- Debit Card

- Smishing

- General Safety Tips

- Report an Unauthorized Transaction

- Report Fraud

- RBI Advisory

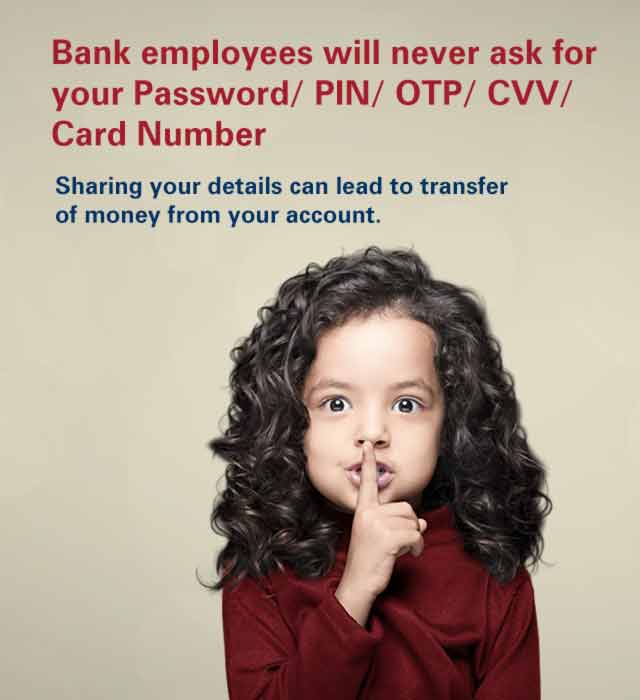

- Protect Your Privacy

- Phone Banking

- Personal Loan

- Password Safety

- Home Loan

- Videos

- Vishing

- Spoofing

- Investment

- Deposite

- Car Loan

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- Bank's Commitment

- Money Mule

- Deregistration Process

- Login Process

- Cyberstalking

- Customer Education Series

- Aadhaar Card Safety Tips

- Botnet

- Cards

- Credit Card

- Digital Signature Certificate

- Frauds through social networks

- Glossary

- Internet Banking

- Pin and Password related

- List Of Publisher

- Loans

- Mobile Banking

- Safe Password

- Skimming

- Computer Virus

- Spear Phishing

- SIM SWAP

- Mobile Banking Safety Tips

- Beware of Imposters

- Fraud Vishing

- Fraud E-mail

- Customer Education Series

- Phishing

- Atm-safety

- ATM

- Digital Signature Certificate

- DSC Registration

- Safe Online Banking FAQ

- Know Your Bank Note

- Isafe Mobile

- SIM Swap

- Online Shopping

- phishing-tutorials

- Bank OTP

- beware-of-malware

- cash-detective-game

- debit-pin-safety

- Disclaimer

- phishing-game

- Demo

- channel

- Demo

- RBI Notification

- RBI Awareness Campaign

- Safe Banking

- Safe Online Banking FAQ

- OTP Faqs

- Safe Online Banking FAQ

- Fraud Prevention

- Report Fraud

- Report an Unauthorized Transaction

- Cards

- More

Want us to help you with anything?

Request a Call back

ATM / Debit Card Safety Measures

Tips to remember when you receive the card

- Always keep your card in a safe place, just as you would take care of cash and cheque books.

- Sign in the signature panel on your ATM/debit card(s) as soon as you receive it.

- Never write down your PIN (personal identification number) anywhere. Memorize it.

- If you receive a replacement card, be sure to destroy your old card by cutting it into four and discard the pieces.

Tips to remember when transacting at the ATM

- Ensure that no one sees you enter your PIN (personal identification number).

- Never allow a stranger to assist you while using an ATM.

- After completing your transaction, secure your card and cash immediately. Always count your cash before leaving the ATM area and not outside it.

- Do not leave your transaction record at the ATM. Shred it before discarding it.

- Change your ATM PIN frequently, at least once a month.

Tips to remember when using your Debit Card for shopping

- Use your card with merchants that you know and can trust. Never allow the shopkeeper to take your card to a different shop/room for swiping it.

- Make sure that your debit card is returned to you after completing a purchase; and be sure that the card that has been returned is your own.

- After a purchase, always take your charge slip(s) with you and tear up any carbon copies.

- Check receipts against your monthly billing statements to verify your card transactions. Report any unauthorized transaction(s) immediately.

- Check your charge slips against your monthly account statements to verify your card transactions.

- Once you have reconciled your account statements, tear up all charge slips and discard them.

Contact Us

- If your credit card gets stolen/lost.

- If you card doesn't function and you need a replacement card.

- To report unauthorised transactions.

Please call our Customer Care