Cash - Safety Tip

- Do not fold bank note

- Do not staple bank note

- Always handled bank note with clean and dry hands

- Avoid writing anything on bank note. Keep the water mark always clear

- Never take help from stranger at ATM or Branch cash counter for counting the notes

Tips To Keep Your Cheque Book Safe

- Record all details of cheques issued.

- Do not leave your cheque book unattended. Always keep it in a safe place, under lock and key.

- Whenever you receive your cheque book, please count the number of cheque leaves in it. If there is a discrepancy, bring it to the notice of the Bank immediately.

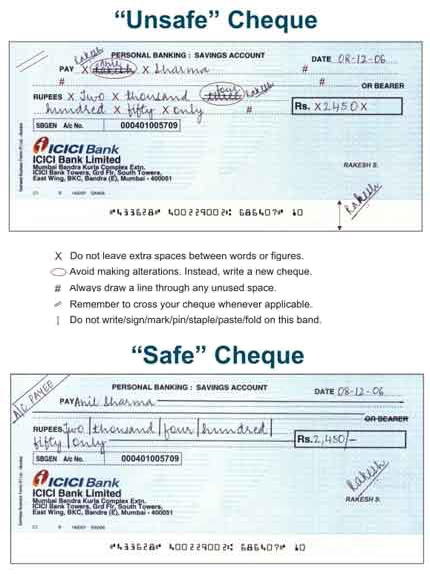

Tips To Fill A Cheque Leaf Correctly

- Do not sign blank cheques. Always fill in the date, the name of the receiver and the amount before signing the cheque.

- Remember to cross your cheque whenever applicable and prevent it from being misused.

- Always draw a line through any unused space.

- Never sign in multiple places unless authenticating a change.

- Avoid using cheques with changes on them. Issue a new cheque if possible.

- When you cancel a cheque, mutilate the MICR band and write "CANCEL" across the face of the cheque

- Do not write/sign/mark/pin/staple/paste/fold on the MICR band.

- Always use your own pen to write a cheque.

General Safety tips

Safeguard your account information

- Do not access any website (including ICICIBank.com) from a computer other than your own. If you use a public computer, change your password after such use in your own computer.

- Create a strong password.

Be cautious with cheques

- Never send or hand over a blank cheque. If you need to share your bank details as printed on the cheque leaf with somebody, write 'CANCELLED' diagonally across the cheque.

- If you cancel a cheque, dispose it off properly after crossing out the cheque number and MICR code.

Monitor your accounts frequently

- Review your e-mail alerts, SMS -financial /non-financial and monthly bank statements regularly.

- Update your contact details and e-mail ID regularly with the bank.

- Notify the bank immediately if you receive alerts about any unusual activity in your account.

- Ensure all the documents which are requested and collected at the branch are printed on the ICICI Bank’s letter head duly stamped and signed by the authorized signatory example: Bank account/loan statement requested at the Branch

- Be prudent to check the statement received at the Branch with the actual transaction carried out in your account

Never share your information

- Never share your Card details, Internet Banking User ID, Password or URN with anyone on phone, e-mail or SMS.

- Never reply to e-mails, SMS or calls asking for Password / PIN / CVV / OTP, even if the person claims to be a bank employee.

- Do not access your bank account through links in e-mails or SMS