- As soon as you receive the consignment carrying your card, ensure that the card in the envelope has your name, and that it is spelt accurately. If there is any not-error, inform Customer Care immediately.

- If you had applied for an add-on card also with the primary card, ensure that the add-on card is present in the same consignment as the primary card. If it is not present or you have any clarifications, please call Customer Care.

- Sign on the reverse of the card immediately on receipt. This helps comparing your signature when you make payments at shops, hotels etc. Unsigned cards are invitations for misuse.

- If you lose your credit card, report the loss to ICICI Bank immediately by calling Customer Care. The card will be blocked instantly. On the same call, you can also request for a new card to be sent to you.

- Also report the loss of card to the police station of the area where you suspect the card was lost or misplaced.

- Make sure you are using a secure site while making payments through the Internet. Look for a lock icon in the status bar of your web browser. This icon indicates that a site is employing an encryption technology during the transmission of your sensitive data.

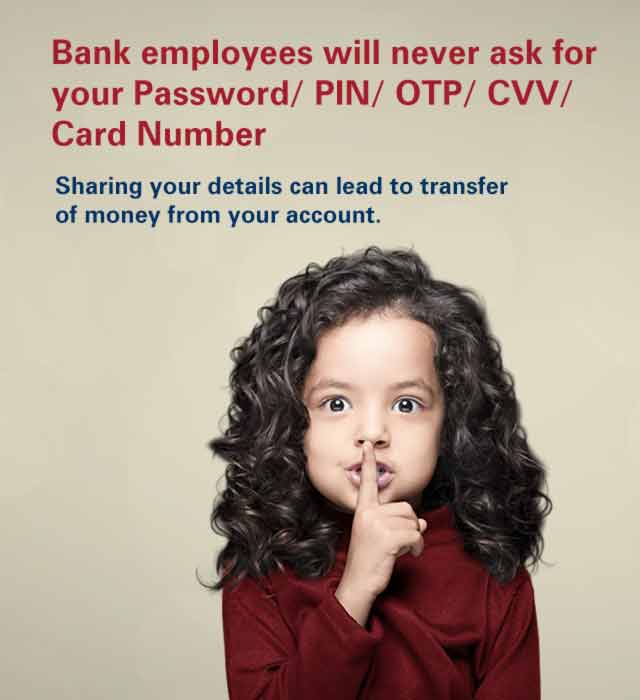

- Never respond to phishing e-mails that falsely claim to be from a bank and ask you to disclose your personal and bank related confidential details. ICICI Bank will never ask you to send your personal banking details

- Get yourself enrolled for 3D Secure (Verified by Visa (VbV)/ MasterCard SecureCode (MCSC)). This is now mandatory for carrying out online transactions.

- Avoid accessing your Internet banking account on unsecure public computers (e.g. internet cafes)

- Once you have completeed your online banking transactions, remember to log-off by clicking on the "log-off" option. Close your browser and lock your computer if it is left idle.

- Get your card replaced if you have used your card in a high-risk country. 'High-risk' countries have a track record of large number of fraudulent activities.

- Keep the card in a safe place like your wallet or purse, where you can quickly notice if it is missing. Many times it is too late by the time cardholders come to know that the card is missing.

- Note the contact numbers of your bank where it is readily available. Make a diary note of your card numbers for any time reference.

- Ensure that the card you got back after a transaction is indeed yours, before putting it in the wallet. Many times, cards get exchanged at crowded merchant locations like service stations and malls or super markets.

- When you use your card for purchases, ensure it is swiped in your presence and not swiped on multiple devices.

- Ensure that your card number, card-expiry date and the three-digit security code on the back of the card (popularly known as CVV number) are not captured in writing anywhere. This can be done if you ensure the card is swiped in front of you at all times.

- Do not hand-over your card to anyone, even if they claim to be representatives from your Bank.

- If the card is to be cancelled, cut it in four pieces diagonally across the magnetic stripe and discard. This will ensure that the cancelled or expired card cannot be misused for counterfeit / skimming.

- Do not use a replacement card before the Primary card is blocked.

- Don't expose the card to excessive heat or keep close to a magnetic field.

- Register your mobile number for alerts and remember to update it in the Bank's records, in case it changes.

- Memorise the PIN and destroy the mailer. The PIN is an important validation of your identity. The use of PIN along with card is considered as your authentic signature. Keep your PIN a well-guarded secret, always.

- Check your bank account and credit card statements regularly. If you notice any transactions you do not remember having carried out, report the same to your bank immediately.

- Inform change of address to the Bank promptly. Inform postal authorities also to forward your mails and consignments to the new address.

- Do not hand-over copies or original documents containing your personal data like your birth date, PAN number, financials, address proofs, etc. to an unknown person. Always ask for identification.

- Never sign a blank application form, to be filled in by an agent or bank representative later.

- Never give a photocopy of the back of your card to anyone for any reason, even if it is an application for a new credit card.

- Choose a strong PIN code, which is not easy to guess. Change the PIN number frequently.

- Do not fall prey to social engineering attacks. Do not reveal personal details and card numbers in response to attractive-sounding schemes from suspicious callers.

- Destroy statements, charge slips, bank mails before disposing. Many identity theft cases take place through mail sniffing or garbage pilfering. Shred the statement or the charge slips before disposing.

- If your credit card gets stolen/lost.

- If your card doesn't function and you need a replacement card.

- To report unauthorized transactions.

Please call our 24-hour Customer Care