- Personal Loan

- Smishing

- General Safety Tips

- Report an Unauthorized Transaction

- Report Fraud

- RBI Advisory

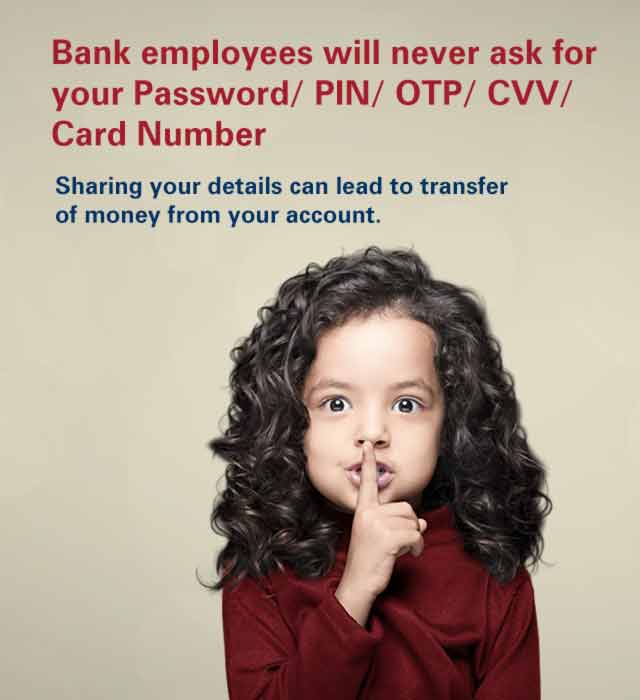

- Protect Your Privacy

- Phone Banking

- Password Safety

- Home Loan

- Videos

- Vishing

- Spoofing

- Investment

- Deposite

- Car Loan

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- multilingual-disclaimer

- Bank's Commitment

- Debit Card

- Money Mule

- Deregistration Process

- Login Process

- Cyberstalking

- Customer Education Series

- Aadhaar Card Safety Tips

- Botnet

- Cards

- Credit Card

- Digital Signature Certificate

- Frauds through social networks

- Glossary

- Internet Banking

- Pin and Password related

- List Of Publisher

- Loans

- Mobile Banking

- Safe Password

- Skimming

- Computer Virus

- Spear Phishing

- SIM SWAP

- Mobile Banking Safety Tips

- Beware of Imposters

- Fraud Vishing

- Fraud E-mail

- Customer Education Series

- Phishing

- Atm-safety

- ATM

- Digital Signature Certificate

- DSC Registration

- Safe Online Banking FAQ

- Know Your Bank Note

- Isafe Mobile

- SIM Swap

- Online Shopping

- phishing-tutorials

- Bank OTP

- beware-of-malware

- cash-detective-game

- debit-pin-safety

- Disclaimer

- phishing-game

- Demo

- channel

- Demo

- RBI Notification

- RBI Awareness Campaign

- Safe Banking

- Safe Online Banking FAQ

- OTP Faqs

- Safe Online Banking FAQ

- Fraud Prevention

- Report Fraud

- Report an Unauthorized Transaction

- More

Want us to help you with anything?

Request a Call back

Personal Loan

Personal Loan is taken to fulfill dreams like vacations, marriage, house renovation etc. Way to fulfill dreams by availing personal loan can be easy if we follow simple safety tips.

Safety Tips while taking a Personal Loan

- Always verify DSA/ DMA / Connector who approaches you for loan for authenticity. Ask for their ID proofs/ authorisation from the Bank.

- Do not ever handover original KYC documents to the DSA / Bank Executive.

- Always mention the purpose for which you are submitting the documents while self-attesting it.

- Visit our website for all the relevant information related to loan.

- Sign the application form only after filling it and reading the terms and conditions.

- Do not make payment in cash to anyone. Always issue crossed, postdated cheques and security PDCs in favor of the lending Bank only.

- After submitting the documents, if you decide not to avail the loan, inform the Bank immediately to ensure cancellation of the loan.

- If the file you have submitted is not logged with the bank, then ask executive to return the documents submitted. Remember to destroy documents of your identity immediately to avoid misuse.

- Ask for status of the loan application if disbursement amount is not received within the committed time period. You can call our Customer Care and log a complaint if executive with whom you are dealing with is not supporting you.

- If you observe any suspicious activity during the loan process, please visit our website and report the same.