulus. ECB President Ms Christine Lagarde told the European Parliament that she realises subzero interest rates and bond purchases can hurt savers and lead to overvalued asset prices such as real estate, but that governments should do more to boost the economy.

- UK Government began a 10-week consultation setting out its plans for the "freeports" (or free trade zones).

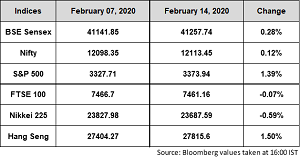

Indian equity markets ended higher amid strong global cues. Investor sentiment has turned positive for now as central banks and policymakers have stepped in with measures to stimulate growth to mitigate any negative impact of the coronavirus outbreak. An upbeat commentary from Finance Minister also boosted the sentiment.

During the week Sensex gained 0.28% to close at 41257.74 while Nifty advanced 0.12% to close at 12113.45

Indian Government bonds remained stable as traders expect the inflation to come down in the coming months and pave way for rate cut later in calendar year. Steps taken by the Reserve Bank of India (RBI) on liquidity suggests that the central bank is unlikely to hike rates despite the higher-than-expected rise in headline inflation.

The 10Y benchmark yield ended at 6.40% as compared to the previous week’s close of 6.44%.

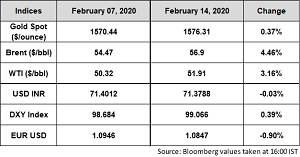

Oil prices rallied on hopes that Russia will back the Organisation of Petroleum Exporting Countries (OPEC) plan to cut output in the wake of Coronavirus hit to Chinese oil demand.

Gold is trading higher as investors retreated to safe haven after a sharp rise in number of coronavirus deaths and infections.

The Indian Rupee remained flat against the dollar. Foreign banks sold dollar, likely for Foreign Portfolio Investments (FPIs). Jump in new coronavirus cases dampened risk appetite.

Dollar index is trading marginally higher amid optimism over the US economy, speculation around the Federal Reserve leaving interest rates unchanged and safe-haven demand.

The EUR/USD is trading flat, above the fresh four-month lows. The GBP/USD pair rose and USD/JPY pair also moved higher.

Source: ICICI Bank Research, Private Banking Investment Strategy Team, Bloomberg and CRISIL.

Related Content

09.03.2020

28.02.2020

20.02.2020